Home-(Sweet Home)-Bias and other stories

Behind the relative calm that now seems to reign on the financial markets, fragmentation is still there. And if you see it charted, it is actually qui

Home, is where your assets are. Or at least this is the case for Eurozone banks, based on how their balance sheets look today. The appearance and rise of “financial fragmentation” in the Eurozone market has been a thorn in the side of European policymakers over the last three years, leading to a number of even significant responses. The ECB reacted by providing massive amounts of liquidity and – more importantly – by introducing the Outright Monetary Transactions (OMT), which proved especially effective in reducing sovereign risk across Europe. On a more structural side, the fear of a reversal of financial integration acted as a push towards the agreement on a Banking Union, i.e. what is supposed to become the biggest step forward in European integration in many years to date. Such policy responses successfully eased tensions on the financial markets and this – as it happened often during these three years of European crisis management – somewhat reduced the incentive for policymakers to actually push those ideas into practice. But behind the relative calm that now seems to reign on the financial markets, fragmentation is still there. And if you see it charted, it is actually quite scary.

The Great Retrenching

Starting in 2009 (and accelerating since 2010) Eurozone banks have been massively retrenching within domestic borders. This has led, especially in those countries perceived to be weaker, to an impressive re-domestication of banks’ assets in general and of debt portfolios in particular. Figure 1 helps give an idea of the magnitude of such effect. The first panel reports loans extended to euro area residents and holdings of securities other than shares issued by euro area residents, aggregated across all euro area banks and normalised to January 1999, for comparability. In line with the general trend in banks assets, both series more than doubled over the last decade, after the currency unification. The beginning of the crisis in 2008 coincided with a halt in the growth of banks' asset, but aggregate figures for loans and debt holding do not really point to a dramatic reversal. Panels 2 and 3, which disaggregate both loans and debt holdings between “domestic” and vis-à-vis “other euro area”, are far more enlightening. They show the extent to which the aggregate growth in loans and debt holdings prior to the crisis was mostly due to an explosion in cross border (intra-area, in this case[1]) activity. Loans by euro area banks to counterparts located in other euro area countries – including other euro area banks – almost triplicated over 10 years whereas loans to domestic borrowers “just” doubled. The difference is even more striking on the debt side, where holdings of debt issued by residents of other euro area countries increase by 4.5 times between 1999 and 2009 and holdings of debt issued by domestic residents remained constant, starting to increase only when the crisis broke out in 2009. Since the outbreak of the crisis in 2008, the drop in cross-border (intra-area) loans and debt holdings has been as spectacular as the previous increase had been.

Figure 1 – Euro Area banks’ loans and debt holdings – total, domestic and intra-area (1999/01=100)

Source: ECB.

Note: Loans include loans to all euro area residents, so also loans to Monetary Financial Institutions; debt is the item "securities other than shares” reported in the ECB's statistics on MFIs' balance sheet (further disaggregation by specific i strumento is not possible at the cross border level usino ECB comparable data). Here alla securities other than shares are considered, without disaggregating across issuing sectors.

Home-(Sweet-Home)-Bias

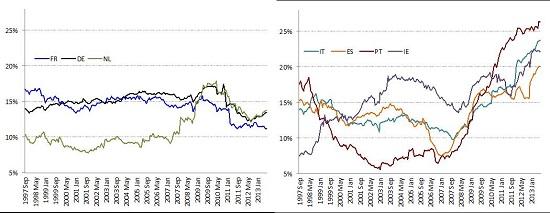

In the case of Eurozone, aggregate figures can be misleading, as the devil tends to be in the country-level details. A deeper look behinds averages reveals indeed interesting and different features across Eurozone countries. Figure 2 shows the holdings of securities other than shares issued by euro area residents (both public and private issuers) as a percentage of banks’ total assets in various countries. A first interesting fact is that there exist completely opposite dynamics between North and South. In Northern countries – such as Germany, the Netherlands and France – banks’ holdings of debt have been declining since 2008, whereas they have been skyrocketing in Southern Member States[2]. With respect to the second group, it is important to bear in mind that these figures are in terms of total assets, and the jumps evident at the end of the series are also due to the decrease in the outstanding total assets (denominator effect), as banks have eventually started to deleverage. A second interesting fact is timing. The increase in debt holdings in the South starts early on during the first crisis phases; it slows down in 2009 to pick up again in the second half of 2010 and later on. The decrease of debt holdings in the North instead starts quite unequivocally around May 2010, i.e. the date of conclusion of the first macroeconomic adjustment programme for Greece.

