SNS Reaal expropriation: Should Senior bondholders carry the burden on future bank resolutions?

Last week the Dutch government announced the full expropriation of SNS Reaal, the 4th largest Dutch bank and decided to write-off shareholders an

Last week the Dutch government announced the full expropriation of SNS Reaal, the 4th largest Dutch bank and decided to write-off shareholders and junior bondholders while senior bondholders where left untouched.

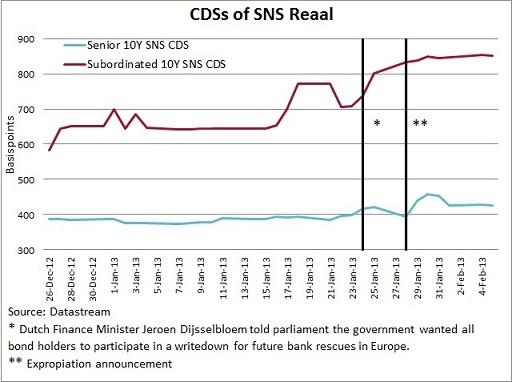

Looking at markets’ reaction, the decision was expected, as we observe an important widening in the spread between the Senior and Subordinated bonds before the announcement and the valuation of the defaulted bonds didn’t change much after the expropriation.

In the market side there is Fitch Ratings saying that if the European policy towards bank resolution will change towards bailing-in ordinary bondholders, ratings would be lowered and this would change how they look at banks.The idea of bailing in ordinary bondholders in future bank’s resolutions in Europe to avoid using taxpayers’ money is rising in popularity, already counting with the support of German and Dutch Finance Ministers, and the Finish Prime Minister.

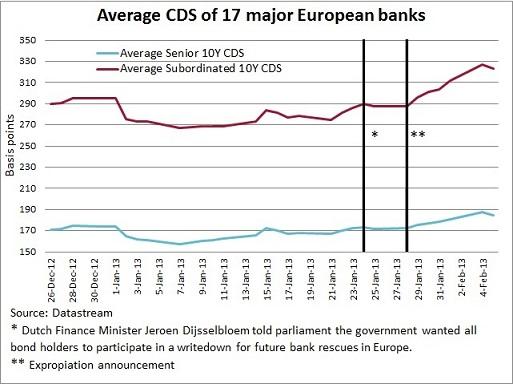

On average the CDS for 10Y Senior bonds of the 17 biggest European banks [1]rose by 12 basis points while those of Subordinated bonds rose by 34 basis points since Dijsselbloem’s intervention in the Parliament (i.e. from January, 24 to February, 5), increasing the spread between Senior in Subordinated bonds by 22 basis points. To give a better idea of the magnitude of the market reaction, this is about 3.2 standard deviations (SD) from the weekly volatility in the case of Senior bonds, 6 SD for the Subordinated ones and 3 SD in their spread.

The adequacy of the application of a bail-in regime in the future Single Resolution Mechanism in Europe is an important topic that counts with many supporters and opponents and has to be treated in depth in future research, especially if it is to be applied by 2015 as it is currently being discussed in the European Commission but in a nutshell:

· Their opponents argue that it would raise funding costs for financial corporations in Europe and this additional cost will be transferred to the real economy as higher interest rates for mortgages and loans to non-financial corporations. This is an unavoidable short run consequence.

· While supporters claim this measure could break the moral hazard of bail outs avoiding excessive risk taking by financial institutions that leads to banking crises. In the long run lower financial risk taking will lead to a more stable financial system and fewer bank collapses (no need to enforce bail-ins), thus the initial increase in borrowing costs will be reverted.

[1] Deutche Bank, HSBC, BNP Paribas, Credit Agricole, Barclays Capital, Royal Bank of Scotland, Banco Santander, Societe Generale, UBS, Lloyds, ING, Unicredit, Credit Suisse, Nordea Bank, Commerzebank, HBOS, Intesa Sanpaolo.