Quantifying the macroeconomic impact of the European fund for investments

In his keynote address at the 2014 Bruegel Institute annual dinner Poland’s Minister of Finance Mr. Mateusz Szczurek laid out a proposal for jumpstart

Introduction: The European Fund for Investments

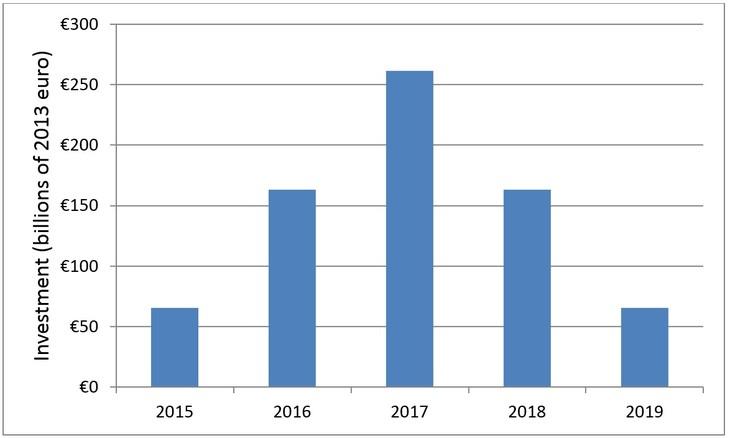

In his keynote address at the 2014 Bruegel Institute annual dinner Poland’s Minister of Finance Mr. Mateusz Szczurek laid out a proposal for jumpstarting the EU economy, avoiding a prolonged stagnation and building solid foundations for long run growth. This proposal is based on European-level program of scaling up public investment by around 5.5% of European Union GDP or 700 billion euros within the next 5 years. The capital spending would start at 0.5% of European GDP in 2015, peak at 2% in 2017, and be gradually phased out afterwards (Figure 1). The gradual path reflects the nature of large scale public investment projects and gives policymakers time to react and adjust the size of the program to changing economic conditions. In order to mobilize such considerable investments, European Fund for Investments (EFI) would be established. A gradual injection of paid-in capital and guarantees by all EU Member States would be leveraged by borrowing in the financial market. The Fund capital would be directly invested in the selected infrastructure projects, with particular focus on energy, transportation and ICT.

This note presents the background calculations of the program’s potential effects on the EU GDP and justifies its proposed size of 5,5% of EU-28 GDP.

Figure 1. Proposed path of EU-28 public investment under the EFI

Uncertainty about the sources of low growth and the size of output gap

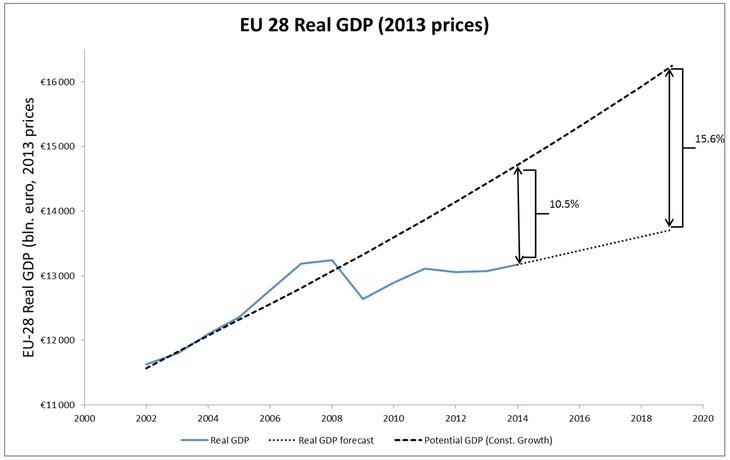

The weak economic recovery across Europe and the risk of the so-called secular stagnation are the key motivations behind the proposal. Nearly six years since the beginning of the financial crisis the European GDP is still well below its pre-crisis level and around 10% below the level consistent with trend growth prior to the crisis. Figure 2 summarizes this situation. It shows three curves. The solid line is the evolution of actual real GDP of the 28 EU economies since 2002. The dashed line is an extrapolation of the average 2% trend-growth prior to the financial crisis; this is the EU’s potential output if no permanent underlying stagnation occurred. The dotted segment on the other hand is an extrapolation based on the meager average growth of 0.8% since the trough in 2009. The EU economy is now about 10% below where it could be if the pre-crisis trends were maintained. If the current slow growth continues, it will be 16% below in 2019.

