Mergers and acquisitions of Banks in the Euro Area: where are the borders?

The creation of a monetary union has allowed wholesale banking in Europe to become increasingly integrated, until the financial crisis reversed the tr

The creation of a monetary union has allowed wholesale banking in Europe to become increasingly integrated, until the financial crisis reversed the trend in 2008. The other side of the coin is an overall low degree of integration within the retail banking market of the Euro area, especially when compared to the US. This blog post studies the geographical distribution of bank M&A deals in the EA as measure of the retail banking integration both in absolute terms and relative to the US.

Financial integration in Europe

In their latest Bruegel policy contribution – presented at the informal ECOFIN in Vilnius on the 14th of September – André Sapir and Guntram Wolff discuss how Europe's financial system could and should be reshaped. The authors document the low degree of retail banking integration and how the wholesale banking integration was undone with the crisis kicking in. As a striking feature, they show the number of EA cross-border M&A deals between banks in Europe to be significantly lower than the counterpart on the other side of the Atlantic.

The following figures show the geographical distribution of bank M&A deals over time in both Europe and the USA. These are the main results:

- There are fewer deals in the EA than the US;

- There are relatively fewer cross-border deals in the EA than the US;

- The financial crisis has inhibited cross-border deals in the EA, but not in the US.

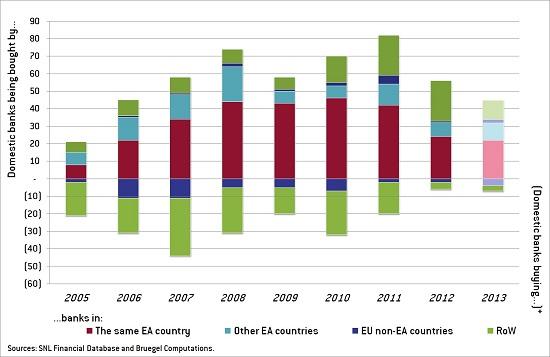

Figure 1: Total number of M&A deals involving EA17 banks

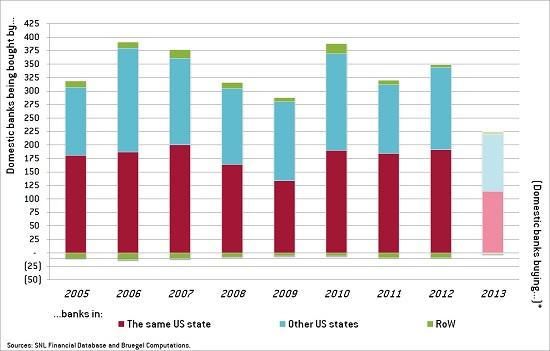

Figure 2: Total number of M&A deals involving US banks

NOTE: Figures 1 and 2 are obtained by aggregating across individual EA countries and US states, respectively.

The bars for 2013 – in lighter colors – include only the deals up to the end of October, therefore representing expectedly 80% of the figures expected at the end of the year.

*A symmetric copy of the red bars – domestic banks buying banks in ‘the same EA country’/‘the same US state’ – and of the azure ones – domestic banks buying banks in ‘other EA countries’/‘other US states’ – would need to be reported also on the negative semi-axis. We omit those to avoid redundancy.

- The total number of deals (Figures 1 and 2)

- The number of cross-border deals (Figure 3)

- The impact of the financial crisis on cross-border deals (Figure 3)

In a recent keynote speech, the ECB Executive Board member Yves Mersch advocated for a new single and stricter regime of supervision and resolution. To illustrate how far short we remain of a fully integrated financial market, Mr Mersch referred to Bruegel figures reported in Sapir and Wolff (2013) according to which the total number of M&A deals is much lower in the EA than the US.[1] In particular, with an annual average of 82 deals involving EA banks, against 345 involving US banks, there are about four times more M&A deals in the US than in the EA. This is an even more striking feature, if we consider the comparable population, GDP and financial market size.

