Crowdfunding: Broadening Europe’s capital markets

The rising financing gap for SMEs as well as high growth firms is a serious concern for Europe battered by financial fragility. These firms, particula

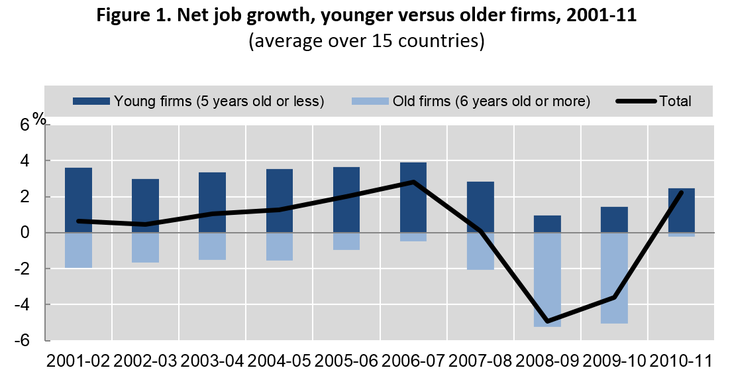

Source: OECD (2013a), STI Scoreboard 2013

Note: Figures refer to the preliminary results of the OECD DYNEMP project based on data from Austria, Belgium, Brazil, Finland, France, Hungary, Italy, Japan, Luxembourg, the Netherlands, New Zealand, Norway, Spain, Sweden and the United States.

In the U.S., the majority (70%, according to IRSG) of corporate fundraising is through the securities market while in Europe, companies have traditionally relied on bank lending.

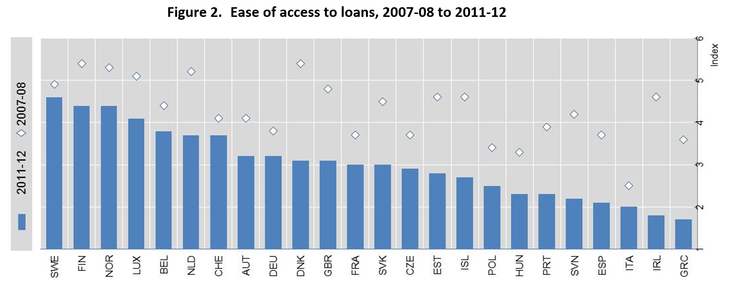

The curtailing of bank lending over the past several years due to the financial crisis has created a huge constraint for these firms, particularly as non-bank capital is less prevalent in Europe. In the U.S., the majority (70%, according to IRSG) of corporate fundraising is through the securities market while in Europe, companies have traditionally relied on bank lending.

Source: World Economic Forum (2012), The Global Competitiveness Report 2012-2013 and World Economic Forum (2008), Schwab, K. (2012), The Global Competitiveness Report 2012–13. Geneva: World Economic Forum. Schwab, K. (2009), The Global Competitiveness Report 2008–09.

Note: Scale from 1 to 7 from hardest to easiest, weighted averages.

At a time when banking intermediation is under pressure, it is important for European Union policymakers to further explore alternative forms of financial intermediation. Commission President Jean-Claude Juncker recently spoke about the need to improve financing in Europe by “further developing and integrating capital markets” and reducing the dependence on bank funding. He and his new team should address regulatory fragmentation in financial markets head on in order to facilitate efficient funding and growth of innovation in Europe.

For innovative young firms, equity capital can be particularly important to fuel growth across borders, yet the European capital markets are highly fragmented making it difficult for these firms to access the necessary financing. Different rules and regulations apply to various types of financial instruments and financial intermediaries across European countries. Financial intermediation plays a critical role for young firms as information asymmetries make it difficult for investors to identify and evaluate the potential of these firms.

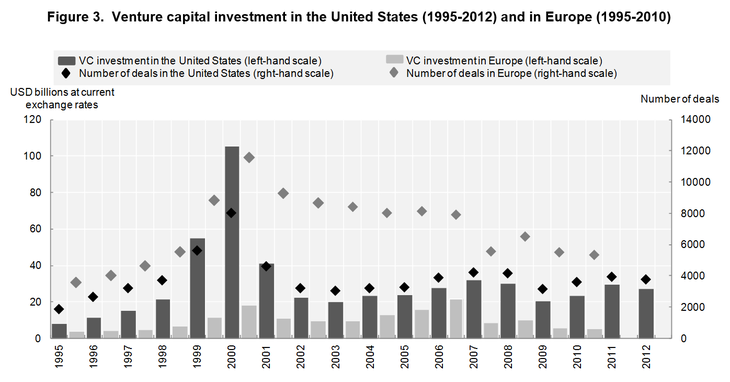

Venture capital and angel investment are playing an increasingly important role in Europe but activity is still overshadowed by the U.S. where the capital markets are more developed.

