What is the net of good and bad news from Brussels and Washington?

The short answer is: somewhat positive. The longer, but still broad-brush, answer starts from noting that two important documents have been issue

The short answer is: somewhat positive.

The longer, but still broad-brush, answer starts from noting that two important documents have been issued in the last few days: the In-depth reviews following the so called AMR (Alert Mechanism Report) from the European Commission and the World Economic Outlook from the IMF. It is useful to look at these two documents from a specific perspective, namely to find elements to answer the question whether the balance between good and bad news about the euro area is positive or negative. Equivalently, one can use the information and the assessments they provide to conclude how the healing process from the euro area crisis is progressing. An assessment in the same vein, concentrating on the growth problem in the euro-area, is offered by the recent Bruegel Policy Brief by Zsolt Darvas, Jean Pisani-Ferry and Guntram B. Wolff.

Let´s follow the scorpion approach - in cauda venenum - and begin with the good news.

The first piece of good news is the fact itself that the EU Commission has produced a thorough AMR, which is an element of the MIP (Macroeconomic Imbalances Procedure), which is in turn part of the so called 'Six-Pack' governance package. The sequence of acronyms is terrible, but those willing to go beyond it and recall the famous sentence of Monnet: “J’ai toujours pensé que l’Europe se ferait dans les crises, et qu’elle serait la somme des solutions qu’on apporterait à ces crises.” (I always thought that Europe will be built on the occasion of crises, and that it will result from the accumulation of solutions implemented to deal with these crises.) can understand why this is good news. The euro area has exploited the opportunity of the crisis to improve its macroeconomic governance and the AMR-MIP-Six Pack sequence is part of this progress. The remark from the IMF WEO (page xiii) that “institutional progress has been made over the past year, in particular on creating a road map for a banking union” as well as the achievement of the European Stability Mechanism and the decision on the Outright Monetary Transaction programs go in the same direction.

The second piece of good news is that both the WEO and the AMR show that flows are continuing to adjust in the euro area, even if there are “differences in nature and pace across the Member States” and this could generate spill-overs across countries. The adjustment is evident in current account developments, in fiscal deficits, in the changes in external competitiveness, in Unit Labour Costs, in the correction of house prices, in the reduction of private debt. Of course, the question is whether the improvements in the flows are temporary, basically forced by the brunt of the recession, in particular in Southern Europe, or are more structural. In this respect, both the WEO and the AMR forecast that the improvement will continue at least over the immediate future.

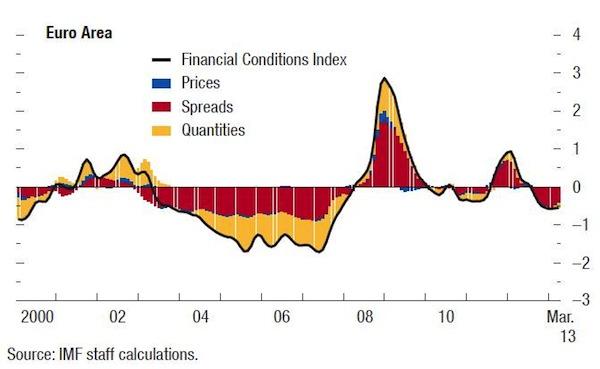

The third piece of good news, reported by the WEO (page xv), is that “over the past six months, advanced economy policymakers have successfully defused two of the biggest short-term threats to the global recovery: the threat of a euro area breakup and a sharp fiscal contraction in the United States caused by a plunge off the fiscal cliff. In response, financial markets have rallied on a broad front.” Somewhat in the same line, goes the assessment of April 2013 Global Financial Stability Report of IMF that “near-term financial stability risks have eased.” The lower spreads on the sovereign bonds of the peripheral countries, the easing of tension in the funding of Southern European banks shown by the reducing Target balances, the incipient market access for Portugal and Ireland confirm that the financial situation has improved. (See Chart 1 below)

Chart 1 – Financial Condition Index, standard deviations from average, positive = tightening

Now come the bad news

The first bad news is that, while flows are adjusting, stocks are still unbalanced. The net international investment positions as a share of GDP have stayed at high negative levels in many current account deficit countries, the long-run price competitiveness losses have not been fully corrected in most Member States, public and private debt (households and corporations) remains in a number of cases too high.

