The state of foreign bank branches in Korea

Foreign bank branches in Korea have gradually gained importance, increasing their share of the total assets of the Korean banking industry from 6.3 pe

Foreign bank branches in Korea have gradually gained importance, increasing their share of the total assets of the Korean banking industry from 6.3 percent in 2000 to 14.2 percent in 2009. But recently, both their growth and profitability have been stagnant. The likelihood of either closures or asset sales is increasing, especially with the rapidly deteriorating performance of US and European bank branches. Thus, monitoring the repatriation of funds from Korea to the foreign banks’ headquarters should be strengthened, while the Bank of Korea and Financial Supervisory Committee should put in place a plan to handle potential large-scale capital outflows.

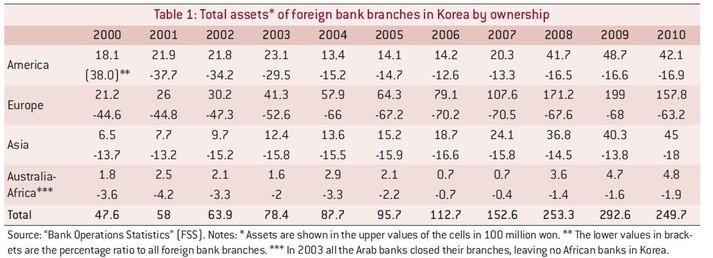

From 2000 to 2009, the foreign bank branches’ total assets grew by 6.1 times from 47.6 trillion won (€40 billion) to 292.6 trillion won (€158 billion) (see Table 1), at a CAGR (Cumulative Annual Growth Rate) of 22.4 percent. And as a result, the market share of foreign bank branches (using total assets) increased from 6.3 percent to 14.2 percent during this period. Yet due to mergers and acquisitions, and financial difficulties in their home territories, the number of foreign bank branches in Korea fell from 43 in 2000 to 37 in 2009.

However, the total assets of foreign bank branches decreased sharply in 2010 by 42.9 trillion won, or 14.7 percent, to 249.7 trillion won (Table 1). The decrease was attributable primarily to European and US bank branches.

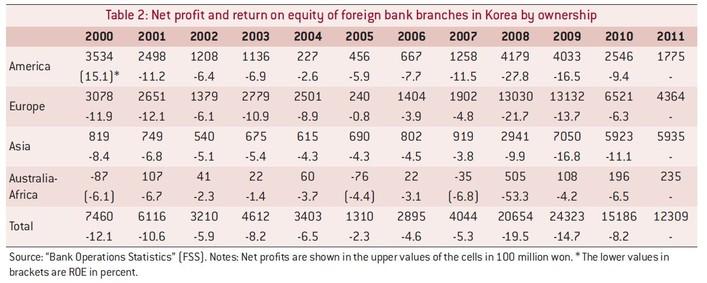

After the peak of profitability in 2008, the foreign bank branches, especially those of US and European banks, continued to face a worsening trend through 2011 (Table 2).

The foreign bank branches’ net profit decreased by 45.5 percent in 2011 to stand at 1.2 trillion won compared to 2.2 trillion won in 2008. And, return on equity dropped from 19.5 percent in 2008 to 8.2 percent in 2010. The number of foreign bank branches recording net losses has continued to rise since 2008: 2008 (1), 2009 (1), 2010 (3), and 2011 (5).

US and European bank branches recorded a net profit of 0.6 trillion won in 2011, a decrease of 64.7 percent from 1.7 trillion won in 2008. The Asian bank branches’ net profit peaked in 2009 and the decline in profit was less significant afterward.

On the other hand, by 2011 the profit of Korean-owned banks returned to almost the pre-crisis level, though return on equity is below its pre-crisis peak (Table 3).

The Korean Financial Supervisory Service should monitor the global operations of foreign banks to prepare for potential bank closures because of the European crisis and the poor performance of foreign bank branches. In addition, the Bank of Korea should put a plan in place to handle potential large-scale capital outflows.

Between 2000 and 2010, 11 foreign bank branches closed their operations in Korea (five foreign bank branches entered the market during the same period). With this in mind, it is imperative that monitoring of home-country business operations is strengthened through cooperation between the regulators of the host and home countries.

In accordance with Article 62 (Domestic Assets of Foreign Financial Institutions) in the Banking Act of Korea, domestic customers are first to receive reimbursements from the bank in case of foreign bank branch closures. However, it is important to keep in mind that regulators must closely monitor and manage those foreign bank branches that repatriate excessive funds before closure since this could potentially make it difficult for the foreign bank branches to service their debts in Korea.

In addition, it is important to have a contingency plan ready in cases of foreign bank branches closing due to internal financial difficulties and/or inability to perform their core operations. Currently, the US is preparing to implement the Volcker Rule, which forbids proprietary trading. Once the Volcker Rule takes effect, foreign bank branches from the US are likely to reduce their investment portfolios significantly.