Figure 2 – Holding of debt issued by EA resident, % of total banks’ assets

Source: ECB

It is even more interesting to look at how such increase (or decrease) in debt holdings is split across domestic and international holdings. The existence of long-lived forms of “home-bias” in banks’ government debt portfolios is by no means a new discovery. It has actually been a leitmotiv in the European policy discussion over the last three years, because of its almost deadly consequences for the banks. The reasoning is well known: banks hold a lot of government debt – for a number of reasons, including regulatory ones – and have a tendency to hold disproportionately more debt issued by the government of their country of residence with respect to other equally risk-weighted sovereigns. In a framework in which public finance is decentralised and States are solely responsible for saving banks, this resulted in the “vicious circle” between banks and sovereign and shocks affecting either of the two sides spilled over amplified to the other one. Despite being particularly pronounced in sovereign holdings, the home bias is however not necessarily an exclusive feature of this particular portfolio.

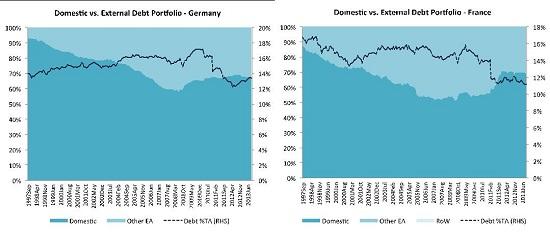

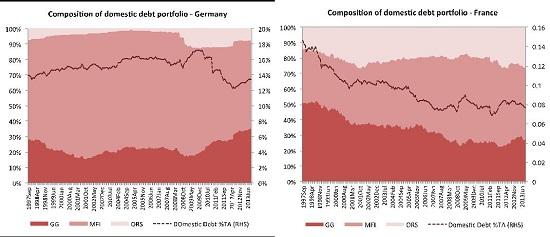

Figures 3, 4 and 5 show the breakdown of banks’ total debt holdings between external and domestic, for selected Eurozone countries. Whenever possible – i.e. for all countries with the exception of France and Germany – the external holdings vis-à-vis the rest of the world has been added. A trend towards some renationalisation of debt portfolios is evident for all countries, but the degree is significantly different between the North and the South. In Germany, holding of domestic securities other than shares did increase in proportion of the total but only slightly and only during the first phase of the crisis (2008/2009). In France, the increase came later when the sovereign crisis intensified in 2011. For both countries, however, the re-domestication of securities holdings has been relatively contained. It has to be noted that data on extra-euro area debt holdings are not readily available for these two countries, so what is captured here would actually be best described as a reshuffling of the total Euro area portfolio. However, the way these figures are constructed would imply that if data on rest o the world holdings were available, they would add on top of the intra-area holdings reported here. Considered that holding of debt issued by residents of the rest of the world can be zero or positive, this means that here we might be underestimating the the size of Foreign issued debt in the total, but not overestimating it. The actual weigh of domestic debt in the total could therefore be even lower than reported here.

Figure 3 – Foreign vs. Domestic debt and composition of domestic portfolio: Germany and France

Source: ECB and National Central Banks

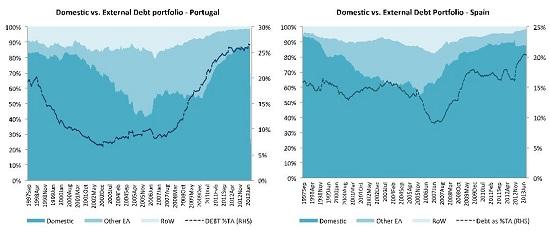

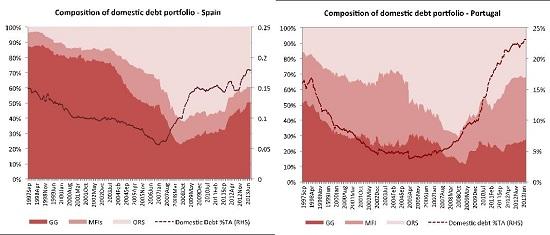

The picture is dramatically different for Spain and Portugal. Figure 4 shows how banks’ debt holding in these countries became significantly diversified between 1999 and 2007, when the share accounted for by domestic debt reached a minimum of 40% in Portugal and 55% in Spain. The crisis rapidly reverted this process and by end of summer 2013 almost 90% of banks’ debt holdings in these two countries were accounted for by domestic instruments. In both cases, these numbers are close to what they were before the introduction of the euro,raming that three years of crisis effectively dismantled the degree of international diversification achieved during the first ten years of currency unification.