Figure 2. Losing ground after the crisis

There are two polar ways to interpret the current (and projected) economic weakness.

- EU economy is only suffering from depressed demand in the aftermath of the global financial crisis and sovereign debt troubles in Europe. In this scenario, EU could and should return to the pre-crisis potential growth path (dashed line). Expansionary macroeconomic policies are needed in order to achieve this goal.

- EU has entered a prolonged period of slow or non-existent growth which fully explain current output size. In this scenario, EU’s potential growth is permanently lowered due to productivity slowdown, regulatory burden and demographic changes, and deep structural reforms are needed to boost long run growth.

The truth lies somewhere in between and uncertainty over the nature of the current economic weakness complicates the proper policy response to the current situation. If deficient demand is to blame, relying exclusively on structural reforms is likely to be insufficient. Such reforms take a long time to affect growth and in the meantime a prolonged recession (due to deficit of demand) may turn into structural problems (stagnation of potential GDP) through the so-called hysteresis effects, e.g. because of the loss of skills and labor-force attachment of long term unemployed, forgone investment in physical and human capital and innovation (DeLong and Summers, 2012). If underlying problems are of structural nature, stimulating macro policies will be ineffective and risk overheating the economy, but this risk can be easily managed as discussed below.

Europe needs investment stimulus

While the output gap persists, conventional policy choices for the EU are severely restricted at the moment. Expansionary monetary policy is limited by the zero lower bound while expansionary fiscal policies are constrained by fiscal discipline induced by the SGP.

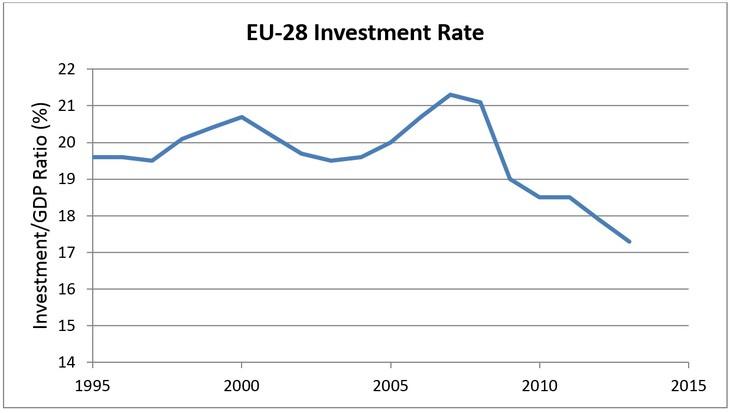

The situation calls for a new policy approach. The fact that the economic crisis caused a historically unprecedented collapse in capital investment in the EU (Figure 3) and current historically low level of long term interest rates suggest that cheap and plentiful savings are not being transformed into much-needed productive capital by the private sector. Boosting public investment, which is the goal of EFI, seems to offer an attractive and viable option for such a new policy approach. It would address both the lack of demand and the slowdown of potential growth in an environment where the risk of crowding out of private investment is extremely low.

Figure 3. The collapse of EU investment rate

Quantifying the impact and sizing the EFI

The impact of the investment boost on economy, and its optimal size depend on two considerations:

First, as discussed above it depends on the economy’s current output gap. Given the uncertainty over this variable discussed earlier, the “naïve” but reasonable approach is to target closing about half of the 16% gap between the low-growth projection and the pre-crisis trend that is expected to occur in 2019 in the absence of the EFI.

Second, the effect of the additional public spending of EU-28 GDP depends on the size of the multiplier, so quantifying the effects of EFI program and deriving its size are based on latest research on the size of output multipliers associated with government expenditure. Namely we adopt a multiplier of 1.5, which is consistent with recent estimates from the IMF (Blanchard and Leigh, 2013) and somewhat conservative, taking into account depressed state of economy, which tends to increase multipliers (Auerbach and Gorodnichenko, 2013).

