Blogs review: The economics of a regime shift

What’s at stake:For several years already (see our previous reviews on price level and nominal GDP targeting), monetary economists and historians have

What’s at stake: For several years already (see our previous reviews on price level and nominal GDP targeting), monetary economists and historians have called for a regime change in monetary policy that would break with the past and greatly affect inflation and growth expectations. After two decades of deflation, this change has come to Japan. As with the UK experiment with fiscal contractions, the early effects of the Japanese experiment have been followed with great interest on both side of the Atlantic where the policy approach has been more incremental. In this post, I complement the discussion of Abenomics with historical evidence from the Great Depression.

The idea of economic defeatism

Paul Krugman writes that in a sense, the really remarkable thing about “Abenomics” is that nobody else in the advanced world is trying anything similar. In fact, the Western world seems overtaken by economic defeatism. In Europe, there is no hint of a major change in policy. At best, we may be looking at a slight relaxation of the savage austerity programs.

Christina Romer and David Romer show that what are widely viewed as the two largest errors in Federal Reserve history – inaction in the wake of banking panics early in the Depression, and inaction in the face of high and rising inflation in the 1970s – were both borne of excessive pessimism about the power of monetary policy. Fear that policies might not work or might be costly led policymakers to conclude that the prudent thing was to do nothing. Yet there is now widespread consensus that action would have been effective in both these periods.

Christina Romer argues that last September, the Fed changed its tone and actions substantially. But the truth is even these moves were pretty small steps. With its most recent action, the Fed has pushed the edges of its current regime. Nevertheless, the key fact remains that the Fed has been unwilling to do a regime shift. And because of that, monetary policy has not been able to play a decisive role in generating recovery. Joseph Gagnon (HT NYT) gives this analogy to illustrate the economic defeatism of policymakers: it’s as if we went to the biggest fire we’ve ever seen and we poured more water on it than we’ve ever poured, and the fire isn’t completely out. Well, we should try more water.

The end of one big deflation: the US (and UK) in the 1930s

Christina Romer argues that through a combination of actions, the most important of which were monetary, Franklin Roosevelt managed to turn our ocean liner of an economy on a dime. Roosevelt’s actions were bold enough and different enough from what had been done before that people had no choice but to notice. Industrial production climbed 57% in the first four months of the Roosevelt administration. And real GDP continued to grow at an average rate of nearly 10% per year between 1933 and 1937. The video below suggests that Roosevelt’s ideas of reflation were getting through to ordinary Americans.

Source: YouTube

In their 1990 EEH paper Peter Temin and Barry Wigmore analyze the beginning of the recovery in the US within the framework used by Sargent (1983) to study the end of hyperinflations. Sargent argued that the key to costless stabilization was the establishment of a new policy regime. Actions were needed to establish the new regime and its credibility, but the immediate effects were through rapidly revised expectations.

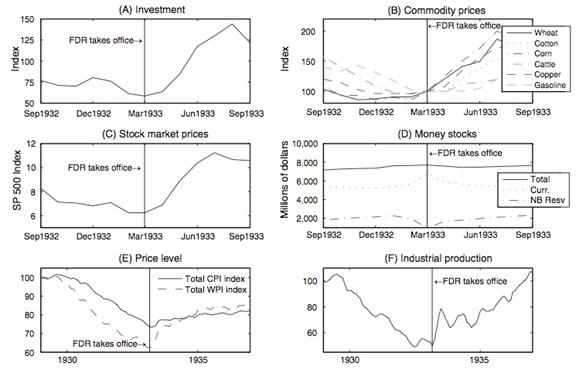

Peter Temin and Barry Wigmore’s argument is that FDR established a new macroeconomic policy regime shortly after his inauguration in March 1933. The Hoover administration had been financially conservative, adhering to the rules of the gold standard and fiscal orthodoxy. Its policy stance in the troubles of the early 1930s therefore, was decidedly deflationary. Roosevelt broke with this ideology, devaluing the dollar within 6 weeks of his inauguration, promoting fiscal expansion, and championing the virtues of inflation-or reflation as he termed it. The problem with the traditional focus on the National Industrial Recovery Act (NIRA) as a source of the recovery is it came too late to explain the turn around.