Figure 4 – Foreign vs. Domestic debt and composition of domestic portfolio: Spain and Portugal

SOURCE: ECB and National Central Banks

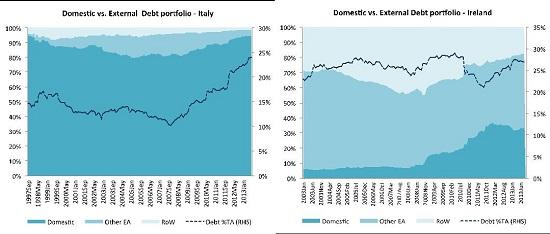

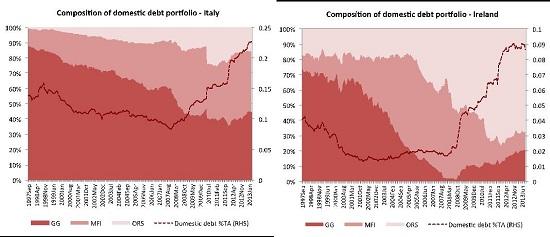

Ireland and Italy are instead extreme cases in two diametrically opposed directions. In Italy, banks’ debt portfolio never really internationalised in the first place, as the share accounted for by domestic securities did never fall below 80%, not even in the golden years of financial integration. In Ireland, instead, domestic debt holding were almost inexistent (below 10%) until 2008. The outbreak of the financial crisis and the sovereign crisis led to renationalisation even in Ireland, where the share of domestic holdings is now around 30%, an unprecedently high value.

Figure 5 – Foreign vs. Domestic debt and composition of domestic portfolio: Ireland and Italy

Source: ECB and National Central Banks

Sovereign overdose

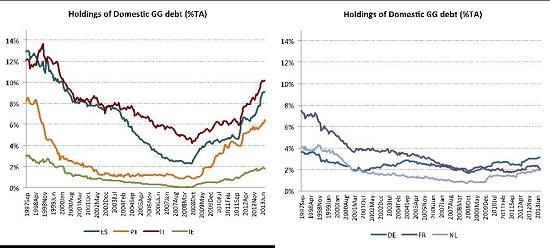

This evidence basically suggests that, especially in the South of the Euro Area, the weight of debt has been increasing in percent of banks' total assets and that it has been progressively re-nationalising. The last piece of the puzzle to add, is a look at which issuer sector this debt was coming from. Figures 6,7 and 8 do exactly this by breaking banks' holding of domestically issues debt down by issuers.

Figure 6 – Composition of Domestic debt portfolio: Germany and France

Source: ECB and National Central Banks

There has been an increase of the government sector in proportion of the total portfolio almost everywhere, perhaps with the exception of France where the share of domestic government debt in the domestic debt portfolio has barely changed. There are however significant differences across countries. In Germany and France, domestically issued debt has not exploded in proportion of total debt and it has even decreased in percentage of total assets. The increase (if any) in the share of domestic government debt represents somewhat a "reshuffle" of the existing domestic portfolio.

Figure 7 – Composition of Domestic debt portfolio: Portugal and Spain

Source: ECB and National Central Banks

In Spain, Portugal, Ireland and Italy, the situation is fundamentally different. There, debt in percentage of total assets has been growing over the last 5 years and the debt pool has been renationalising massively, with domestic debt accounting by now for almost 25% of total assets in Italy and Portugal, almost 20% of total assets in Spain and almost 10% in Ireland where it was exceptionally low before the crisis. At the same time, the weight of domestic government in these increasingly domestic portfolio has been growing considerably while holdings of debt issued by banks and other resident sector were squeezed. As a result, banks' holdings of domestic debt have reached everywhere new heights, accounting for 9% of total assets in Spain, 10% in Italy, 6.4% in Portugal. Unfortunately, there is not enough disaggregated data to assess what specfic sector has been affected the most within the "Other resident" category, which includes both non-financial corporations and other (than banks) financial institutions.

