Blogs review: The Piketty data controversy

What’s at stake: While everyone praised the data collection effort behind the bestseller book “Capital in the 21st century”, Chris Gile

What’s at stake: While everyone praised the data collection effort behind the bestseller book “Capital in the 21st century”, Chris Giles of the Financial Times has dug up data-entry errors and dubious adjustments, which appeared unexplained in the book. While Piketty appears confident in his response to the FT that the overall conclusions of his book are robust, he hasn’t yet provided a point-by-point response to the questions raised.

Piketty, Reinhart and Rogoff

Matt O’Brien writes that the nine most terrifying words in the English language for a researcher are: "You made spreadsheet errors like Reinhart and Rogoff did." But that's what Chris Giles of the Financial Times thinks rockstar economist Thomas Piketty did, among other mistakes, in his groundbreaking new book, "Capital in the Twenty-First Century."

Matthew Yglesias writes that the universally praised element of Capital is its collection of historical data on wealth, so allegations that his construction of data series is riddled with errors is a really big deal. Neil Irwin writes that one of the most common approaches for people writing about Piketty’s blockbuster book has been to critique his theories and predictions while effusively praising his data collection. Piketty, after all, did yeoman’s work compiling data from tax and other records to try to determine a history of wealth inequality around the world.

Ryan Avent writes that this does look quite a lot like the Reinhart-Rogoff contretemps. The errors identified in their spreadsheet turned out to be far more embarrassing to the authors than a threat to their work. But none of that mattered when the news broke. Partisans took to their bunkers to lob bombs at each other, the truth of the matter be damned. It would be unfortunate were that to happen in this case, but it almost certainly will, and indeed it has already begun. James Hamilton writes that the contrast between Krugman’s defense of Piketty and the zeal with which he jumped on top of the Reinhart-Rogoff dog pile is amusing.

Branko writes that if you create (as Piketty did) bunch of data for a bunch of countries, there are bound to be issues. The question is, was there intentional data manipulation to get the answer one desires. I do not know it but it strikes me as unlikely that if one wanted to do it, he would have posted all the data, complete with formulas, on the Internet.

The FT attack

Matt O’Brien writes that Giles identifies three basic types of issues. The first are simple transcription errors. He finds, for example, that Piketty accidentally entered Sweden's wealth data from 1908 instead of 1920. There are data-entry errors, and they're embarrassing, but they don't change the big picture. The next concern is methodological. Giles thinks Piketty should average European data by population, not by country. He doesn't like that Piketty draws trends between large gaps in the numbers. Or that Piketty labels data from, say, 2004 as "2000" on some of his charts. And Giles isn't sure why Piketty has put together some of his wealth data—which is sparse, and needs to be adjusted, if not constructed—the way that he has. But these aren't errors. They're questions. Ones that Piketty should answer, but still just questions. The last problem is the most significant. Giles points out that Piketty seems to have mixed up different sources on British wealth the last few decades, and overestimated their inequality.

Ryan Avent writes that while some of the data and adjustments in the spreadsheets lack adequate documentation, Giles does not have the evidence to justify the implication that figures are drawn "from thin air". Data fabrication is a serious charge to make, and I am surprised Mr Giles would allege it without clearer proof.

The British exception

Simon Wren-Lewis writes that the only issue of substance involves trends in the UK wealth income ratio, but of course an article headlined ‘Data sources on UK wealth income ratio differ’ would not have had the same punch. Justin Wolfers writes that while it’s quite natural for a journalist to emphasize the differences between his findings and those of a famous author, the most striking fact is how closely The F.T.'s analysis agrees with Mr. Piketty’s. Their preferred time series for the evolution of wealth inequality are remarkably similar. To the extent that the FT and Piketty disagree it’s not yet clear whether the cause is obvious errors as pointed out by the newspaper, or judgment calls where perhaps the professional economist deserves the benefit of the doubt.

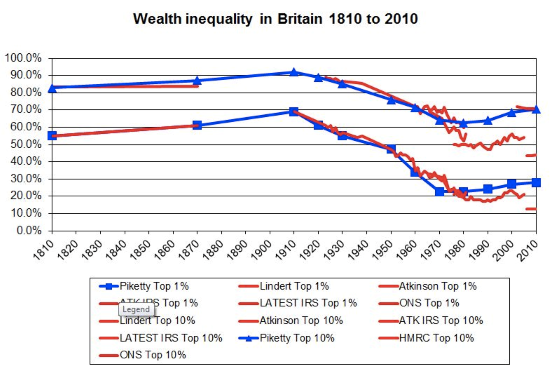

Jordan Weissmann writes that the FT argues that Piketty’s graphs simply “do not match” his underlying data on the UK, and that official estimates show no significant increase in the country’s concentration of wealth since the 1970s. Once Britain’s corrected data is included in the picture, the FT argues, the evidence that wealth inequality is growing across Europe disappears.

Source: FT Money Supply

Jonathan Hopkin writes instead of a U-shaped trend over the 20th century, claimed by Piketty, the FT's alternative data suggests a flatlining distribution since the 1970s, thus invalidating the claim of rising inequality. But this is misleading, because by throwing in new data that gives a lower figure in the same chart, the visual impact is of a different trend that is not really supported by the data. The IRS numbers that Giles throws in raw were used by Tony Atkinson and Piketty to construct the longer series, with adjustments to attempt to make them consistent with different sources for earlier periods. The fair test of whether Piketty's trend exists or not is to compare the IRS numbers with data for the earlier period. In fact those numbers track the trend of the Piketty series fairly closely, but with lower absolute values.

Chapter 10 as “the central theme” in the book

Mike Konczal writes that the idea that the ownership of capital will become more concentrated isn't an essential part of the theory. Though obviously if it does grow, then it's an even greater problem. Rising inequality in the ownership of capital is not the necessary, major driver of the worries of the book. It isn't that the 1% will own a larger share of capital going forward. It's that the size and importance of capital is going to go big. If the 1% own a consistent amount of the capital stock, they have more income and power as the size of the capital stock increases relative to the economy, and as it takes home a larger slice.

Ryan Avent writes that Piketty's wealth-inequality analysis certainly matters as a component of the book's argument, but it is not accurate to say, as Giles does, that the results in Chapter 10 constitute the "central theme" of the book. Much of the data was collected by Piketty and other economists in a series of published papers that have since been used to create the World Top Incomes Database. None of this work appears to be at issue. Rather, Giles focuses on wealth inequality, to which Piketty turns in Chapter 10 of his book. Piketty has not published nearly as much research on the question of wealth inequality, and it seems that much of the analysis in Chapter 10 was done specifically for the book, based on others' research.