Southern Europe no longer indebting to the rest of the world

This post is an update on the current account developments in Southern Europe and the composition of corresponding financial flows.

Elimination of current account deficits masks changes in composition of capital flows

The boom period in Southern Europe was marked by large current account deficits and corresponding capital inflows. The crisis led to significant private capital outflows (Merler and Pisani-Ferry 2012), which stabilized around the middle of last year as documented in an earlier post. The crisis did not, however, lead to a sudden reversal in total capital inflows to Southern Europe because the decline in private inflows was coupled with an offsetting increase in liquidity provided by the Eurosystem (as recorded in Target2) and official programme money (for Greece, Ireland and Portugal). This post is an update on the current account developments in Southern Europe and the composition of corresponding financial flows.

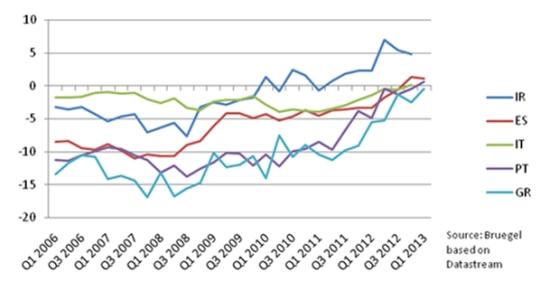

Figure 1 plots the evolution of the current account in the crisis countries. On a seasonally adjusted basis, Ireland reached surplus already in the first quarter of 2010. The other four countries reduced their average current account deficit from -6 % of GDP in 2011 to -1.7 % in 2012. As documented by Wolff (2013), the adjustment since the crisis has come to a significant extent from increased exports. This is true for all countries except Greece, where the declining deficit is almost exclusively due to import compression. Concerning the most recent data, Spain exhibited a positive current account balance in both 2012Q4 and 2013Q1 on a seasonally adjusted basis. The balance turned also positive for Italy and Portugal in 2012Q4 and 2013Q1 respectively.

Figure 1: Current account balance (%/GDP) 2006Q1-2013Q1, seasonally adjusted.

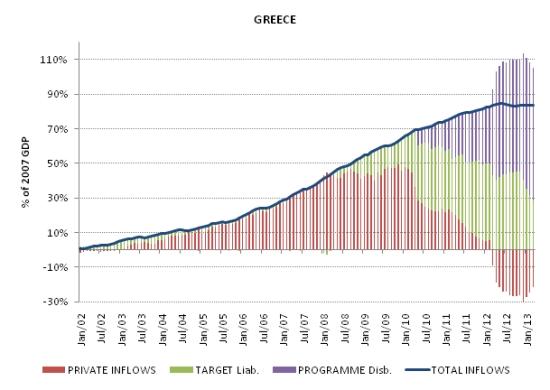

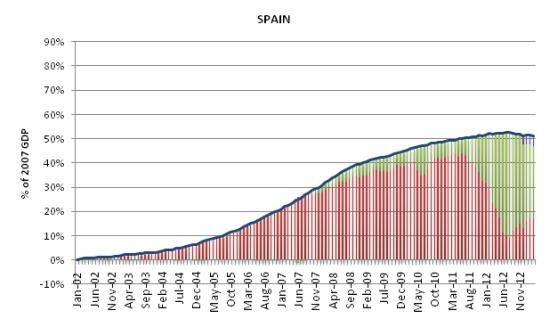

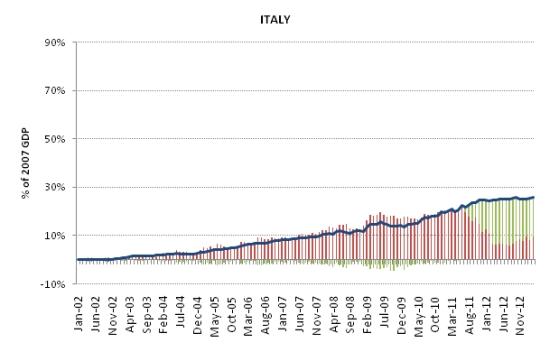

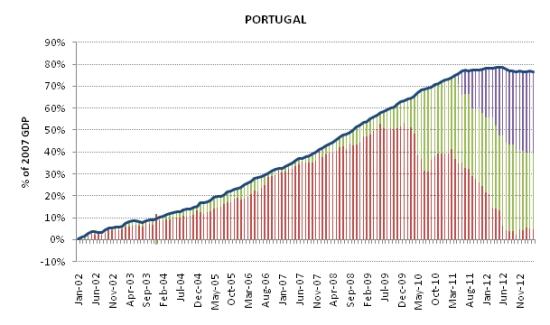

Declining current account deficits have halted the increase in total capital inflows to Southern Europe (Figures 2–5 at the end), which were negative for Portugal and Spain in the first three months of 2013. This relative inertia, however, masks changes in the composition of capital flows. A decline in Target2 liabilities has partly been offset by continuing public disbursements relating to adjustment programmes (Greece, Ireland and Portugal) or bank recapitalization (Spain). This offset has not been perfect, though, as manifested by the return of private inflows particularly in Greece, Italy and Spain during the first three months of 2013. To the extent that Target2 credit has been replaced by private inflows, this represents a normalization of financing conditions.

Financial account data is released with a lag and therefore we are not able to comment on the evolution of capital flows in the second quarter of 2013. However, Target2 data is available until April 2013 for most countries and May 2013 for Italy and Spain among others[1]. In April, Target2 net liabilities increased in Greece, Portugal and Ireland by 12bn in total after having generally declined in previous months. This was coupled with an increase of 19bn in claims by Germany after five months of declines. Aside regular variation, this might reflect wobbles in the euro area macroeconomic outlook leading investors to shun small vulnerable economies. Nevertheless, Italy and Spain continued to decrease their Target2 liabilities (by a total of 8.4bn in April and 17.6bn in May). What is more, Germany’s Target2 claims decreased again by 18.7bn in May, close to March levels.

Southern countries achieving external balance means that (as a whole) the economies are becoming no longer reliant on foreign financing. Before sectoral problems such as distressed banking systems or indebted sovereigns are overcome, however, Southern Europe will partly rely on official liquidity from abroad.

Figures 2–5: Components of cumulative net capital inflows (Jan 2002–Mar 2013).

Source: Bruegel based on Datastream (financial account data), Osnabrück University (Target2) and IMF, European Commission, EFSF, ESM (programme disbursements).

[1] Osnabrück University helpfully maintains a database of Target2 positions at eurocrisismonitor.com.