Figure 8 – Composition of Domestic debt portfolio: Italy and Ireland

Source: ECB and National Central Banks

Conclusion

The evidence presented so far clearly shows how the crisis has changed the composition of the assets side of banks in the Eurozone. Three important facts stand out. First, banks hold a lot of debt in proportion of their assets, and today this is more true in the South than in the North of the euro area. Second, banks' debt portfolios have massively re-nationalised in the South, with domestic debt accounting by now for even as much as 90% of the total. These figures imply that the international diversification of banks' debt holdings in these countries is back to the level where it was before the introduction of the euro. Third, in the most troubled euro area countries, the portfolio is being increasingly reshuffled in favour of government debt rather than private debt. This is consistent with evidence collected by the industry participants. For example a new Fitch Ratings study, recently reported by the press, assesses the effects of Basel III on the credit and capital allocation of European global systemically important banks, finding that since the new rules were finalized in December 2010, these banks have increased their total exposure to sovereign debt by EUR550 billion, or 26%, and have reducef their exposure to corporates by EUR440 billion, or 9%. For these banks, Fitch observes a reallocation credit across sectors (from more to less capital intensive exposures) rather than meaningful reductions to their overall risk exposure. At the same time, the report stresses, in the case of the Eurozone high market volatility, economic pressures, slack loan demand and elevated sovereign spreads could also have contributed to some of these shift. These facts are particularly relevant in the context of he present euro area policy juncture. In the short term, they raise important questions for the forthcoming ECB's supervisory exercise, which is due to take place next year. The issue of how government bonds holdings should be dealt with in that exercise have recently gained attention, after Bundesbank's president Weidmann publicly advocated that sovereign bond portfolio should be "stressed", to cater for the fact that some of them can no longer be considered risk free. Weidmann is also reported to have said that in the medium-term government bonds should be treated as corporate bonds, to reduce incentives for banks buy them.

Figure 9 – Domestic Government Debt as % of Total banks assets

Source: ECB

In this circumstances, drawing a dividing line between short and medium-term is however particularly important. The large (domestically-biased) government debt portfolios of banks in the South of the euro area are the result of three years of crisis, during which banks have been buying the debt of their own countries that foreigners were offloading in search of safety. The rising yields on that debt have allowed banks to profit from a "carry trade" that might have delayed the restructuring of banks business model and contributed to the squeeze of investment to other sectors. It is hard to argue that this kind of business model should be taken as a benchmark for the medium and long-term future, and to the extent that it incentivizes its continuation, the zero-risk weighting allowed by Basel may not be the best way to go. Sapir and Wolff (2013) also advocate the introduction of a system of risk weighting of government bonds, after showing comparable figures on the financial fragmentation of Eurozone financial market (see here). They also rightly point out that in the euro area, the interbank market rapidly became highly integrated after the introduction of the single currency, but retail banking remains largely fragmented along national lines, with bank mergers predominantly between institutions of the same country. This feature, related to the importance of intermediation in the Eurozone context, proved to be destabilizing in the occurrence of the crisis and there are reasons to advocate a change in the future. But in the short term these are the banking system and the rules that we have. The zero-risk weighting has been there for some time, and penalizing banks now by applying ex-post risk weights seems hardly justifiable. Not to mention that based on the evidence presented here (see Figure 9), such a penalty would hit banks in Southern countries the hardest, as these are the banks that hold significantly larger debt portfolios in percentage of their total assets and given the existence of home bias, these holdings happens to be disproportionately national and disproportionately biased towards the domestic government. On a more theoretical note, in order to "stress" those government debt holdings, the ECB would necessarily need to make an assumption on the evolution of government bonds' yields in different countries. This would require specifying a "benchmark" value for each country's yield in normal time, and a value under stress. Now the problems with this is not only that those value will inevitably be somewhat arbitrary, but also (and most importantly) that it would require the ECB to make public its prior on a "benchmark" yield in normal times, which the ECB adamantly refused to do earlier for concerns of introducing self-fulfilling dynamics (e.g. when discussing whether the OMT purchases would target specific value for yields/spreads). For all these reasons, changing the rules of the game retroactively make little sense and a clear distinction between medium-term optimal objectives and short-term transitory dynamics is essential.

[1] The Eurosystem provides statistics on cross-border loans and securities holdings of euro area banks, but these only distinguish between “domestic” and “other Euro Area”. Loans and holdings vis-à-vis the rest of the world are aggregated in a single category called “external assets”. Some of the National Central Banks do provide a disaggregation by instrument of the assets vis-à-vis the rest of the world (which are used later in the analysis) but not all of them do. So for comparability purposes in this paragraph the analysis is restricted to ECB data, looking only at “domestic” versus “other euro area” positions.

[2] Notice that Greece has been excluded by the analysis because it presents specificities (the debt exchange) that could make the interpretation of results difficult.