Should we worry about Target2 imbalances? Why Central Bank negative equity does and doesn’t matter

Over the past few months Germany has become the safe haven of Europe. Depositors fearing a euro break-up have moved their deposits away from the perip

Over the past few months Germany has become the safe haven of Europe. Depositors fearing a euro break-up have moved their deposits away from the periphery, realizing effective insurance. As a consequence, peripheral banks’ funding has shifted from private to public sources (see e.g. Pisany-Ferry and Merler). The Target2 imbalances that capture this have risen to unprecedented levels.

The question is whether these matter, especially in the case of a break-up of the eurozone. On the one hand, Hans Werner Sinn claims it does, big time as “Germany would lose $899 billion […] should Greece, Ireland, Italy, Portugal and Spain go bankrupt and repay nothing, while the euro survives”. On the other hand, Felix Salmon writes that there is no reason to worry about these potential losses as it basically boils down to an accounting loss for the Bundesbank since it could simply print new Deutschmarks. According to Salmon, As long as “German banks kept those Deutschmarks on deposit at the Bundesbank, and remained shy about lending them out to borrowers in other countries, the money supply in Germany wouldn’t actually increase at all” and there would be no inflationary consequences. To get a sense of what’s going on in this debate, it is useful to look at a stylized example.

A stylized example with two countries

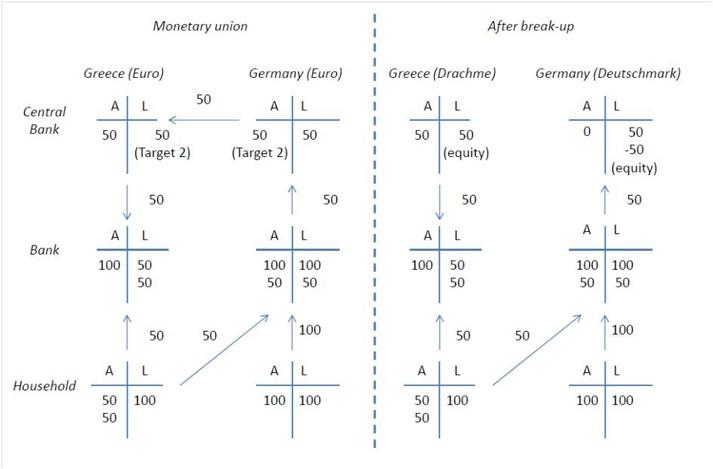

Let’s consider an imaginary monetary union with two countries (called Germany and Greece for convenience) where households hold 100 euro of deposits, banks invest this money in assets, and capital flight has resulted in a 50 euro Target2 exposure.

The left-hand side depicts the situation before break-up. The starting point is the bottom of the diagram where one sees that Greek depositors have withdrawn half of their deposits from Greek banks and have placed them in German banks. The banks in ‘Germany’ therefore have 150 euro of liabilities, consisting of 100 euro deposits by German and 50 euro deposits by Greek households. In the absence of attractive investment opportunities (or afraid this money might be withdrawn unexpectedly), German banks deposit the Greek households’ 50 euro with the German Central Bank. The German Central Bank incurs a liability of 50 euro and gains an asset of 50 euro vis-à-vis the Eurosystem. The Greek bank, on the other hand, has assets worth 100 euro and only 50 euro in deposits. It needs to borrow 50 euro from its central bank. It can do so against collateral. Then the Greek central bank gains a collateralized asset with a book value of 50 euro and creates 50 euro, which is reflected by a liability of 50 euro vis-à-vis the Eurosystem.

Figure 1: Stylized example of capital flight

Note that in order to be allowed to borrow from the Eurosystem, a Greek bank has to provide collateral (ECB guidelines, p29). It is only when commercial banks default and the collateral posted turns out to be insufficient that central banks make a loss, a point made by Guntram Wolff on this blog. Borrowing from the Eurosystem is managed via its NCB, who is also responsible for assessing the quality of the collateral posted by the bank and holds it as well. And yes, collateral standards have been relaxed over the crisis and recently, some NCBs (those of Ireland, Spain, France, Italy, Cyprus, Austria and Portugal) have been authorized to accept lower quality - less liquid - collateral as a basis for these loans (see box 2 in the ECB’s February 2012 monthly bulletin). However, the fact that these loans are collateralized will reduce the probability and size of losses for central banks in a non break-up scenario.

The right-hand side illustrates the situation after the break-up, when Euros are converted to Drachmas and Marks, respectively. The risk originating from Greek banks that default on Eurosystem loans is now fully carried by the Greek central bank, which has loans outstanding and holds the collateral. At the same time, capital flight from the Greek financial system will intensify. Therefore, it seems reasonable to assume that the Greek central bank defaults on its liability vis-à-vis the Eurosystem and that the German central bank fully writes off its corresponding asset. As a result, the Greek central bank now has 50 euro of positive equity on its balance sheet, while the German central bank has negative equity of 50 euro.

