The calm after the storm: developments in Cyprus’ banking sector

At present there is calm after the storm; despite having less stringent restrictive measures than almost a year ago, the banking system remains stable

On March 24th, the Central Bank of Cyprus (CBC) released new data on key aggregate financial stability indicators, including provisional data for the fourth quarter of 2013. Our preliminary figures show some improvement in the profitability and capital adequacy ratios of the Cypriot banking system, reflecting the progress made on restructuring last year.

The facts

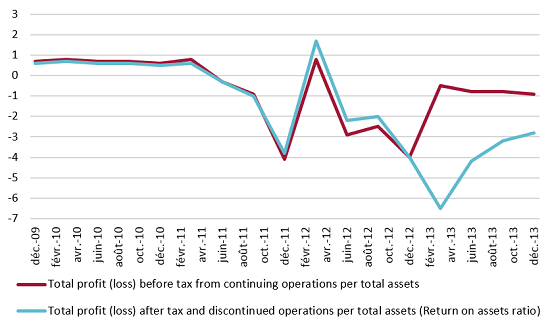

Although the banking system as a whole is still not generating profits, losses were much more moderate during 2013 than the year before; the total losses before tax from continuing operations (not taking into account the parts of the business that have been disincorporated due to restructuring or other reasons) stood at less than 1% of total assets for the last quarter of 2013, while the ratio for return on assets (after tax profit/losses on a discontinued operations basis as a share of total assets) was shrinking continuously since the bail-in of depositors in March 2013.

Cyprus banking sector profitability

Note: The difference between the two lines reflects the one off costs of the ongoing restructuring process.

Source: Central Bank of Cyprus

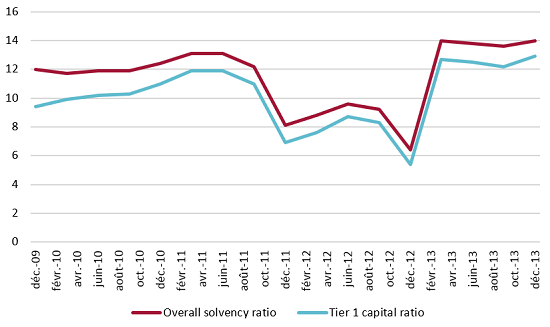

Thanks to the recapitalization of the two largest banks, the Tier 1 capital ratio stood at its highest level of the last five years at 12.9% and the overall solvency ratio at 14%. Both of them close the euro area average at 13% and 15.4 (during the first half of 2013).

Cyprus banking sector capitalization

Source: Central Bank of Cyprus

The most worrisome financial concern in Cyprus is the high and increasing level of non-performing loans. According the CBC’s new definition (see legal framework), the percentage non-performing credit facilities soared to 44.9% at the end of January, showing a slow but continuous increase since September 2013 when it stood at 40.3%. For the cooperative credit sector the number was almost equally high at the end of January at 40.4% and also increasing.

There is an undergoing discussion about the creation of a bad bank that would buy troubled assets, including NPLs, to clean the banking system like in the cases of Spain and Ireland, which was also mentioned in a Reuters interview with Bank of Cyprus Chief Executive John Hourican.

The restructuring process of the cooperative banking sector was somewhat slower than expected last year, but its recapitalization is expected to be completed shortly according to the latest Troika Statement on the Third Review Mission. The restructuring plan of the cooperative sector includes the merging of 93 cooperative credit institutions into 18 monetary institutions under the supervision of the recently created Central Cooperative Bank.

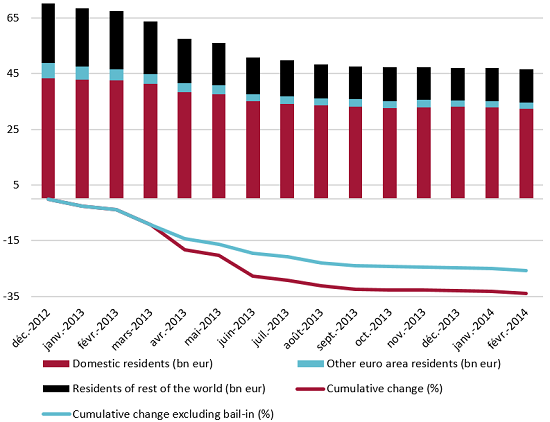

The total amount of deposits in the Cypriot banking system has basically stabilized since October around a total of 46-47 billion euros, decreasing at a monthly rate just 0.3% in the last quarter of 2013. Despite the imposition of capital controls, the cumulative shrinkage of total deposits since December 2012 still amounts to all of 33.9% (17.3 billion euro), of which 27.2% were withdrawn since the end of March when the capital controls were imposed. Discounting the effect of the 5.8 billion bailed in deposits (of which 2.8 billion were accounted for in April statistics and 3 billion distributed between the months of June and August, see chronology in the Monetary and Financial Statistics of the Central Bank of Cyprus), the reduction on total deposits still amounts to 18.1% or 11.5 billion euro since the end of March 2013.

Cyprus total deposits by residence

Source: Central Bank of Cyprus

From the 17.3 billion reduction in the total outstanding amount of deposits in Cyprus after the establishment of the capital controls: 9 billion euro (or 52% of the total decline) came from domestic deposits, 1.2 billion euro (7%) from other euro area residents and 7.1 billion euro (41%) from residents of the rest of the world. Presumably, the bail-in of depositors hit depositors from the rest of the world harder, but lacking sufficient evidence, the amount of deposit flight by residence discounting the effect of the bail in cannot be estimated.

What can we conclude?

In absence of counterfactual, assessing how effective the restrictive measurements on capital movements in Cyprus have been at containing the deposit flight from the island is a very difficult task. And more so as Cypriot authorities have been progressively relaxing the controls as the banking sector becomes more financially stable. All we can say is that at present there is calm after the storm; despite having less stringent restrictive measures than almost a year ago, the banking system remains stable. Though dealing with mounting non-performing loans remains the biggest financial challenge.

As we stated before, so far so good, but it is yet to be seen whether Cyprus will be able to lift the capital controls by the end of the year as expected by the Governor of the Central Bank of Cyprus, Panicos Demetriades.

This post was written on request following discussions with @Alexapostolides.