Shrinking times

Over the last 5 years, the Eurozone financial system has been flooded with liquidity, due to the ECB’s very special response to the very special bank-

Over the last 5 years, the Eurozone financial system has been flooded with liquidity, due to the ECB’s very special response to the very special bank-sovereign euro crisis.

In 2008, faced with an almost frozen interbank market, the ECB changed the way it allocates the Central Bank’s funds, introducing a policy of full allotment. As a result, the amount of liquidity provided to banks in the euro area was no longer determined by the ECB’s assessment of the banking system’s overall liquidity needs, but by banks’ own assessment of their individual liquidity needs. Supply started to be anchored 1:1 to demand and consequently taken out of the control of the central bank.

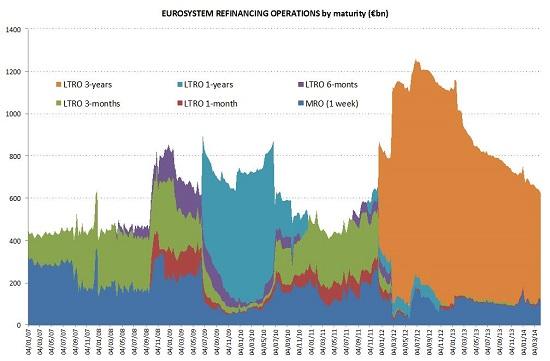

Then, in December 2011 and February 2012, the ECB conducted two Very Long-Term Refinancing Operations (VLTROs) with maturity of three years, under which banks borrowed as much as 1 trillion of very cheap and long-term liquidity. Additional 200bn were borrowed from other facilities, for a total outstanding liquidity of 1.2tr. Therefore, the balance sheet of the ECB more than doubled with respect to its pre-crisis level and the average maturity of the asset side lengthened. At the peak, in summer 2012, lending to banks amounted to 41% of all ECB’s assets, and 86% of it had maturity of three years (Figure 1).

The result was the creation of an environment in which excess liquidity became the norm.

Excess liquidity is the liquidity that banks hold in excess of the aggregate needs arising from minimum reserve requirements and autonomous factors amount.

Excess liquidity is defined as deposits at the deposit facility net of the recourse to the marginal lending facility, plus current account holdings in excess of those contributing to the minimum reserve requirements.

In normal times, when the interbank market functions properly, banks would channel liquidity to each other across the system and excess liquidity would have little or no reason to exist, because the cost opportunity of holding it would be just too high.

Banks in fact would deposit the liquidity in excess of their needs back into the ECB’s deposit facility, which before the crisis was remunerated at a positive interest rate. On the other hand, by lending that liquidity on the interbank market, banks could ask for an interest rate no smaller than the benchmark rate at which the ECB itself lends liquidity to banks, i.e. the Main Refinancing Rate (MRO rate). Since the refinancing rate is above the deposit rate, in normal conditions banks would prefer to lend their liquidity surplus to other banks rather than hoarding it at the deposit facility.

All this logic broke down during the financial crisis, when uncertainty and risk aversion became the most relevant drivers of banks liquidity policy.

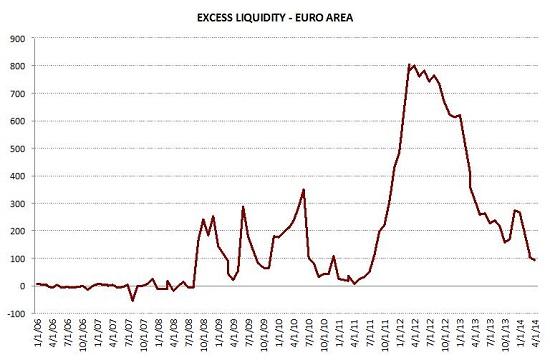

Faced with a blocked and increasingly expensive interbank market, banks started to demand central bank liquidity well in excess of their needs, as a form of insurance against liquidity shocks and the risk of being cut off from interbank lending. Consequently, at the height of the crisis excess liquidity in the Eurozone peaked at 800 billion.

In early 2013, the ECB offered banks the possibility to repay (early) the funds they had borrowed under the LTROs. Since then, banks have used this possibility extensively.

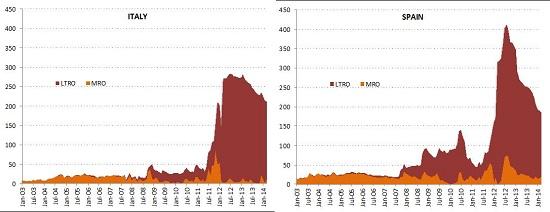

The largest repayments have come from Spain, where banks had previously been most reliant of the ECB financing (see Figure 3). Italian banks have also started to repay LTRO funds recently and so have banks in Germany and the core (which however had not borrowed much in the first place). Therefore, the amount of excess liquidity in the system has been almost entirely reabsorbed.

