Blogs review: Updating the Phillips curve

What’s at stake: The missing disinflation – or even deflation – in the Great Recession has generated a large literature, which proposes a set of

What’s at stake: The missing disinflation – or even deflation – in the Great Recession has generated a large literature, which proposes a set of possible tweaks to the traditional Phillips curve (anchored expectations, non-linearity at zero because of downward nominal rigidity, reduced impact of LT unemployed, mis-measurement of inflation expectations or even inflation). Although this literature clearly points to the need for updating the traditional relationship (especially when it is used to estimate the NAIRU), it remains hard to conclusively choose between the different alternatives proposed.

Robert Hall writes that prior to the recent deep worldwide recession, macroeconomists of all schools took a negative relation between slack and declining inflation as an axiom. Few seem to have awakened to the recent experience as a contradiction to the axiom.

The anchored expectations hypothesis

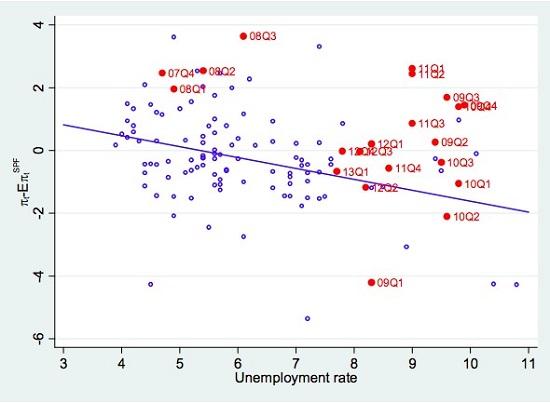

Olivier Coibion and Yuriy Gorodnichenko write that the ‘anchored expectations’ hypothesis of Bernanke (2010) – that is, the credibility of modern central banks has convinced people that neither high inflation nor deflation are likely outcomes, thereby stabilizing actual inflation outcomes through expectational effects – can only go some way in accounting for the absence of more significant disinflation between 2009 and 2011. The figure below illustrates that the missing disinflation is still present even when we condition on the ‘anchored’ expectations of professional forecasters.

The missing disinflation (controlling for anchored expectations)

Source: Olivier Coibion and Yuriy Gorodnichenko

Downward wage rigidities and the role of LT unemployment in the wage formation process

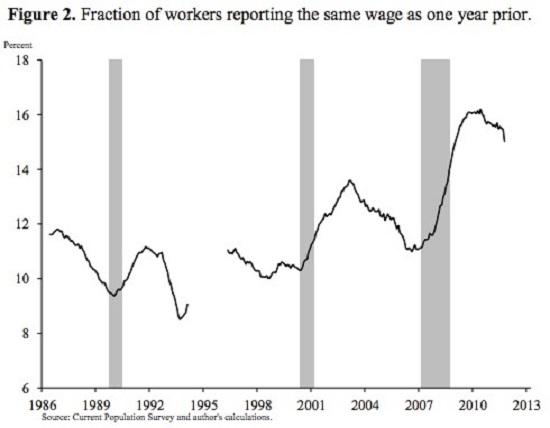

Mary C. Daly and Bart Hobijn write that Phillips (1958) already conjectured that part of the curvature in the historical relationship between money wage growth and unemployment that he documented for the U.K. was because “workers are reluctant to offer their services at less than prevailing rates when the demand for labor is low and unemployment is high so that wage rates fall only very slowly.” The authors confirm that there is always a non-trivial fraction of workers receiving zero wage changes in the U.S. economy. This fraction increases around business cycle downturns and has risen to historical highs since the 2007 recession. Notably, the prevalence of zero wage changes has remained high during the recovery.

Source: Mary C. Daly and Bart Hobijn

Ricardo Llaudes argues the long-term unemployed play a marginal role in the wage formation process. Unemployment duration matters in the determination of prices and wages, and that a smaller weight ought to be given to the long-term unemployed. The author shows that the impact of the long-term unemployed is found to have a particularly negligible effect in some Western European countries.

NAIRU in an outdated version of the Phillips curve

Olivier Coibion and Yuriy Gorodnichenko write that one can use an estimated Phillips curve to solve for the evolution of the natural rate of unemployment needed to account for inflation dynamics (this is the approach followed by the European Commission to compute the NAWRU as we discussed in our previous issue “the structural balance controversy”). To account for the missing disinflation, the natural rate of unemployment would have needed to track actual unemployment very closely over the entire period of the Great Recession, implying that essentially all of the unemployment dynamics during the Great Recession must have been structural. We interpret the dynamics of the natural rate of unemployment needed to account for the missing disinflation as being too at odds with other empirical evidence to treat this as a plausible explanation.

Household inflation expectation and the unique set of factors of the Great Recession

Ben Walsh writes that the reason prices didn’t fall in the Great Recession is that business follow households’ lead on inflation expectations. And households have an unorthodox way of setting their inflation expectation: they pay a lot of attention to gas prices, which rose after the financial crisis.

Olivier Coibion and Yuriy Gorodnichenko write that the primary reason for the success of a household inflation expectation-augmented Phillips curve is simple: Household inflation expectations experienced a sharp increase starting in 2009, rising from a low of 2.5% to around 4% in 2013; Other measures of inflation expectations, such as those from financial markets or professional forecasters, have hovered in the neighborhood of 2% over the same period. One unusual implication of our explanation is that the absence of more pronounced disinflation – or even deflation – likely reflected a unique set of factors, which policymakers should not necessarily expect to be, repeated in future crises.

The mis-measurement of inflation in low inflation regimes

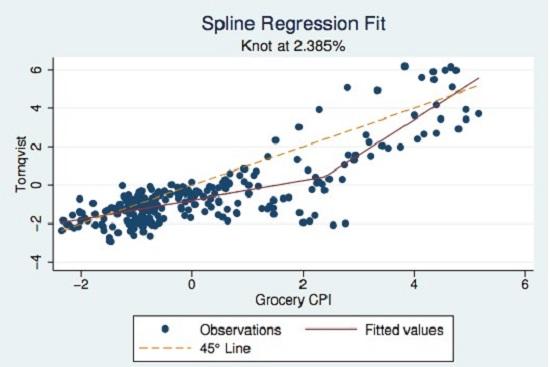

Jessie Handbury, Tsutomu Watanabe and David E. Weinstein show that there is little relation between measured inflation and actual inflation in a low inflation regime. When the inflation is low, much of the movement in the CPI is noise. We find – using 5 billion Japanese price and quantity observations collected over a 23 year period – that when the annual CPI registers an inflation rate of 0 percent, true inflation is -0.8 percent. When CPI inflation is 2 percent, the bias rises to -1.8 percent and true inflation is, in fact, 0.2. In other words, a 2 percent CPI inflation target is actually a price stability target, when using annual data.

Source: Jessie Handbury and al.

Jessie Handbury, and al. write that there is a very strong positive relationship between true inflation and CPI inflation when the inflation rate exceeds 2 percent, but there is a much weaker connection between CPI inflation and actual inflation when the CPI is registering rates of inflation below 2 percent per year. A central bank that deems a movement in CPI inflation from 0 to 2 percent as the same as a movement from 2 to 4 percent is liable to dramatically overreact to inflation when it is low and underact when it is high.