Blogs review: The China slowdown effect

What’s at stake: As China moves from being an economy with surplus labor to an economy with labor shortages, the implications for the global econ

What’s at stake: As China moves from being an economy with surplus labor to an economy with labor shortages, the implications for the global economy could be far reaching. The required rebalancing of the Chinese economy appears challenging as it could reduce the income gains for ordinary citizen, destabilize the ruling elite that has benefited from an investment-driven economy and reveal the instability of the financial system.

The end of cheap labor and the Lewis turning point

Mitali Das and Papa N’Diaye write in June issue of the IMF’s Finance and Development (HT Timothy Taylor) that fast-rising wages, worker activism, and intermittent labor shortages suggest that China, whose economic rise has depended on a vast supply of low-cost labor, is about to enter a period of widespread labor shortages. But the data shows that wage growth still lags productivity, resulting in rising profits, which suggests that China has not reached the so-called Lewis, at which an economy moves from one with abundant labor to one with labor shortages.

Paul Krugman writes that China has hit the “Lewis point” — to put it crudely, it’s running out of surplus peasants. The economist W. Arthur Lewis argued that countries in the early stages of economic development typically have a small modern sector alongside a large traditional sector containing huge amounts of “surplus labor” — underemployed peasants making at best a marginal contribution to overall economic output. The existence of this surplus labor, in turn, has two effects. First, for a while such countries can invest heavily in new factories, construction, and so on without running into diminishing returns, because they can keep drawing in new labor from the countryside. Second, competition from this reserve army of surplus labor keeps wages low even as the economy grows richer.

Jean-Joseph Boillot suggests that China has some tools available to delay the onset of the Lewis turning point. Given the increase in life expectancy, it shouldn’t be, for example, hard for the government to increase the retirement age.

Rebalancing in a Minsky world

Paul Krugman writes hitting the Lewis point should be a good thing. Wages are rising; finally, ordinary Chinese are starting to share in the fruits of growth. But it also means that the Chinese economy is suddenly faced with the need for drastic “rebalancing”. The question is whether this can happen fast enough to avoid a nasty slump. In ordinary times, the world could probably take China’s troubles in stride. Unfortunately, these aren’t ordinary times: China is hitting its Lewis point at the same time that Western economies are going through their “Minsky moment,” the point when overextended private borrowers all try to pull back at the same time, and in so doing provoke a general slump.

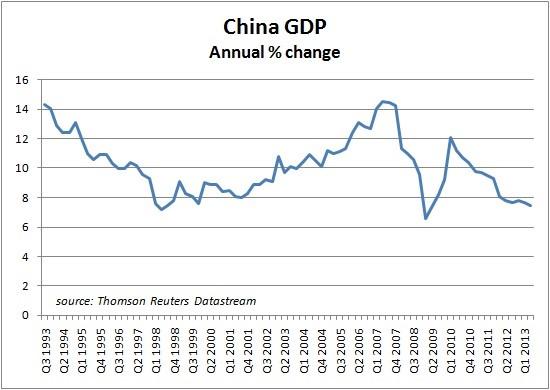

Source: FT data blog

Michael Pettis writes that for China to rebalance towards a healthier and more sustainable model without unrest, China does not need to grow at 7 per cent or even 6 per cent a year. This is a myth that should be discarded. What matters for social stability is that ordinary Chinese continue to improve their lives at the rate to which they are accustomed. If household income can grow annually at 6-7 per cent, income will double in 10 to 12 years, in line with the target proposed by Premier Li Keqiang in March during the National People’s Congress. It will not be easy though. A reduction in investment and GDP growth will almost certainly put pressure on employment and household income growth unless a significant transfer of resources from the state sector to the household sector counterbalances it. This will be strongly opposed by members of the political elite who have benefited from the strong state sector, but it is not clear that China has many alternatives. The arithmetic of rebalancing does not otherwise work.

The risk of a collapse in the financial system

Kate Mackenzie writes that there are many ways in which a crisis might not erupt in quite the way — or at quite the speed — that some commentators seem to be expecting.

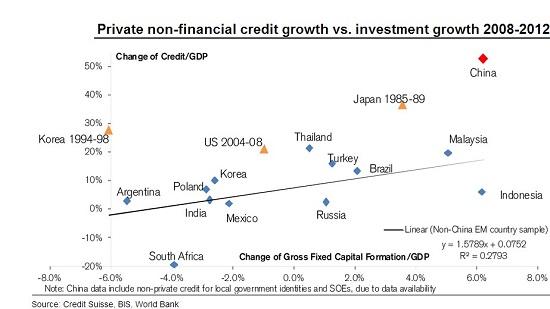

Minxin Pei (HT FT Alphaville) writes that since 2008, Beijing has maintained growth with a massive injection of credit, much of it invested in speculative real estate, excessive industrial capacity, and infrastructure with dubious financial viability. In a highly leveraged economy, as China is today, a significant deceleration could quickly lead to cascading financial defaults. Deeply indebted real estate developers, local governments, and state-owned enterprises will not pay their creditors (both banks and suppliers), thus triggering chain default. This could throw the entire economy into turmoil. We saw a little preview of this during the credit squeeze in June.

Source: SoberLook (HT Marginal Revolution)

James Hamilton writes that despite the official explanations, recent moves in interbank lending rates (SHIBOR) could definitely be signaling some financial fragility. If there are significant disruptions to China's system for funding credit, that could have implications for anyone borrowing from or lending to Chinese entities. And it may be a mistake in the world of modern global finance to assume that what happens in China, stays in China.

The distributive impact of a collapse in commodity prices

James Hamilton writes that a significant economic downturn in China could well mean a collapse in oil prices. One would think that, as a net importer, this would be an overall favorable development for the United States, and certainly it would be a significant plus for many individual U.S. firms and producers. But it's worth remembering what happened after the collapse in oil prices in 1986. In the years leading up to that, just as today, there had been a dramatic economic boom in the U.S. oil-producing states, as oil producers invested heavily in more expensive projects. When oil prices collapsed, domestic producers took a significant hit. The labor and capital that had specialized for that sector cannot costlessly move to other regions and activities. Plunging oil prices were good news for much of the nation, but sent the U.S. oil-producing states and their neighbors into their own regional recession.

Read more on China

China seeking to cash in on Europe’s crises

China's financial liberalisation: interest rate deregulation or currency flexibility first?

Financial openness of China and India: Implications for capital account liberalisation

Developing an underlying inflation gauge for China

Are financial conditions in China too lax or too stringent?

How tight is China’s monetary policy?

The Dragon awakes: Is Chinese competition policy a cause for concern?

How loose is China’s monetary policy?

China gingerly taking the capital account liberalisation path