Actual numbers

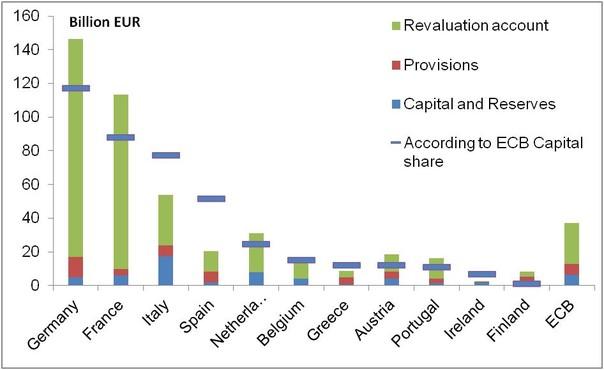

Of course, the German Central bank and other central bank including the Greek central banks have buffers against such events. How large are these buffers? This ECB document explains that they exist of equity capital, loss provisions, and revaluation reserves. Figure 1 gives an overview of these positions for a subset of EMU countries. The total buffer is approximately 470 billion euro. Compare this with the Target2 liabilities of the Eurosystem periphery in Table 1. Together their size is twice the size of the buffer. The vertical bar shows each member state’s total buffer size, while the horizontal blue line shows what the buffer size for each country would be if this aggregate buffer were distributed over countries according to their ECB capital share.

Figure 2: NCBs buffer size

Source: National Central Banks’ 2011 annual accounts

Table 1: Target2 liabilities sizes in billion EUR

|

Country |

Target2 liability |

|

Spain |

423 |

|

Italy |

280 |

|

Greece |

105 |

|

Ireland |

103 |

|

Portugal |

73 |

|

Total |

984 |

Source: http://www.querschuesse.de/target2-salden/ (accessed 31/08/2012)

Negative equity in principle doesn’t matter

A central bank’s level of equity by itself is meaningless. Although the central bank may lose money, real consequences of these losses only arise if this affects e.g. inflation, investment, or (through the exchange rate) the value of foreign assets. In our stylized example, nothing real changes for Germany as long as Greek depositors keep their money with German banks and German banks keep their money with the central banks: investment doesn’t change and inflation isn’t affected. In this sense, Felix Salmon is right to argue that Target2 assets and liabilities are mere accounting conventions.

But the real world is not static. After a break-up and initial depreciation of the Drachme, Greek depositors may return to their Greek banks, or German banks may restart lending to Greek banks when health is restored to the Greek financial system. Both imply an appreciation of the Drachma and a depreciation of the German Mark; investors are selling German Marks to acquire Greek Drachmas. The cheaper German Mark will fuel the economy, driving up inflation. Alternatively, when Greek depositors keep their money in Germany, German banks may decide to invest these deposits. If they are invested in Germany, its economy may experience a credit boom, overheating the economy and increasing inflation.

Thus, in a dynamic world the Bundesbank will have to respond to increasing or decreasing inflation. It may, for example, want to increase interest rates to bring down inflation. If the Bundesbank retains its credibility and successfully manages inflation expectations, losses will be limited. The extent to which losses occur therefore depends on the credibility of the German central bank’s monetary policy.

And central bank policy can in principle be perfectly credible with negative equity. Incurring a loss of 50 DM of negative equity is the equivalent of creating 50 DM of central bank money. Both have no backing whatsoever: whether the central bank has 50 DM of liabilities or pushes the button and creates 50 DM of assets and annihilates the negative equity is immaterial, as Karl Whelan argues here. Chili and Czech Republic, which are currently running credible monetary policy with negative equity positions, demonstrate this.

Or does it?

Of course there is the issue of central bank dividend payments foregone by the government. In the years following the break-up the German central bank may want to use its profits to regain positive equity value. These are of the order of a few billion euro, 2011 it was 2.2 billion, for example. Although these are indeed real losses, this number is several orders of magnitude smaller than the 1000 billion euro loss others are talking about.

More importantly, however, central banks themselves claim that negative equity may impact a central bank’s willingness to act. This is a self-fulfilling prophecy: if central bankers are unwilling to take on negative equity, it will impact their behavior and then, yes, negative equity does induce losses. For example, the Bundesbank might ask the German government to recapitalize it, which would result in increasing taxes. And it gets even more complicated. It is the expectation of future central bank policies that matters for the inflation rate. If firms and consumers believe central banks are unwilling to take on negative equity (even though they are), central bank policy may lose its credibility.

Thus, if central bankers believe, or the public believes that central bankers believe, that a negative equity position of the central bank leads to a change in monetary policy, real consequences materialize and central bank equity matters. In that sense, Sinn has a point in claiming that Target2 assets and liabilities will lead to losses in case of a break-up. But this is more complex than simply taking the Target 2 imbalances and equating those to a loss. In particular, a onetime shock beyond control of an otherwise credible central bank is something completely different from a central bank that consistently creates too much money. Why should consumers believe that the German Central Bank has suddenly changed its anti-inflationary policies? In the end, whether or not Target 2 imbalances lead to losses if a currency union breaks down is largely the German Central bank’s own business.