Source: Gauti Eggertsson

Gauti Eggertsson writes that it is hard to overstate how radical the regime change was. “This is the end of Western civilization,” declared Director of the Budget Lewis Douglas. During Roosevelt’s first year in office, several senior government officials resigned in protest. These policies violated three almost universally accepted policy dogmas of the time: (a) the gold standard, (b) the principle of balanced budget, and (c) the commitment to small government. Interestingly, the end of the gold standard and the monetary and fiscal expansion were largely unexpected, since all these policies violated the Democratic presidential platform.

Nicholas Crafts writes that the years from 1933 through 1936 also saw a very strong recovery with growth of over 4% in every year in the UK. The policy framework adopted by the Chancellor of the Exchequer, Neville Chamberlain (in office from November 1931 to May 1937) from mid-1932 has a strong resemblance to the so-called ‘foolproof way’ of escaping from the liquidity trap (Svensson, 2003) and to ‘Abenomics’ in today’s Japan. A key aspect was that the Treasury under Chamberlain, rather than the Bank of England under Montagu Norman, ran monetary policy after the exit from the gold standard. The classic problem with the ‘foolproof way’, especially for central banks, is whether they can credibly commit to maintaining inflation once recovery appears to be under way. Because of its problems with fiscal sustainability, the Treasury was in a good position to persuade markets that it wanted sustained moderate inflation as part of a strategy to reduce the real interest rate below the growth rate of real GDP and to benefit from this differential in reducing the public-debt-to-GDP ratio.

The end of another one big deflation: Abenomics

Christina Romer argues that the regime shift we are seeing in Japan is just the kind of bold action that might actually succeed in changing both inflation and growth expectations a substantial amount. She also writes that the initial indicators are consistent with Japan’s actions being perceived as a genuine regime shift.

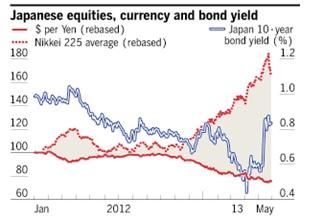

Source: Martin Wolf

Source: NY Fed

Martin Wolf writes that Japan’s effort to get its economy moving entered difficult terrain last week. Bond yields rose and stock prices fell. True, the yield on 10-year Japanese government bonds was 34.7 basis points (0.347 percentage points) higher than on May 6. But it was still only 0.91 per cent. This is where it was just over a year earlier. The Nikkei stock market index fell 9.5 per cent between May 22 and 27. But this followed a jump of 80 per cent between November 13 2012 and May 22 2013. Yes, the yen rose a little against the dollar last week, but it is still 23 per cent below its level in early October 2012.

Kate Mackenzie writes in FT Alphaville that the big thing happening in the Abenomicsphere recently is of course rising JGB yields. This might be the precursor to something terrible, i.e. yields rising unsustainably high, but higher yields are also a necessary effect of moving away from deflation.

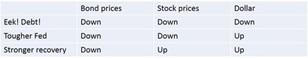

Paul Krugman explores three fundamental stories, each of which could explain a Nikkei plunge:

All of these imply a fall in stocks; but they have different implications for bond and currency markets. The impact of expected future monetary policy on long-term interest rates is ambiguous — rates might rise because they expect the BoJ to tighten, or fall because they fear that it will fail to end deflation. But worry about the BoJ’s resolve should have a clear impact on the yen, which should strengthen — which it did. So to the extent that this wasn’t just markets doing their occasional panic thing, it looks like a sudden outbreak of concern about whether the Bank of Japan has really changed as much as it seems. Scott Sumner sends us to a Reuters report, which explains that a rift within the Bank of Japan’s board was highlighted in the minutes of the April 26 meeting, which showed some policymakers opposed targeting 2 percent inflation in two years and called for more flexibility in guiding monetary policy.