Tim Geithner and Europe’s phone number

According to a famous (yet apocryphal) joke by Henry Kissinger, there is no telephone number to call to speak to Europe. Indeed the fragmentation of E

According to Henry Kissinger's famous (yet apocryphal) joke, there is no telephone number for Europe. US Treasury Secretary Tim Geithner, however, seems to have resolved Kissinger's dilemma by calling not one number but dozens. This, at least, is what his official schedule indicates: from January 2010 to June 2012, the last date for which his calendar is publicly available, he had no fewer than 168 meetings or phone calls with euro-area officials, plus 114 with the International Monetary Fund. And the person he spoke to most often, apart from the IMF chief, was the European Central Bank president.[1]

I had the idea to examine this data when I was recently asked to speak at a conference on the US and the euro-area crisis. I was looking for some sort of quantitative evidence of the involvement of the Obama administration in the European discussion, and thought the frequency of these contacts would provide an informative indicator. Obviously, the calendar does not indicate what the subject matter of discussions was. But what else could have justified 58 contacts in 30 months between Tim Geithner and the ECB’s successive presidents, Jean-Claude Trichet and Mario Draghi? Admittedly, he may have had a more diverse array of topics to discuss with German Finance Minister Wolfgang Schäuble (36 contacts) or his French counterparts (32 contacts). But why would have he called them significantly more than the UK Chancellor of the Exchequer (19 contacts), with whom euro-area issues must also have been discussed? The one institution with which he certainly addressed other issues is the IMF (114 contacts with successive Fund chiefs Strauss-Kahn and Lagarde, and deputies Lipsky and Lipton), but here again, knowing how concentrated on Europe the IMF has been in recent years, the euro crisis certainly featured high on the agenda.

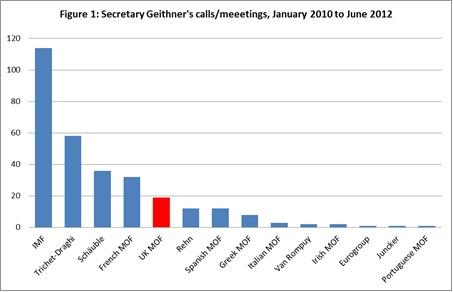

Figure 1 displays the distribution of contacts for the entire period. Three striking facts emerge:

- First, the data confirm the key role played by the IMF and the frequency of contact it has with the US Treasury Secretary. Nevertheless, there were significantly more contacts with European policymakers (168 against 114), which can be regarded as indicative of the direct involvement of the US administration in European policy discussions;

- Second, the ECB emerges on top of all European institutions, far ahead of the European Commission and even further ahead of the Eurogroup, for which only two contacts are recorded (a G3 conference call in March 2011 and Geithner’s participation in a Eurogroup meeting in Poland in September 2011). There is little doubt that for the US Treasury, “Mr Euro” is first and foremost the ECB president. This finding is especially striking, as the ECB’s institutional interlocutor is the Fed, not the US Treasury.;

- Third, there have been many more bilateral contacts with the German and French finance ministers than with the European Commission or the chair of the Eurogroup. This confirms the driving role of major national capitals.

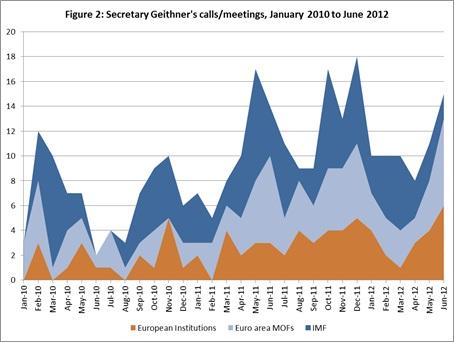

Figure 2 displays the number of monthly contacts distributed into three broad groups: European institutions, national governments, and the IMF. It indicates four episodes of intensive transatlantic consultations:

- Before the agreement on the first Greek programme in May 2010. In March, Geithner had no fewer than 9 calls or meetings with Fund chief Strauss-Kahn;

- In autumn 2010, in the run-up to the Irish programme. In November 2010, at a time of controversy between the IMF and the ECB over a possible bail-in of Irish bank creditors, Geithner had 5 contacts with the Fund and 5 with Jean-Claude Trichet;

- From spring 2011 to end 2011 (with a short respite in late summer/early autumn). This was a period of intense discussions on the restructuring of the Greek debt and the search for a comprehensive response to an escalating crisis. The US administration was especially vocal on the so-called “firewall”. Contacts during this period were more frequent than ever before and involved all categories of European partner;

- In spring 2012. During this period, in which discussions increasingly focused on the plans for a banking union, contacts with the Fund were relatively less frequent, in comparison to those with European institutions and national capitals. During this period Geithner had several contacts with his Spanish counterpart De Guindos, and with Italian PM and Finance Minister Mario Monti.

Summing up, the data suggests constant and very active involvement on the part of the Obama administration in the search for solutions to the euro crisis. They also tell us who matters in Europe in the eyes of the US administration: clearly, the one European institution that really counts is the ECB. In spite of the complex governance arrangements in place, other European institutions matter much less than Berlin and Paris.

Thanks to Julian Lentz for his assistance in the compilation of data.

[1] Excluding contacts with Mario Draghi prior to his appointment to the ECB. Draghi was chairing the Financial Stability Board, so presumably contacts up until November 2011 were devoted to G20 affairs.