Russian Roulette, reloaded

European attention will be back to Russia and Ukraine this week, as sanctions are reviewed. In the meantime, important changes have taken place.

European attention will be back to Russia and Ukraine this week, as sanctions are reviewed. In the meantime, important changes have taken place. European FDIs and loans to Russian borrowers have started to dry up, while lending from China has reached new highs, raising important questions about the effectiveness of measures supposed to restrict Moscow’s room of maneuver in seeking access to capital.

Geopolitical conflicts have one common characteristic: they catalyse attention according to cycles. The Ukraine-Russia affaire is not an exception, in this respect. On Tuesday, EU diplomats will meet to review the sanctions imposed to Russia with the aim to “amend, suspend or repeal them”. At the moment, the FT reports, there seem to be no signs that the measures would be suspended or changed.

Russia did not look particularly open to compromise last week, when president Putin demanded a reopening of the EU-Ukraine recently-ratified trade pact - which was the casus belli in the Ukraine crisis. According to the FT, Putin accompanied his demands with threats of “immediate and appropriate retaliatory measures” if Kiev were to actually implement any part of the deal. These points were not welcomed well in Europe, in particular in Germany, which is reportedly insisting that there should be no dilution of sanctions imposed on Russia.

This new stand-offs will attract Europeans' attention back to their Eastern borders. The first question to answer - before wondering what to do with the sanctions in place - is whether they have been effectively biting. It may be too early to tell, but some recently published data - which are reviewed here - show interesting signs that may support the points of those who are skeptical.

Capital has been flowing out of Russia over the last quarter of 2013 and the first quarter of 2014 and the financial account at the end of Q1 2014 reached a deficit of almost 9% of GDP

On net terms, capital has been flowing out of Russia over the last quarter of 2013 and the first quarter of 2014. The right panel of figure 1 shows that the financial account at the end of Q1 2014 reached a deficit of almost 9% of GDP, excluding the movements in reserves assets. Reserves - shown in the left panel of figure 1 - have been decreasing since a peak in 2012, and more markedly since end-2013, reaching 458 USD bn on the 19th September 2014. This amounts to a 10% decrease over the nine months since the beginning of the year. As a comparison, during the crisis of 2008-09, reserves went down in Russia by 37% over six months, and by about 13% monthly during the two worst months.

To be fair, the fact that reserves have not dropped nearly as fast as in 2008-09 does not preclude the possibility that Russia may experience another balance of payment crisis. Reserves have in fact been constantly decreasing - although slowly - and psychological factors could play as an amplificator, if external pressure were to intensify significantly (which may come from expected redemptions on external debt, especially if sanctions were to be simultaneously thoughened).

But what is behind the relatively contained drop of the Russian financial account? Understanding this may be an essential prerequisite to assess the effectiveness of sanctions. On one hand, the limited coverage of the data - which stops in the first quarter of 2014 - does not (yet) allow us to assess the impact of the second wave of sanctions. But there might be something - quite interesting - going on.

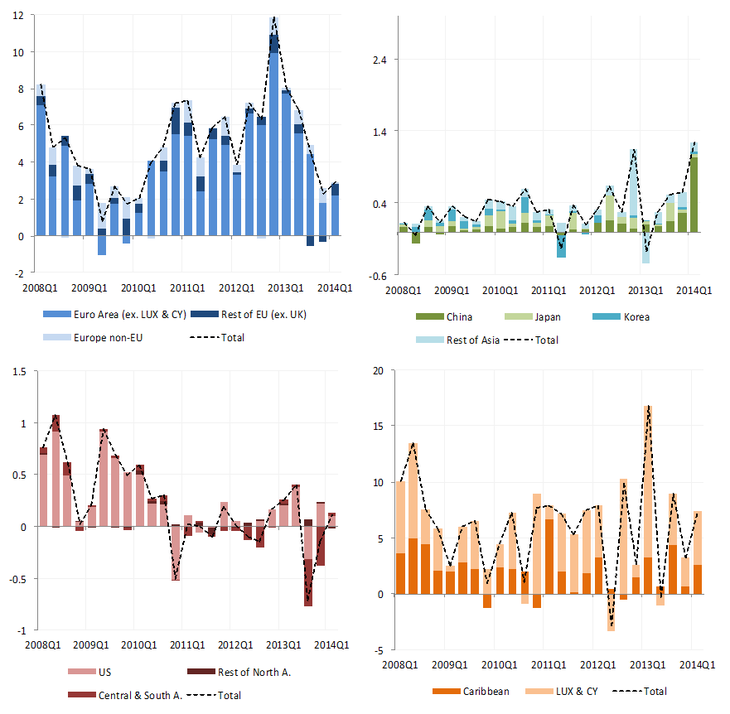

Figure 2 reports quarterly data on foreign direct investments (FDI) in Russia from 2007 till the first quarter of 2014, broken down by investing countries. Data were taken from the Central Bank of Russia’s website, and they are provided already in net terms (i.e. inflows minus outflows), meaning that a negative number in one quarter represents a net outflow in that quarter and a positive number represents a net inflow. The upper-left panel shows FDI coming from European countries, both EU and non-EU. The other three panels show FDI coming from Asian, American and Caribbean countries.