Source: OECD (2013), Science, Technology and Industry Scoreboard 2013, calculations based on PwCMoneyTree, EVCA/Thomson Reuters/PwC and EVCA/PEREP_Analytics.

Note: Data for the United States refer to market statistics, data for Europe refer to industry statistics. Europe includes here Austria, Belgium, Bosnia-Herzegovina, Bulgaria, Croatia, Czech Republic, Denmark, Estonia, Finland, France, Germany, Greece, Hungary, Ireland, Italy, Latvia, Lithuania, Luxembourg, Former Yugoslav Republic of Macedonia, Montenegro, Netherlands, Norway, Poland, Portugal, Romania, Serbia, Spain, Slovak Republic, Slovenia, Sweden, Switzerland, Ukraine and United Kingdom.

Over the past decade, European venture capital investment has been approximately one-fifth to one-third the size of investment in United States but this figure has dropped further in recent years. Also, the number of venture capital deals in Europe is higher than in the United States, showing that venture capital firms in Europe are, on average, dispersing funds more broadly through smaller deals. In fact, according to the data above, deals in the United States have been on average almost double the size of European deals.

Angel investment has been playing an increasingly important role in the financing innovative young firms but remains primarily local due to the fact that the majority of angel investments are made individually to entrepreneurs within the investors’ communities. A growing number of angel investors are investing through groups, networks and syndicates but the majority of these investments also remain local or national.

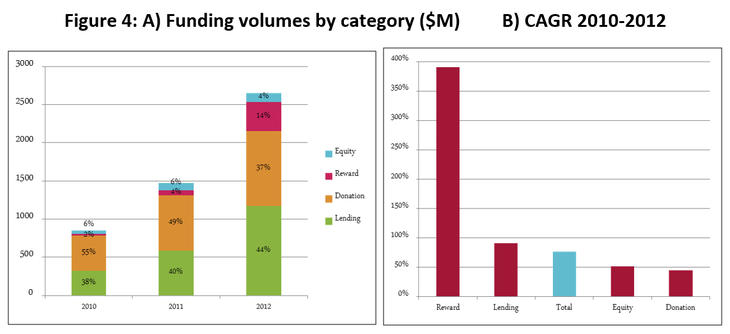

As analysed in a paper just published by Bruegel, Crowdfunding is increasingly attracting attention, most recently for its potential to provide equity funding to start-ups.

Source: Bruegel elaboration on the basis of crowdfunding industry report 2013 (Massolution).

Equity crowdfunding can open up additional channels for new ventures to access finance at a time when securing funding is difficult, however, policy makers should carefully assess the risks of this new financial intermediation tool. The challenges that equity crowdfunding poses are distinct and more complex than those of the other forms of crowdfunding and the risks also differ from other forms of seed and early stage equity finance, such as angel investment and venture capital. Unlike other forms of equity financing, crowdfunding is intermediated by online platforms. These platforms differ in terms of the role they play in screening and evaluating companies. Also, their role during the investment and post-investment stages can vary dramatically.

Due to exemptions in legislations, Europe has been at the forefront of equity crowdfunding globally. However, the market is highly deregulated with few legal protections provided to funders. In response, some member states have introduced ad hoc legislations for crowdfunding, while some others will introduce new laws soon. Being internet based, equity crowdfunding has the potential to contribute to a pan-European seed and early stage financial market to support European start-ups. However, in order to maximise this benefit, policies to address equity crowdfunding models should be adopted homogeneously by all member states. This approach would maximise the benefits of equity crowdfunding and help to reduce the risks. It would also help to address some of the fragmentation in Europe’s financing markets and encourage new forms of financial intermediation. The Commission should work with Member States to address the current patch-work of national legal frameworks which constitute an obstacle to the appropriate development of this nascent model of funding across Europe as part of the work towards a Capital Market Union.