Blogs review: Ordoliberalism and Germany’s approach to the euro crisis

What’s at stake: The debate over the legacy of ordoliberal ideas in Germany’s approach to the euro crisis has gained renewed interests ahead of t

What’s at stake: The debate over the legacy of ordoliberal ideas in Germany’s approach to the euro crisis has gained renewed interests ahead of the federal election, which will be held on 22 September 2013 to determine the members of the 18th Bundestag. Beyond the question of whether a change in government would dramatically change the country’s approach to the euro crisis, understanding the main tenets of ordoliberalism appears important to investigate the reasons behind the European aversion towards countercyclical policy.

Understanding Germany’s distinctive approach

Stephen Silvia writes that there is a gulf in the accepted wisdoms of the economics profession in Germany and the United States. Spend a little time in the academic circles of each country and it soon becomes clear that Americans are from Keynes, Germans are from Hayek. To be sure, America has its Chicago School “freshwater economists and Keynesian “salt water” economists. But the economics profession is much less ideologically diverse in Germany than in the United States. The default setting is a combination of neomonetarism and the free market ideology of the Freiburg school of “ordoliberalism,” which in turn draws on influence from the Austrian school of economics.

Sebastian Dullien and Ulrike Guerot write that there is more to Germany’s distinctive approach to the euro crisis than the much-discussed historical experience of the hyperinflation in the Weimar Republic and simple national interest as a capital surplus country. An important but rarely discussed reason for Germany’s emphasis on price stability is the influence on German economic thinking of “ordoliberalism” – a theory developed by economists such as Walter Eucken, Franz Böhm, Leonhard Miksch and Hans Großmann-Doerth as a reaction both to the consequences of unregulated liberalism in the early years of the twentieth century and subsequent Nazi fiscal and monetary interventionism.

Jan-Werner Müller writes in the London Review of Books that ordoliberalism is what Angela Merkel wants for the Eurozone as a whole: rigid rules and legal frameworks beyond the reach of democratic decision-making. Brigitte Young writes that Ordoliberal ideas have been an important agenda setter and veto player in Euro crisis resolution and that Merkel has been consistent in pushing for measures, which reflect the ideas of Ordnungspolitik.

The central tenets of ordoliberalism

Christopher Allen writes that the structural problems that Germany faced in 1945 of rebuilding an exhausted economy in the face of stiff international competition were not entirely dissimilar to those the nation had faced in the 1870s. It was thus natural to turn toward those policies that had been used to create an industrial society out of an agricultural one 75 or 100 years earlier. Those methods subordinated domestic demand to the needs of industrial capital and emphasized the importance of supply-side policies for the reconstruction of German industry. Similarly, the introduction of a program of social insurance had been central to Bismarck’s strategy for securing social peace within the context of rapid industrialization during the Second Reich.

Sebastian Dullien and Ulrike Guerot write that the central tenet of ordoliberalism is that governments should regulate markets in such a way that market outcome approximates the theoretical outcome in a perfectly competitive market (in which none of the actors are able to influence the price of goods and services). Ordoliberalism differs from other schools of liberalism (including the neo-liberalism predominant in the Anglo-Saxon world) in that it places a greater emphasis on preventing cartels and monopolies. At the same time, like neo-liberalism, ordoliberalism opposes intervention into the normal course of the economy. For example, it rejects the use of expansionary fiscal and monetary policies to stabilize the business cycle in a recession.

Jan-Werner Müller writes that ordoliberals thought of themselves as the true neoliberals: they alone had learned from the failures of laissez-faire in the 1920s; they alone had formulated a new vision of liberalism in which a strong state provided the framework for economic competition (and price stability), as well as a social safety net (to prevent socialism). In their eyes, other so-called neoliberals, from the Austrian School or the Chicago School, were really ‘paleoliberals’ stuck in 19th-century orthodoxies about self-correcting markets.

Jürgen Stark writes that Eucken’s main insight was that a market economy can only flourish in a sustainable manner if certain timeless principles are adhered to – and, importantly, all at the same time, because of what he called “the interdependence of orders”. Let me enumerate these principles:

· the primacy of price stability;

· the promotion of perfect competition on all markets;

· the protection of property rights;

· the freedom of contract;

· unlimited liability; and, finally,

· stability-oriented economic policies.

Stephen Padgett writes that a central tenet of ordoliberalism is a clearly defined division of labor in economic management, with specific responsibilities assigned to particular institutions.

Why Keynesian ideas never took root in Germany

Christopher Allen notes that even the center left governments of Helmut Schmidt (1974-82) and the center right governments of Konrad Adenauer and Ludwig Erhard (1949-66) Keynesian ideas and policies were used sparingly in the Federal Republic. In fact, Keynesian policies were popular only for a brief period during the Grand Coalition (1966-69) and the early years of center-left government (1969-1974) under Willy Brandt and his economics minister Karl Schiller. Schiller was the first widely influential “post Freiburg” economist on the left in Germany, and his views did not achieve currency until the 1960s. Yet, with the rise in inflation in 1972, precipitating Schiller’s departure from the Economics Ministry, the leading Keynesian theorist had lost some of his luster.

Christopher Allen writes that members of the Freiburg school believed that the depression had been caused, not by a deficiency of aggregate demand, but by the state’s experimentation with activist policies that led to a breakdown of the market order. What was needed then was not the experimentation of the 1920s and 1930s, but a clear set of policies based on sound economic theory. Christopher Allen also writes that while Keynes was deeply concerned by the inability of the private economy of ensuring equilibrium, the German economists have come to believe that such “framing” coordination can be secured from within the private sector itself, through the coordinating activities of powerful industry and employer associations, as well as the massive universal banks.

Simon Wren-Lewis wonders if Ordoliberalism and Keynesian ideas are really that incompatible. The New Keynesian view of stabilization policy is to bring the economy as close as possible to the market equilibrium that would prevail if prices were flexible. That does not sound so different to what Dullien and Guerot defines as the central tenet of Ordoliberalism.

The euro approach after the German election

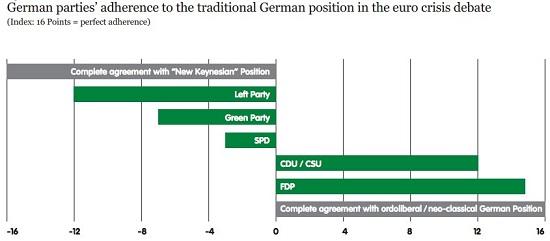

Sebastian Dullien and Ulrike Guerot write that a change in the government after the next general election is unlikely to dramatically change the country’s approach to the euro crisis since the ordoliberal tradition have informed the thinking of all five main political parties in Germany. Wolfgang Munchau writes that the SPD has not gained any traction against Angela Merkel because more than any other social democratic party in the west, it has bought into the neoclassical economic policy consensus. That makes it hard to find a narrative with which to attack Ms Merkel. If and when the party’s ageing leadership retires, or is swept away by bad results, a younger generation might offer a different perspective.