Foreign Direct Investment in the Russian Federation in 2007 - 2013, Q1 2014 (Balance of Payments Data, inflows minus outflows)

Over time (if we disregard possibly dubious flows from the Caribbeans) Europe has played a crucial role in providing FDI to Russia, with the largest share of European FDI coming from Euro area countries (in particular Ireland and the Netherlands, followed by France and Germany). Cyprus and Luxembourg are clear outliers in Europe and their abnormal flows are more similar to those from the Caribbean countries, together with which they are represented (see here for wide discussion of Cypriots FDI flows to and from Russia).

FDI flows from Europe have been shrinking significantly in the last three quarters up to March 2014, while flows from Asia - mostly China - picked up to high levels during the same period

Figure 2 shows that FDI flows from Europe have been shrinking significantly in the last three quarters up to March 2014. This occurred probably in anticipation of escalating tensions, and speeded up during the first quarter of 2014, when the first wave of sanctions was agreed.

More interestingly, FDI flows from Asia - mostly China - picked up to high levels during the same period and literally exploded in the first quarter of 2014. During the first three months of 2014, European net FDI inflows to Russia amounted to 2.9 USD billion (2 billion of which coming from the euro area), i.e. down 63% year on year. Asian net FDI flows to Russia were instead 1.2 USD billion (1 billion of which coming from China), i.e. up 560% year on year.

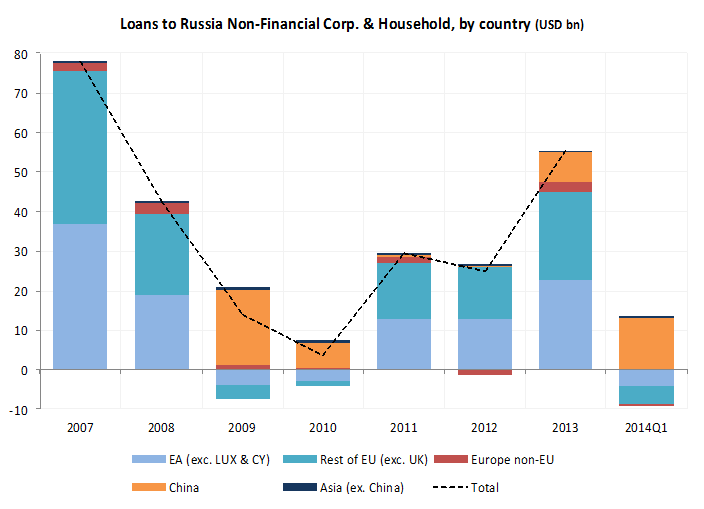

This is not the only sign suggesting that Russia might have been re-orienting the geography of its capital flows over the latest months (something I already looked at here). Figure 4 shows the amount of loans to Russia non-financial corporations and households from foreign lenders, over the period 2007-2014Q1. These are net loans (i.e. disbursement net of repayments) so they can be taken as a proxy of the new lending.

The data for the first quarter of 2014 is not properly comparable with the previous - annual - points, but it is nevertheless striking. It shows the expected negative net new lending by European lenders and the - less expected - positive and big net new lending by Chinese lenders. As a comparison, China net new lending to Russian NFCs and Households was 13 USD billion for the sole first quarter of 2014, compared to 7.5 USD billions for the entire 2013.

The sanctions to make access to European financial market more difficult for Russian banks and companies may prove far less effective than expected

Obviously, it is too early to draw conclusions, and assessment at this point in time needs to be cautious. But this data may be the first sign of a geographical reshuffling of capital flows to Russia, with China possibly starting to substitute outgoing European countries. Data on the past two quarters - covering the period during which sanctions were toughened on the European side - will be key to understand whether this development can be a lasting trend.

But if this were to be the case, then the sanctions that were supposed to make access to European financial market more difficult for Russian banks and companies may prove far less effective than expected.

Read the first post

Read more on China and Russia