Today’s ECB overnight liquidity operation report shows that excess liquidity in the euro area is now close to 92.8 billion, versus 115.25 billion yesterday. This is the first time since 2011 that excess liquidity drops below 100 billion, a threshold that has been generally regarded as key for the impact on overnight rates.

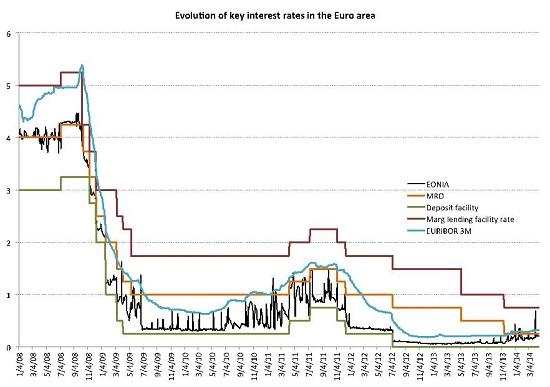

The rise and fall of excess liquidity has in fact consequences on the market interest rate, in particular the EONIA.

Before the crisis, the ECB’s main rate would steer short-term money market rates, resulting in the close alignment of the EONIA and the MRO rate. The crisis, and the introduction of the full allotment procedure, changed all the normal benchmarks. As a result of the increasing amount of excess liquidity in the system, the EONIA dis-anchored from the MRO and fell to the bottom of the so called interest rate corridor, i.e. just a few basis points above the rate on the ECB deposit facility. This is the lowest possible bound for the EONIA, as banks are unlikely to lend on the money market more cheaply.

Consequently, the rate on the ECB deposit facility became the main driver of money market rates, and when it was lowered to zero, it also took the EONIA alongside it, to unprecedented low levels.

On one hand, the recent trend in excess liquidity is positive, as it points towards a normalisation of bank funding conditions in the euro area. On the other hand, it raises issues that the ECB should carefully consider.

First, there is obviously the impact that such developments could have on the short-term market rates. The relationship between excess liquidity and short-term rates is not an exact science, as its sensitivity is also influenced by external factors; in particular the degree of fragmentation in the interbank market [see also this ECB paper for more rigorous analysis]. However, in fact, since the end of 2013 when excess liquidity started approaching the threshold of €100 billion, the volatility of short-term interest rates has been increasing a lot.

After remaining stable at around 10 bp for more than one year, the EONIA embarked on an upward trajectory, spiking sometimes even above the MRO. The ECB had anticipated this in the Monthly Bulletin of January, where they pointed out that if "any transition period, as the liquidity provision normalises, would lead to greater volatility, which could imply that short-term rates could become less closely anchored to the ECB deposit facility rate. This would make expectations about future money market rates more complex to interpret, as several factors, such as future liquidity developments and uncertainty, would be priced in overnight index swaps, in addition to expectations about the future path of policy rates."

Now that excess liquidity has eventually fallen below the psychological threshold of 100 billion, the impact on short-term rates could be amplified and the ECB might need to take action to counteract unwanted developments. ECB Member Benoit Coeuré, for example, recently said that there might be “situations where the level of excess liquidity may not be appropriate for our monetary policy stance, and we would have to find ways to inject more liquidity into the system”.

Second, the shrinkage of excess liquidity is the mirror image of a more general problem. For a little bit more than a year now, the ECB balance sheet has been shrinking. This qualifies the ECB as a special case among the Central Banks of the major advanced economies, where balance sheets have instead been growing (or at least have remained stable) over the same period. What is “special” about the development in the ECB’s balance sheet is that fact that the shrinkage is outside the control of the ECB, as the main driver is precisely banks’ decision to reimburse funds they borrowed from the ECB itself. The shrinkage is not per se a negative thing, but the current economic context characterised by a very weak recovery and especially low inflation puts it in a different perspective, creating a rational for the ECB to regain control over the size of its balance sheet.

The most important question is what the ECB could actually do to halt the shrinkage of its balance sheet and prevent unwanted development on the short-term rates. Banks are voluntarily returning LTRO funds in the attempt to clean the stigma associated to them and get their books in order for the approaching Asset Quality Review that will assess, among other things, banks “liquidity risk”.

The appeal of another LTRO-like operation seems quite small if not non-existent in such a context. Therefore, the time has come for truly unconventional monetary policy.