China's financial liberalisation: interest rate deregulation or currency flexibility first?

In this follow-up, I argue that on top of these structural and institutional factors, there are also three short-term cyclical considerations in favou

In my article last Tuesday, I considered three institutional factors that would tend to favour a strategy of freeing the renminbi (RMB) exchange rate ahead of fuller interest rate liberalisation in China. In this follow-up, I argue that on top of these structural and institutional factors, there are also three short-term cyclical considerations in favour of a strategy of accelerating currency flexibility ahead of full interest rate liberalisation in China.

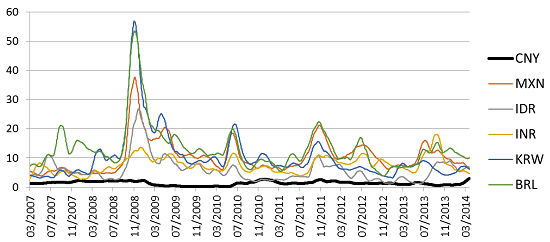

First, the low exchange rate volatility of the RMB complicates China’s tasks of interest rate liberalisation, monetary management and financial stability. RMB volatility has been extremely low, currently standing at one third to one fifth of that experienced by other major emerging-market currencies (Graph 1), and making the RMB one of the most attractive carry targets among major emerging-market currencies.

Graph 1: Historical volatility of selected EM currencies (%)

Note: one-month historical vol of the dollar spot rates, 3-month moving average.

Source: Datastream.

This, together with a sizable positive carry, has given rise to attractive risk-adjusted returns on RMB carry trading, enticing more speculative short-term capital inflows into China. This adds challenges to the tasks of both exchange rate and interest rate liberalisation. Thus the RMB needs to first become meaningfully more flexible (and thus less managed) before further interest rate deregulation, which at the moment would be much less beneficial than many have claimed.

Second, should deregulations lead to a further rise in domestic deposit rates, it would further widen the positive carry, unless the US Fed's tapering and policy normalisation suddenly accelerate. The 3-month SHIBOR (Shanghai Interbank Offered Rate) currently stands at 4-5 percent, while the 3-month US$ LIBOR is only 0.25 percent. So a more volatile RMB and a steadier local interest rate would make more sense at this juncture, because they would deter speculative carry trade inflows.

Third, a generalised trend of higher domestic interest rates in the context of declining inflation and weakening domestic demand is also bad for the Chinese economy, potentially undermining political support for financial reform. A combination of debt-hungry local government and interest rate liberalisation would likely lift real rates, which makes little sense, as China’s domestic demand weakens further.

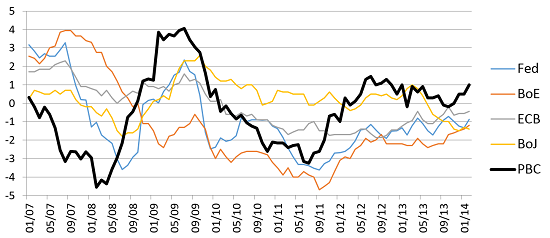

For the past few years, the real policy rate of the PBC has been the highest among the world's major central banks (Graph 2). While the G3 central banks have been aggressively pushing real rates into negative territory to stimulate corporate investment and consumer spending, it seems doubtful that rising and positive real interest rates would help to further pry open the Chinese consumers’ wallet. Indeed, excess saving ought to put downward, not upward, pressure on real interest rates in China.

Graph 2: Real policy rates at major central banks (%)

Note: real rate is defined as policy rate less CPI inflation. The PBC policy rate is the official one-year deposit rate.

Sources: Datastream.

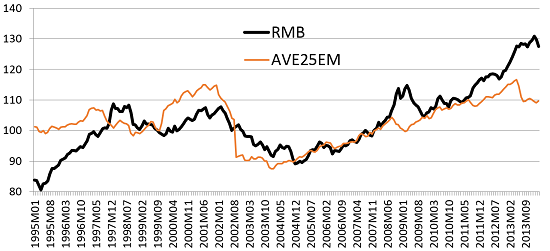

By contrast, the movement of the RMB is likely to become more two-way. The real effective RMB has appreciated 40 percent over the past decade and even gained 20 percent vis-a-vis the average of the top 25 emerging market peers over the same period (Graph 3). The RMB might have become more fairly valued nowadays. Hence freeing the RMB exchange rate would generate relatively less deflationary headwind for the Chinese economy.

Graph 3: REER: the renminbi vis-a-vis the average of 25 major EM currencies

Note: AVE25EM is a simple average of REERs for the top 25 emerging market currencies other than the RMB. December 2007 = 100.

Source: Bruegel.

Thus on balance, there are a number of good reasons, both cyclical and institutional, for China to proceed first and faster with greater exchange rate flexibility before fully deregulating the official bank deposit rates. China urgently needs a more flexible currency and would benefit from a steadier interest rate. Faster exchange-rate liberalisation would better complement both economic growth and interest rate deregulation.

To be clear, I am not advocating a halt to domestic interest rate liberalisation until free floating is achieved, but instead I am simply making a case that currently, greater currency flexibility should urgently accelerate ahead of full interest rate deregulation. Indeed, both the interest rate and the exchange rate should be much freer before further big breakthroughs in China’s capital account opening. But that is a topic for another day.

Assistance by Simon Ganem is gratefully acknowledge