The second bad news is that Europe is lagging behind in the recovery and the IMF had to move from a two speed to a three speed paradigm to describe the current global developments, where Europe is trailing behind emerging economies and the United States, with rates of growth negative this year and anaemic the next one. This is aggravated by the latitudinal macro divide between a South in recession and a North just managing to stay in the positive domain and by the fact that, because of the still fragmented financial conditions impairing the monetary policy transmission mechanism, monetary policy is tighter in the South of Europe than in the North.

Going forward, a potentially third bad news is that the euro area may be trapped in a no-win situation: if financial tensions aggravate, there will necessarily be negative consequences for the real economy, mostly in the South. If the financial tensions further come down, the euro exchange rate may be pushed up from the «modestly stronger relative to medium-term fundamentals» (WEO, page 12) level by the “endogenous tightening mechanism” that is at work in the euro area. This is triggered when commercial banks reduce the liquidity they draw from the ECB and, as a consequence, the money market rate moves away from close to zero up to the 0.75 per cent level of the ECB official rate. This “endogenous tightening”, which would be equivalent to 3 steps of quarter-point explicit monetary policy tightening, could result in exchange appreciation, which would be particularly unwelcome at a time when other central banks in the advanced world are either continuing or even enhancing their expansionary policies.

The fourth bad news is that there seems to be always a new candidate from the rank of euro area countries ready to take the role of crisis bearer: Cyprus has just done it and there is a fear Slovenia may be the next one.

The fifth bad news is that “relative to U.S. banks, euro area banks have made less progress in rationalizing their balance sheets, cutting administrative costs, and rebuilding profitability and capital”, in the words of WEO (page 21).

The worst bad news is the sixth one and takes the overall name of risk of complacency, of which there are three variants: first, adjustment fatigue, in stressed jurisdictions; second, support fatigue in core jurisdictions; third, relenting on institutional innovation, in particular on essential progress for a banking union. Indeed, the WEO quotation above that “institutional progress has been made over the past year, in particular on creating a road map for a banking union” was deliberately incomplete, missing the crucial qualification: “Yet this is not enough”.

And the net is…

Just counting the three good and the six bad news, one would clearly indicate that the net is negative. But there are attenuating factors about some of the six bad news that can tilt the balance in the opposite direction.

The story about the flows and the stocks can be summarized by saying that correction is on-going but not complete and that a continuation of the current trends can achieve the necessary macroeconomic adjustment.

The considerations about growth need to be a bit longer. The first factor attenuating the negative growth situation is that, as shown in the WEO, much of the needed fiscal correction has already been done, especially in Southern Europe, and front loading is painful when you are doing it but helps when you have done it. The second attenuating factor is that the ECB still has room to lower its policy rate and is apparently considering this possibility. In addition, the President fed expectations that the ingenuity of the ECB will devise new ways to repair the broken transmission mechanism, especially when it comes to medium and small enterprises in the South. Finally, structural measures could improve growth prospects.

The ability of the ECB to further expand monetary policy, if necessary, should also protect against the third potential bad news mentioned above.

As regards the fourth bad news, the attenuating factor is that the record of the euro area policy makers in dealing with stressed jurisdictions is, by now, fairly solid on substance even if appalling in style and communication. The progress achieved on the older cases, Greece, Ireland and Portugal, as well as the solution, at least on the fiscal front, finally decided for Cyprus are a good omens about the ability of the euro area to deal with crisis situations.

Unfortunately, it is not easy to identify attenuating factors for bad news five and six. What can be said here is that the record so far is that remedial action has been proportional to market pressure. One would of course had hoped the proportionality parameter to be larger, with a given degree of market pressure delivering more in terms of action by banks as well as policy makers. The hope is, however, that the parameter is high enough to progressively build sufficient measures. In a way, the Monnet sentence reported above describes a dynamic process: crises generate actions that deal with them and cumulatively build the European Union. History shows that Monnet´s prediction turned true. If the historical trend will not be broken, we have found an attenuating factor also for bad news five and six. Thus, one can indeed confirm the short answer: yes, the net of good and bad news coming from Brussels and Washington is somewhat positive for the euro area.