Who got their money out of Cyprus?

The Central Bank of Cyprus released data today on the amount of deposits in Cypriot banks at the end of March. The original rescue plan, inv

The Central Bank of Cyprus released data today on the amount of deposits in Cypriot banks at the end of March. The original rescue plan, involving haircuts to insured deposits, was announced on the 16th of March and the final modified agreement on the 25th of March. The data is therefore an early indicator of: (i) the degree of rush by depositors to withdraw their money; (ii) the efficiency of Cypriot capital controls.

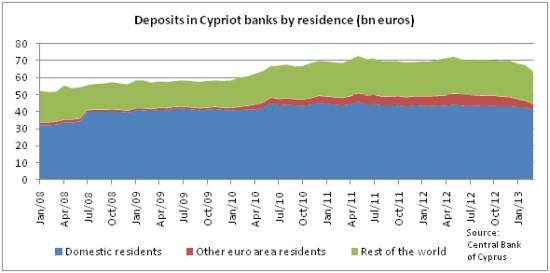

The figure below reveals that total deposits in Cypriot banks decreased from 67.5bn at the end of February to 63.7bn in March, a fall of 5.6 %. This is the biggest absolute and relative monthly decline in deposits in the sample, which starts in December 2005. The previous record (in relative terms) was a decline of 3 % in May 2008.

It is interesting to look at how the decline was distributed among depositors of different nationality and across sectors. Firstly, deposits of domestic residents decreased 3.1 %, those of other euro area residents 12.8 % and those from the rest of the world 9.3 %. Foreigners therefore seemed more eager or more able to withdraw deposits from Cypriot banks.

Differentiating by type of institutions, the decline was most pronounced for ‘other financial intermediaries’ (-11.5 %), followed by non-financial corporations (-7 %), households (-4 %), general government (-1.6 %) and insurance corporations and pension funds (-0.1 %). There was a distinction in sectoral developments, however, depending on the residence of depositors. For instance, whereas deposits by foreign households decreased 10.4 %, the decline was only 2.2 % for Cypriot households. A surprising piece of data is that deposits by foreign governments almost doubled (although from a very low basis) – they increased from 6.3bn in February to 11.8bn in March. Almost all (4.4bn) of this increase was by governments outside the euro area.

The data therefore affirms a significant – though not massive – reduction in deposits since the Cypriot rescue. It also reveals differences in the ability or desire of different agents to decrease their exposure to the Cypriot banking system. The data incorporates, however, only the first two weeks since the original rescue package. Subsequent data will tell to what degree capital controls have prevented a further reduction in the depositor base.