Blogs review: The deflationary bias of Germany’s current account

What’s at stake: For the first time the U.S. Treasury semi-annual report to “Congress on International Economic and Exchange Rate Polic

What’s at stake: For the first time the U.S. Treasury semi-annual report to “Congress on International Economic and Exchange Rate Policies” blamed Germany explicitly for its continuous current account surpluses, which have resulted into “a deflationary bias for the euro area, as well as for the world economy.” The response of the German finance ministry that Germany’s current account surplus offers “no reason for concern” has failed to convince the economics blogosphere, which overwhelmingly shares the views of the U.S. Treasury on this issue.

Current Account = Savings - Investment

Matthew Klein writes that the claim that “the trade surpluses reflect the strong competitiveness of the German economy and the international demand for quality products from Germany” is just wrong. Trade balances simply reflect the balance between domestic production and consumption. The special appeal of German products should show up in the volume of its exports, not the difference between its exports and its imports.

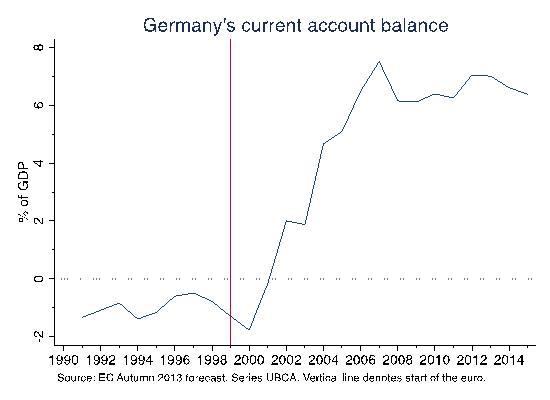

Paul Krugman writes that there’s a tendency, in discussing Germany’s position in world trade, to assume that massive surpluses have always been the German norm — that the country’s high-quality products have always fueled an export engine that inevitably sold much more abroad than Germans bought. But it’s not true. There was an earlier period of surpluses in the mid-80s, largely the counterpart of America’s Reagan-era deficits. But Germany didn’t run a surplus at all in the 90s. Its big move came with the introduction of the euro, and corresponding huge capital flows to the European periphery.

The paradox of thrift in the world economy

Ryan Avent writes that that a CA surplus wouldn't normally be a problem. German surpluses would usually generate appreciation in the German currency, which would eventually reduce the surplus. At the same time, a shortfall in external demand in other economies could simply be offset by higher internal demand. But Germany doesn't have a currency to appreciate; it shares the euro with lots of other economies. And at the moment because rich-world economies are chronically short of demand, and one component of demand is external demand. Germany's large current-account surplus means that it is enjoying a large chunk of the available external demand across the rich world.

Francesco Saraceno writes that the generalization of the German model to the whole eurozone is leading to increasing current account surpluses. Therefore, this is not simply a European problem anymore since the eurozone has moved from a substantial balance to a small but not negligible (1.9%) surplus. The eurozone as a whole today is a net saver, and therefore contributes to depress aggregate demand at the global level. Martin Wolf adds that the shift from deficit towards surplus is forecast by the IMF to be 3.3 per cent of eurozone GDP between 2008 and 2015.

A test for the macroeconomic imbalances procedure

Charlemagne writes that under the so-called macroeconomic imbalances procedure, a current-account deficit greater than 4% of GDP can trigger an alert, possibly followed by “in-depth analysis” carried out by the European Commission, policy recommendations and, ultimately, the threat of sanctions. Yet a country’s surplus must rise above 6% of GDP before Eurocrats start to take notice. Germany was let off last year because its surplus (averaged over three years) was a shade below the warning threshold and was expected to shrink. Now statisticians have revised that figure to 6.1%, and it has grown since then. It stood at 7% in 2012. The test for the Commission will come later this month, when the commission issues its latest economic forecasts and launches the “European semester”, an annual cycle of economic and budgetary assessments that culminate in the spring with “country-specific recommendations”.

Alexander Jung, Christian Reiermann and Gregor Peter Schmitz (HT Mark Thoma) write that suggestions that the Germans stimulate imports are unrealistic as the government also lacks important tools to influence them. Germans will buy more foreign goods if they earn more money. But this isn't something the government can dictate since, in Germany, employers and trade unions negotiate wage levels without any government interference.

The reasons behind a failure of analysis

Twenty-Cent Paradigms (HT Capital Ebbs and Flows) writes that the difficulty, in part, comes from the moralistic connotations of some of the language used to discuss international flows. That is, Germany is running a current account "surplus" which results from a high level of "savings", and saving and having a surplus sound like the results of virtuous behavior (while having deficits and low savings connote profligacy). So the idea that German economic policy is part of the problem is a hard sell to politicians, commentators and voters (and even some economists who should know better). But it takes two to have an imbalance.

Simon Wren-Lewis writes that the problem is not with Germany, but with the macroeconomic myths that seem to be so deeply embedded in current policy. There are three key myths that are leading German policy making astray. Myth 1: The EZ crisis stemmed from fiscal irresponsibility in the periphery EZ countries, and that the crisis can only be solved by reversing this through harsh austerity. Myth 2: An anti-Keynesian view that fiscal policy has no place in managing aggregate demand, which can be safely left in the hands of the ECB as long as the ECB sticks to its job of keeping inflation below 2%. Myth 3: To be independent, central banks must never buy government debt, as this indicates fiscal dominance. Although these three myths have a particular Ordoliberal flavour, they are not so very different from similar myths expounded by politicians and the occasional economist in the US, the UK and elsewhere in Europe. The myths are the problem.

France then, Germany now

Paul Krugman argues that Germany is playing a somewhat similar role than France in the Great Depression, which soaked up a huge proportion of the world’s gold reserves in 1930-31. The French weren’t evil or malicious here — they were just adhering to their hard-money ideology in an environment where that had terrible adverse effects on other countries. Germany’s role is not as drastic as that of France in the 1930s, but has less excuse. For Germany is an economic hegemon in a way France never was.

Uneasy Money writes that undervaluation of the franc would have done no permanent damage to the world economy if the Bank of France had not used the resulting inflow of foreign exchange to accumulate gold, cashing in sterling- and dollar-denominated financial assets for gold. Ryan Avent writes that the whole gold standard analogy and all the complaining about Germany is a red herring, because the ECB can create euros at will and can therefore banish any deflationary pressure emerging from Germany. In this crazy world of too-little demand, Germany deserves criticism for its surplus. But given that rich-world central banks could get printing and solve the problem of too-little demand outright, that criticism could be more usefully allocated elsewhere.