30% of the Euro Area HICP basket is now in outright deflation

A look at the composition of the HICP basket for the euro area shows that the percentage of items that are now in outright deflation has risen to 30%

It’s the week before Christmas, and it has certainly not been a reassuring week for the ECB. The staff projections for HICP inflation for the Euro area were lowered to only 0.7% in 2015 and 1.3% in 2016, and HICP inflation for Germany was confirmed at +0.5% for November 2014 and at +0.4% for France. Most importantly, French core inflation turned into the negative territory for the first time since the French statistical office started measuring it (i.e. since 1990). Also, the massive plunge in Brent oil prices (-25% since September 2014) is still not reflected in the published data, but suggests further downward pressure on inflation rates.

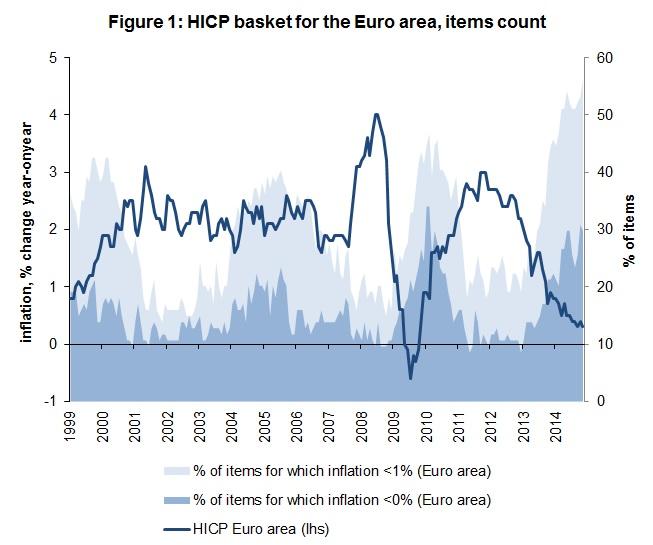

A look at the composition of the HICP basket for the euro area shows that the percentage of items that are now in outright deflation has risen to 30% in November 2014, compared to 21% at the beginning of 2014. The percentage of items in “lowflation” (i.e. recording inflation below 1%) has climbed up 10 percentage points, from 45% in January to 55% in November 2014, surpassing significantly the peak in 2010 of 46% of items in lowflation. As already pointed out previously, this is still well below the Japanese basket count with 50-60% items in outright deflation over 2000-2004 and 2009-12, but it is nevertheless an important indicator, as it has been behind the initially dismissive language of the ECB on price developments.

Source: Datastream

The curve of market expectations on inflation has been drifting down since last year

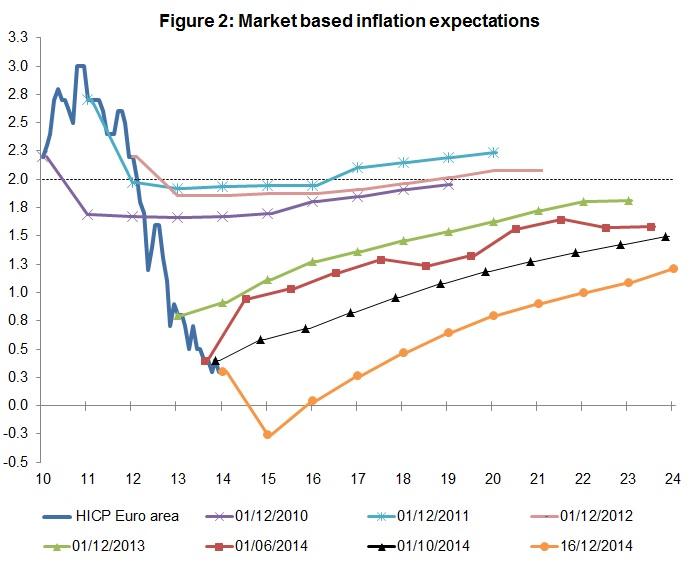

Markets have been incorporating these gloomy developments quickly. The curve of market expectations on inflation (measured here with inflation linked swap rates) has been drifting down since last year. Specifically, while inflation over a 10 year horizon was still at a level of 1.8 % in December 2013(see green curve), the latest expectations revise this number downward to only 1.5% (see orange curve). These numbers reflect that markets don’t believe in the ECB’s capacities to get close to its target for another 10 years - a worrisome development. On the short end of the curve, expectations signal outright deflation on a 1-year horizon and basically zero inflation on the 2-year horizon.

Source: Datastream ThomsonReuters

Considering all the presented evidence, pressure for the ECB to act is reaching new highs. The great hopes put in TLTRO (if there were any) have been disappointed by very low take up, and the ECB already finds itself stuck in the uncomfortable place of someone who might have tested the resilience of inflation expectations a little too long. So, since it's evidently not going to be a merry Christmas, let's hope at least for a happy new year.