Are all euro summits the same? Market perceptions before and after

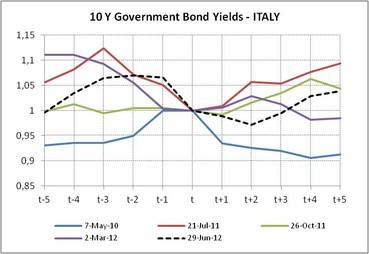

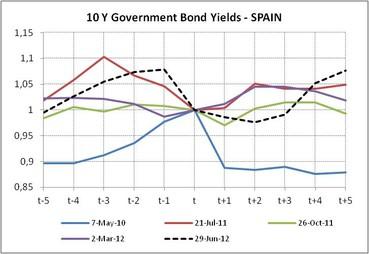

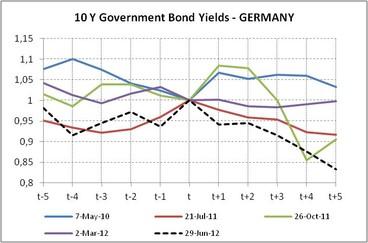

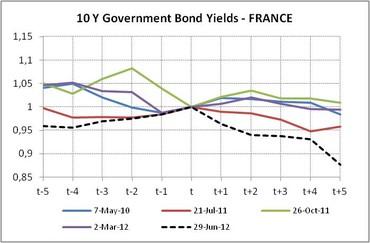

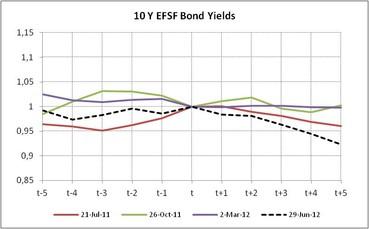

Commentators have frequently argued that all Euro Summits exhibit a similar pattern with significant euphoria after the summit in the financial markets that then soon abates when markets wake up to the actual difficulties of implementing decisions[1]. In this contribution, we study the pattern in government bond yields in the five days before and after euro area summits for Italy, Spain, Germany, France and the EFSF. We normalize the 10 year yield to 1 at t=date of the Summit and plot the yields before and after. We select five Euro Summits’ Dates of significant importance, namely the 7th of May 2010, 21st of July 2011, 26th of October 2011, 2nd of March 2011, 29th of June 2012[2].

A number of results emerge. First, it is true that government bond yields mostly revert to their level five days before the summit after 5 days. In particular in Italy and Spain, no systematic improvement is visible in any of the five summits.

The last summit, however, stands out in terms of the performance of France, Germany and the EFSF. Yields for bonds of these three entities fell markedly by around 10% and the improvement persisted five days after the summit. This contrasts with the temporary improvement observed in Spain and Italy following the summit that only lasted for about 2-3 days. This pattern suggests that the summit results significantly reduce the risk for the core of the euro area governments while virtually no relief is given to Spain and Italy. One possible interpretation is that the creation of a banking union with a strong supervisory authority is a step towards reducing risk to the core euro area tax payers. This interpretation would be consistent with arguments developed in our research that the creation of a banking union will allow imposing greater losses on bank creditors.

We also observe that the pattern of yield developments is rather heterogeneous on the five summits. Typically, we see a deterioration of yields up to 2-3 days prior to the meeting and then a successive decrease of yields during 5 days followed by a new deterioration. The 7 May 2010 summit was different however, as the yields increased up to the summit itself and then came down again significantly to reach levels 5 days before the summit.

[1] See for example Munchau, “The eurozone crisis will last for 20 years“, Financial Times, 9 July 2012

[2] The Euro summit of the 7th of May 2010 stressed the need of accelerating fiscal consolidation and of creating a European stability mechanism to preserve financial stability.

On the 21th of July 2011, The Euro Summit approved the second rescue package for Greece and designed an expanded and more flexible role for the ESFS.

In the Euro Summit of 26th of October 2011, EU leaders agreed on Greek PSI package and on a new EU-IMF program; moreover, they decided to increase banks’ capital requirement to 9% of Core Tier 1 and to improve the leverage capacity of ESFS.

The focus of the 2nd of March 2012 was the job-creating growth and the strengthening of fiscal disciplines.

The Euro Summit of the 29th of June 2012 recognized the need to break the banks-sovereign loop: EU leaders proposed the set-up of euro-area supervisory authority and called for direct financial assistance by EMS/EFSF for bank capitalization.