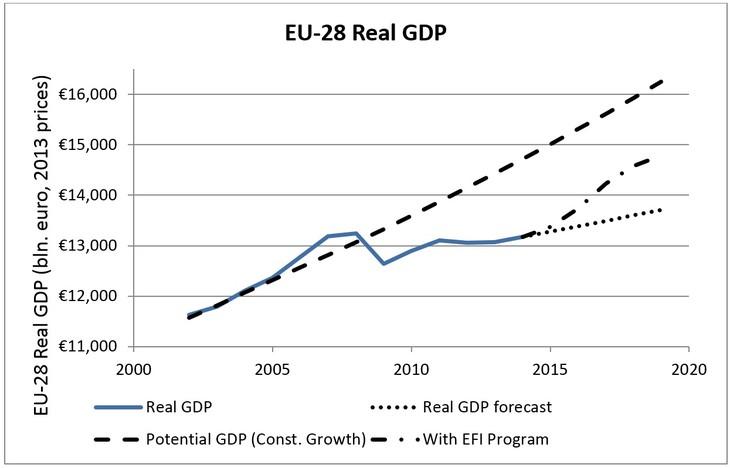

Figure 4 illustrates the impact of the EFI public investment of 5.5% of GDP on the EU-28 economy under these assumptions. The extra investment boosts average growth over 2015-19 from 0.8% to 2.3%, reducing the gap in 2019 between current output and the path of uninterrupted 2% growth from almost 16% to 8.9%.

Figure 4. Effects of EFI Program on EU-28 GDP

Robustness

The objective illustrated in Figure 4 seems to be prudent given the uncertainty about the size of the output gap. It is also quite robust.

In the case that true potential is indeed represented by the pre-crisis trend (and thus the output gap is very large) the multipliers will likely prove to be larger than the ones used here. It is now commonly accepted that the magnitude of the effect is likely much greater in a depressed economy where interest rates are close to the zero lower bound and when spending is directed towards productive public capital. Specifically, in an important recent contribution Auerbach and Gorodnichenko (2013) point to large and persistent effects of government investment in a depressed economy. The impact of the EFI would then probably be higher, if output gap was bigger than assumed here.

The policy itself also offers some important flexibility. If the EU economy continues to experience low inflation and stagnant labor markets as growth rates of GDP pick up, indicating that output gap remains substantial, the scale of the EFI project should be increased and its duration extended.

In the case that the true potential is much below the pre-crisis growth path (dashed line), there is a concern that a stimulus like the EFI could lead to overheating of the economy and a surge of inflation. This is unlikely to be a serious issue for the EFI for several reasons. First, the latest research demonstrates that the effects of the fiscal expansion in an economy that is not in a recession are much more modest. Thus if the output gap isn’t very large to start with, the policy will have much less potential to overheat the economy (Auerbach and Gorodnichenko, 2013). Second, the inherent asymmetry of the zero lower bound helps to contain any downside risk to inflation. While it is hard for the ECB to stimulate the economy further with interest rates already at or close to their minimum, it would find no difficulty cooling the economy by raising them, should that be required. Additionally, given the gradual scaling up of investment over the five years, policymakers would have ample time for course-correction should the stimulus prove excessive.

Long Run Benefits of the EFI

One of the crucial aspects of our proposal is that the investment boost is directed at large scale infrastructure projects in energy, transportation and ICT. Such projects will not only add to the economy’s capital stock and mobilize idle saving. They will also increase the economy’s long term potential growth rate. Thus, if we are seriously concerned about the slowdown in potential growth of the EU economy, we should embrace this idea even more wholeheartedly. Given the current economic weakness and dire forecast, doing too little seems like a greater danger than doing too much.

References

Auerbach, Alan J., and Yuriy Gorodnichenko. 2012. "Measuring the Output Responses to Fiscal Policy." American Economic Journal: Economic Policy, 4(2): 1-27.

Olivier Blanchard, O. and Daniel Leigh, “Growth Forecast Errors and

Fiscal Multipliers”, IMF Working Paper, January 2013.

DeLong, B. and L. Summers, “Fiscal Policy in a Depressed Economy”, Brookings Papers on Economic Activity, Spring 2012

Woodford, Michael. 2011. “Simple Analytics of the Government Expenditure Multiplier.” American, Economic Journal: Macroeconomics 3 (1): 1–35.