German wages grow faster than euro area average – Spring 2013 Review

In December 2012 we published a blog post reporting that German wage growth rates (year-over-year comparison) for 2012 had been higher than

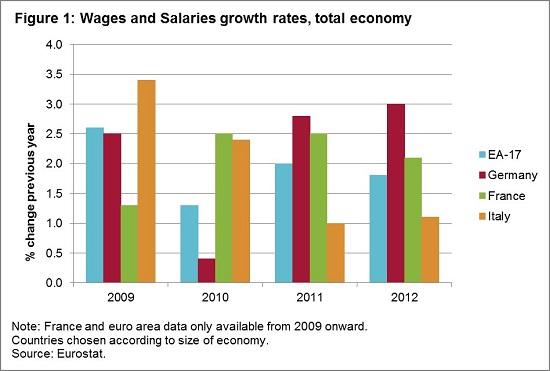

In December 2012 we published a blog post reporting that German wage growth rates (year-over-year comparison) for 2012 had been higher than the Eurozone average, with at that time, 2.5 percent versus 1.7 percent. In the meantime the annual rates for nominal wage and salary growth have been published showing that the difference has increased; German wage growth of 3 % compared to a 1.8 percent increase of the euro area. France and Italy had wage and salary growth rates of 2.1 percent and 1.1 percent respectively (see Figure 1).

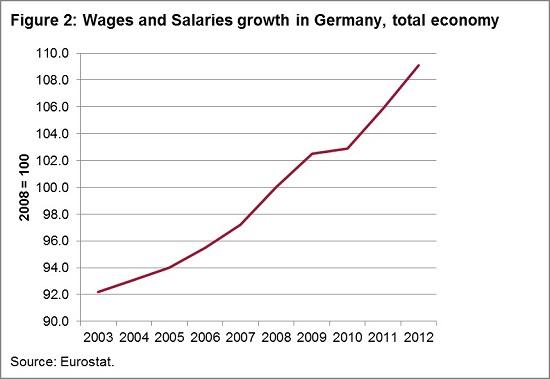

German wage growth rates have been increasing over the previous 8 years, except for a sharp decrease to 0.4 percent in 2010 when Germany had one of the lowest rates in Europe (see Figure 2). When looking at the net wage increase and taking inflation into account the picture becomes even more pronounced. In 2012 Germany had an inflation rate of 2.1 percent, resulting in a net rise in wages of 0.4 percent compared to 2011; meanwhile the Eurozone experienced 2.5 percent inflation, France 2.2 percent and Italy 3.3 percent causing a decrease in net wages of 0.8 percent in the Eurozone, 0.1 percent in France and even 2.2 percent in Italy[1].

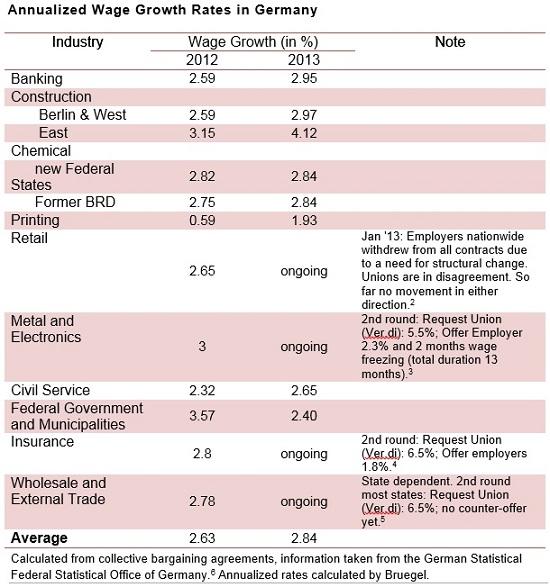

In our blog post from December we further looked at the annualized wage growth rate coming from collective bargaining agreements in Germany’s main industries in 2012. However, many of the collective agreements had been reached in 2011 already. In 2013 many of the agreements have already ended or will end in the near future making it an interesting study to compare the newly negotiated wage increases and have a look at the wage development of this year. With expectations of a small increase in economic growth, German unions started the year with demands of wage increases of around 6 percent, several rounds later most of the main sectors have concluded the bargaining process resulting in an increase in the annualized growth rate for 2013 compared to the previous year. Overall, the average increased from 2.63 percent in 2012 to 2.84 percent in 2013.

The sector with the slowest wage growth remains the printing industry while the construction sector concluded negotiations with the highest annual increase in wages, especially in East-Germany. However, important sectors such as insurance and wholesale and external trade have not been able to conclude the bargaining process yet. Moreover, in retail the collective bargaining process seems to have reached a deadlock after employers all over the nation withdrew from the current contracts at the beginning of the year due to the need for a major update as job descriptions and titles have changed tremendously while the contract definitions remained the same. Even more importantly, the metal and electronics industry, one of Germany’s largest sectors, represented by one of the most powerful unions in the country (IG Metall) is also still in the middle of negotiations, but with employers offering 2.3 percent in the second round it appears likely this sector will experience an increased wage growth of above 2.5 percent as well (see Table 1 below).

Again, looking at real wages in Germany shows that with the latest inflation data lying at 1.8 percent in March 2013 and an AMECO forecast of 2 percent for 2013, most real wages in Germany will also increase this year.

This review confirms the conclusion made in December 2012; the adjustment process is continuing in the euro area. At the same time, the size of the differential between Germany and the euro area is still of a size that relative adjustment of wages may take 5 years.

[1] Source: Eurostat

[2] Faz.de (08.04.2013)

[3] Handelsblatt.de (06.05.2013)

[4] Ver.di (May 2013)

[5] Ver.di (May 2013)

[6] Deutsches Statistisches Bundesamt (2012)