A European approach to corporate tax

The recent ‘tax-sweetener’ state-aid cases against Ireland for its agreements with Apple, Luxembourg with Amazon and Fiat, and the Netherlands with St

When a crowd of angry Americans threw 45 tonnes of tea into Boston harbour in 1773, their concern was the under-enforcement of the principle of ‘no-taxation without representation’ – that governments should not impose fiscal obligations on their citizens without them having a saying on it. More than two centuries later, some European Union member states might feel they have concerns of the same nature. The recent ‘tax-sweetener’ state-aid cases against Ireland for its agreements with Apple, Luxembourg with Amazon and Fiat, and the Netherlands with Starbucks have created momentum for those that believe that the European Commission should act to ensure that European countries coordinate their fiscal policies and possibly converge to harmonised corporate tax levels. Countries that use aggressive fiscal policies to attract foreign investors feel under threat of losing their fiscal autonomy.

Recent tax-sweetener state-aid cases created momentum for those who believe that the Commission should act to ensure that European countries coordinate their fiscal policies

State aid rules however have little to do with convergence of fiscal policies, and the Commission has never said that this should ultimately be the outcome of its investigations. The idea of state aid control is not to prevent free-riding as such. In the current framework, like it or not, it is legitimate for countries to offer advantageous conditions to investors seeking a cheap foothold in Europe from which to serve the entire single market. But state aid is illegal whenever such a policy is discriminatory in the sense that other companies, be they European or not, cannot access the same treatment.

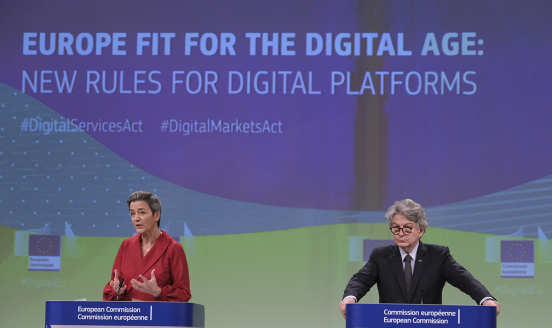

But the impact of tax-sweetener cases could be broader than obliging member states to recover illegal state aid. On January 17, the Commissioners for Competition, Ms Vestager, and for Economic Affairs, Mr Moscovici, vowed to ‘put the EU tax house in order’.[1] With the aim of increasing transparency and preventing tax avoidance, they promised to revive the Commission’s proposal for a common consolidated corporate tax base – in other words, a common methodology to calculate and allocate multinational companies’ taxable incomes to member states. This would be most welcome (the initiative could even have a new acronym, such as Tax Union Base for Enterprises, or TUBE, to distinguish it for previous attempts).

The single market is seen as the key to the reignition of European growth. This requires cross-border competition and harmonised regulatory frameworks. At a time when Europe desperately needs to revive investment, a harmonised tax-base system would greatly enhance Europe’s ability to attract FDI. There is an extensive economic literature suggesting that corporate tax can have a significant effect on investment location decisions. However, when other business environment factors such as bureaucracy and regulatory uncertainty are taken into account, tax becomes much less important. An efficient system in which companies can anticipate more easily how much it will cost to locate their investment in multiple European countries would make Europe as whole more attractive, regardless of corporate tax levels.

The single market is the key to the reignition of growth. This requires cross-border competition and harmonised regulatory frameworks

The tax sweetener scandals have created an appetite for coordination that the Commission would be smart to exploit. Even Vice President Katainen has recently stressed that a common tax base proposal would help capital union. The drive for more coordination can easily dwindle as time passes and member states that oppose tax-base harmonization might succeed in stalling the process, as has happened since the project was launched in 2001. The Commission should therefore assess the reasons why some member states oppose the project. Concerns might be economic, because countries fear gradual loss of their fiscal autonomy and perceive tax-base harmonisation as a backdoor to fiscal convergence. Or they might be purely strategic: that a common methodology and enhanced transparency would reduce their leeway to hide illegal state aid that attracts foreign investors. The Commission can address the first concern through a clear public commitment that implicit tax harmonisation will never be an objective. There are good economic reasons why a degree of tax competition between jurisdictions can be good: it disciplines countries’ fiscal strategies, for example, and reduces the risk of protectionist measures. In the US, states are not bound by a common corporate tax policy. There are also good political reasons: the democratic backing for the EU institutions is too feeble to meet the ‘no taxation without representation’ principle. And institutional constraints: the Treaty explicitly forbids tax harmonisation. Meanwhile, countries' concerns that do not have an economic nature should be put under the spotlight. This would make it difficult for opponents of tax-base harmonisation to justify retaining their murky systems in order to circumvent state aid rules.

There are good reasons why a degree of tax competition between jurisdictions can be good

[1]This is the year for Europe to put its tax house in order, Margarethe Vestager and Pierre Moscovici on The Guardian