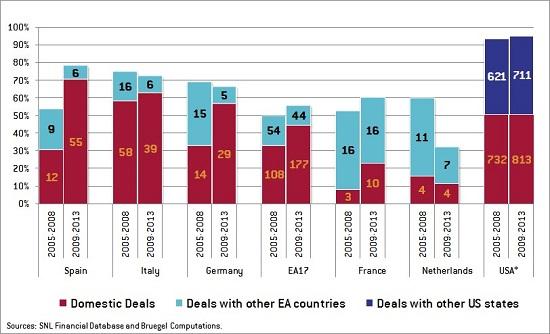

Figure 3: Shares of Bank Acquisitions by country, number of acquisitions in labels

NOTE: The residual (upper) bar, which is not showed, refers to those deals in which the counterpart is outside the EA.

*For the USA, the residual (upper) bar, which is not showed, refers to those deals in which the counterpart is outside the USA.

Only half of the total EA banks mergers took place within the EA borders, while more than 90% of the total US banks mergers took place within the US borders. More crucially, if we restrict the focus to deals in which both counterparts are US banks, we see that only 50% of these takes place also within the same state. Instead, out of the total deals between EA banks, a larger majority – about 70% – takes place within the same country. In other words, when not merging domestically, EA banks have no strong preference for merging with other EA banks rather than non-EA banks. Instead for the US, when not merging domestically - that is, not within the same state - the US banks agree on mergers mostly with US banks from other states, rather than with non-US banks.

In the aftermath of the crisis (sub-period 2009-2013), the share of deals involving only banks within the EA has increased from 50% of the total to 56%. The jump was mostly driven by a strong increase in the share of deals involving only banks within the same EA country, which went from 33% to 45%. On the other hand, the geographical distribution of deals in the US has not changed. To put it differently, with the financial crisis, the borders of the bank M&A market in Europe have shrunk behind the national frontiers, while the same did not occur in the US.

More union for the Union

The evidence on the geographical distribution of bank M&A deals shows not only that there are fewer deals going on in the EA than the US, but also that there are relatively fewer cross-border deals in the EA. Then, with the financial crisis, the share of cross-border deals shrank in the EA, while it remained unvaried in the US. One possible reason for the difference in outcomes is certainly the lack of a single system of supervision and resolution across Europe, which has discouraged cross-border activity, especially in time of crisis. The fragilities stemming out of financial fragmentation can in turn explain why the ECB and the participating national competent authorities must ensure that the same set of supervisory standards will be applied across the whole Banking Union. More ‘unified tools’ are indeed necessary to achieve a more ‘unified banking sector’ - a project often portrayed as the most important integration step since the launch of the Euro – and meet the medium term goal of achieving collective stability and restoring growth.

Notes on methodology

The main source adopted is the SNL Financial Database series, in particular the SNL Companies database and SNL Mergers and Acquisitions database.

We consider a sub-set of the SNL Mergers and Acquisitions database involving deals completed in the period 01/01/2005 to 30/10/2013 and in which either buyer or seller were located in the USA or Europe. This sub-set comprises a total of 4,606 deals.

For some of the deals, only name and geographic location of the subsidiary/branch being bought is reported; therefore the need of crossing the SNL Merges and Acquisitions database with the SNL Companies database which reports the banks’ ownership structure. We consider a sub-set of the SNL Companies database entailing 5,329 banks, their ultimate parent bank and relative geographic location of both. Hence, we could update the first database with the second so to have a more realistic picture of the M&A decisions made by the holding banking groups instead of the subsidiaries.

We acknowledge that more solid evidences would be provided by taking into account the relative size of the M&A deals, or alternatively the total assets of the target banks involved. In most of the cases this information was not reported in the database adopted. However, as a second-best solution, we conducted a similar study with only deals involving the Top 50 banks by total assets in both EA and US. The main results were confirmed.

Following the structure in the SNL Mergers and Acquisitions database, we consider completed mergers as acquisitions in which the reported buyer is the new entity created and the reported seller is the entity dismissed.

[1]The figures used in the keynote speech refer to the data reported by Sapir and Wolff (2013) and updated to the end of August.