Blogs review: The natural interest rate framework

What’s at stake: The natural rate of interest is a key ingredient in the recent discussion of secular stagnation, and more generally in

What’s at stake: The natural rate of interest is a key ingredient in the recent discussion of secular stagnation, and more generally in New-Keynesian models of the Great Recession. But the concept is often poorly understood, in part because the term refers to different things for different people.

John Cochrane writes that in most new-Keynesian thinking, our current problem is that the "natural rate" of interest, required to keep us at potential output, is sharply negative. (This is all exogenous.) With "only" 2% inflation and nominal interest rates stuck at zero, the Fed cannot deliver anything less than a negative 2% real rate of interest. If the "natural rate" is something like negative 5%, then we are stuck at a 3% "too high" real interest rate.

The Wicksellian framework

Richard Anderson writes that the Swedish economist Knut Wicksell based his theory on a comparison of the marginal product of capital with the cost of borrowing money. If the money rate of interest was below the natural rate of return on capital, entrepreneurs would borrow at the money rate to purchase capital (equipment and buildings), thereby increasing demand for all types of resources and their prices; the converse would be true if the money rate was greater than the natural rate of return on capital.

Axel Leijonhufvud writes Wicksell’s terminology divulges his engagement in the ancient quest for a ‘neutral’ monetary system, that is, a system neutral in the original sense that all relative prices develop as they would in a hypothetical world without paper money. Richard Anderson writes that while Wicksell sought to illuminate the transmission mechanism behind the quantity theory and to begin connecting the monetary base, banks’ extension of credit, aggregate demand, and inflation with the natural rate concept, his work laid the foundations that have led economists during the twentieth century to shift away from analysis of the quantity theory.

Greg Ip writes that Wicksell saw financial rates as those set by banks competing to make loans. That job is now performed by central banks. They still think in Wicksellian terms: the natural rate prevails when the economy is at full employment. Set the policy rate above the natural rate and the economy tips into depression. Set it below, and inflation results—or, some worry, speculative credit booms.

The natural interest rate, savings and investment

Axel Leijonhufvud writes that Erik Lindahl (1939) and Gunnar Myrdal (1939) refined the conceptual apparatus, in particular by introducing the distinction between ex ante plans and ex post realizations and thereby clarifying the relationship between Wicksellian theory and national income analysis.

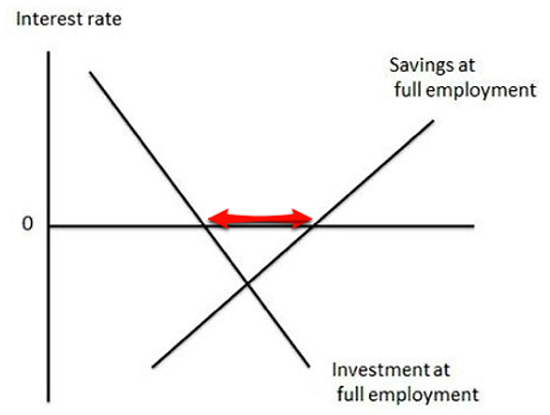

Brad DeLong writes that in the Wicksellian framework, the natural rate of interest is the interest rate at which planned investment (plus net borrowing from the government) is equal to desired saving at full employment (plus the net capital inflow from abroad). If the market rate of interest is below the natural rate, planned investment is greater than desired savings, businesses seeking to invest cannot sell enough bonds to finance investment and thus dip into their cash reserves, the monetary hot potato starts, and you get unexpected and rising inflation (and full or over-full employment).

Source: Brad DeLong

Nick Rowe notes that the Fed can, not only, reduce the market rate, but also try to increase the natural rate. The Fed could also raise the natural rate itself, by doing something (or promising to do something in future) that would increase expected future real income, which would increase current desired investment and reduce current desired saving. Another way of saying the same thing is that it might be useful to distinguish between a short-run and a long-run concept of the natural rate of interest. The short run concept takes the state of expectations as given. The long run concept assumes expectations consistent with the future economy being at the future natural rate. The natural rate of interest is not a number; it's a time-path.

Alternative definitions of the natural rate of interest

Miles Kimball sees a lot of confusion online about the natural interest rate. The main source of confusion is that there is both a medium-run natural interest rate and a short-run natural interest rate.

- The medium-run natural interest rate is the interest rate that would prevail at the existing levels of technology and capital if all stickiness of prices and wages were suddenly swept away. That is, the natural rate of interest rate is the interest rate that would prevail in the real-business cycle model that lies behind a sticky-price, sticky-wage, or sticky-price-and-sticky-wage model. The medium-run natural interest rate is not a constant. Indeed, at the introductory macroeconomics level, the standard model of the market for loanable funds is a model of how the medium-run natural interest rate is determined.

- The short-run natural interest rate is the the rental rate of capital, net of depreciation, in the economy’s actual situation. Low levels of output lowers the net rental rate and therefore lower the short-run natural interest rate. Leaving aside other shocks to the economy, monetary policy will not tend to increase output above its current level unless the interest rate is set below the short-run natural interest rate.