Blogs review: Understanding New-Keynesian models

What’s at stake: Many academics and policymakers have felt uncomfortable with the bold and often paradoxical predictions of New-Keynesian models at th

What’s at stake: Many academics and policymakers have felt uncomfortable with the bold and often paradoxical predictions of New-Keynesian models at the zero lower bound. But few have managed to provide a satisfying criticism, as the mechanics of these models often remain mysterious. A recent tractable formulation of the New-Keynesian liquidity trap by Ivan Werming has helped streamline the model to its essence and has generated important contributions that help clarify its mechanics.

Every law of economics changes sign at the zero bound

Johannes Wieland writes that New-Keynesian models, originally designed and estimated to match normal times, robustly make two predictions at the ZLB: First, demand-side policies are very stimulative and, second, negative supply shocks are expansionary. While many are skeptical whether these models describe the ZLB accurately enough to justify such bold policy choices, actual policy decisions in the U.S. and other countries have been based on these propositions.

Paul Krugman writes the liquidity trap is puts us in a world of topsy-turvy, in which many of the usual rules of economics cease to hold. John Cochrane writes that New-Keynesian models predict that fully expected future inflation is a good thing. Growth is bad. Deliberate destruction of output, capital, and productivity raise GDP. "Forward guidance," and commitments to keep interest rates low for long periods, with no current action, stimulate the current level of consumption. Government spending, even if financed by current taxation, and even if completely wasted, of the digging ditches and filling them up type can have huge output multipliers.

Understanding New Keynesian multipliers

Arnold Kling writes that advocates of Keynesian stimulus use the old Keynesian model to persuade laymen and policymakers and use the new Keynesian model to fend off other economists. You tell the simplistic “spending creates jobs, and jobs create spending” story to the public, and you tell a mathematically elegant but quite different intertemporal substitution story in academic work.

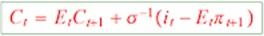

John Cochrane writes that the heart of the New-Keynesian model is a completely different view of consumption than that of Old Keynesian models. People in this model think about the future when deciding how much to consume and allocate consumption today vs. tomorrow looking at the real interest rate. In its simplest form, the FOC Euler equation is given by:

In this model, totally wasted government spending can raise consumption and output, but by a radically different mechanism. Government spending raises inflation π (as it pushes output closer to potential and there is a New-Keynesian Phillips curve). Holding nominal interest rates i fixed, either at the zero bound or with Fed cooperation, more inflation π means lower real interest rates. It induces consumers to spend their money today rather than in the future. The old-Keynesian model is driven completely by an income effect with no substitution effect. Consumers don't think about today vs. the future at all. The new-Keynesian model based on the intertemporal substitution effect with no income effect at all.

John Cochrane writes that you might think that if you have to pay taxes to the government, which buys output to throw it away, you'll have to consume less. But the logical structure of the models is, roughly, that you first decide how much you want to consume, then you'll work hard enough to make the required income. If consumption is determined first by the Euler equation, then you just work harder to pay taxes and make the stuff the government wants to throw away. That gives us a multiplier of one, not zero, and then inflation kicks in to raise desired consumption and give us a larger multiplier.

Paul Krugman writes that the reason the classic Keynesian multiplier isn’t in NK models is not because it has been disproved, but because such models deliberately give hostages — they show that Keynesian outcomes can emerge even if you assume rational expectations and intertemporal blah blah. Many people who do such models consider this a useful strategy, but remain open to the possibility that given real-world imperfections the classic story also has explanatory power.

Are negative supply shocks expansionary at the ZLB?

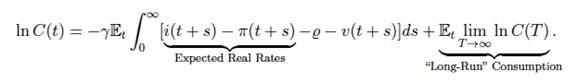

Johannes Wieland writes that solving the Euler equation forward illustrates that today’s consumption depends on the sum of expected real interest rates and expected consumption in the far future. Thus, consumption today is high relative to the long-run consumption level if the expected path of real interest rates is relatively low, and vice-versa (p is a discount rate, v is a demand shifter).

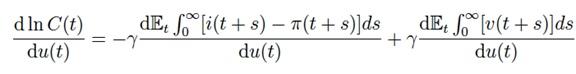

Standard sticky-price models predict that temporary, negative supply shocks are expansionary at the ZLB because they lower expected real interest rates, which stimulates consumption. After demonstrating that negative supply shocks are contractionary in the data, Wieland writes that a less restrictive Euler equation is needed to match the contraction of consumption. In particular, the demand shifter has to respond to the negative supply shock (denoted below by u) in a way that offsets the effects of the decline in real interest rates from higher expected inflation.

There are several mechanisms that can generate this dependency. For example, if nominal wages are sticky and a large fraction of consumers are hand-to-mouth, then a negative supply shock can be contractionary because it lowers real income for these consumers. Another possibility is that negative supply shocks endogenously raise uncertainty in the economy, which will raise precautionary savings for a given real interest rate.

Johannes Wieland focuses on another mechanism where a negative supply shock lowers firm profits and asset values, which reduces net worth at banks. These banks then reduce loan supply, which raises borrowing costs so that borrowers’ consumption contracts. Because a negative supply shock reduces profits and share values, the net worth of financial intermediaries falls, tightening their balance sheet constraints. In turn, banks contract loan supply, the borrowing spread rises, and borrowers reduce consumption such that negative supply shocks are contractionary at the ZLB. In the calibrated model with credit frictions, demand-side policies are up to 50% less effective than in a standard new Keynesian model.

Determinacy and inflation

John Cochrane writes that New Keynesian models offer a fundamentally different mechanism for determinacy of inflation than the Taylor-rule. The common-sense story for inflation control via the Taylor rule is this: Inflation rises 1%, the Fed raises rates 1.5% so real rates rise 0.5%, "demand" falls, and inflation subsides. In a new-Keynesian model, by contrast, if inflation rises 1%, the Fed engineers a hyperinflation where inflation will rise more and more! Not liking this threat, the private sector jumps to an alternative equilibrium in which inflation doesn't rise in the first place. New Keynesian models try to attain "determinacy" -- choose one of many equilibria -- by supposing that the Fed deliberately introduces "instability" (eigenvalues greater than one in system dynamics).

John Cochrane shows that the equilibrium with paradoxical implication depends on the level of inflation agents expect after the trap ends. If people think we must have exactly zero inflation (deviation from long run trend) as soon as the trap ends, then we will experience the new-Keynesian recession and its paradoxical policy implications. If people expect that we can retain a mild inflation and then a smoothly declining inflation, then we will experience a benign period during the liquidity trap and magical policies will not work.