France and Italy: The ABCs of the European fiscal framework

On the 28th of November the European Commission released its opinions on the euro area Member States’ Draft Budgetary Plans for 2015. The purpose of t

The EU’s fiscal framework, the Stability and Growth Pact (SGP), is a complicated system of fiscal rules. Rather than trying to assess the virtues and failures of the SGP, this blogpost aims at understanding its complex rules through the lens of the draft budget plans of France and Italy. France is in the corrective arm of the SGP, while Italy is now in the preventive arm, which allows the examination of various SGP requirements, such as the

- structural balance pillar,

- expenditure balance pillar,

- and the debt criterion

which apply to countries in the preventive arm (like Italy), and the

- headline budget deficit criterion,

- the structural balance criterion,

- and the cumulative structural balance criterion

which apply to countries in the corrective arm (like France). We also discuss the rules regarding financial sanctions.

On 28 November 2014, the European Commission released its opinions on the euro area Member States’ Draft Budgetary Plans for 2015. The purpose of these opinions is to assess each country’s compliance with the SGP, and to recommend appropriate action if there are risks of non-compliance.

One of the surprises was that, in the case of Italy and France (as well as Belgium), the Commission decided to postpone its recommendations until March 2015, “in the light of the finalisation of the budget laws and the expected specification of the structural reform programmes announced by the authorities“. Both Italy and France are “at risk of non-compliance with the provisions of the Stability and Growth Pact”, according to the Commission.

The Framework

The Stability and Growth Pact is composed of a preventive and a corrective arm. The corrective arm is called the Excessive Deficit Procedure (EDP), which is triggered for countries with a general government deficit larger than 3 percent of GDP or with debt larger than 60 percent of GDP not being reduced at a satisfactory pace. France is currently under the corrective arm and Italy was as well until 2013. Italy is therefore now subject to the rules of the preventive arm.

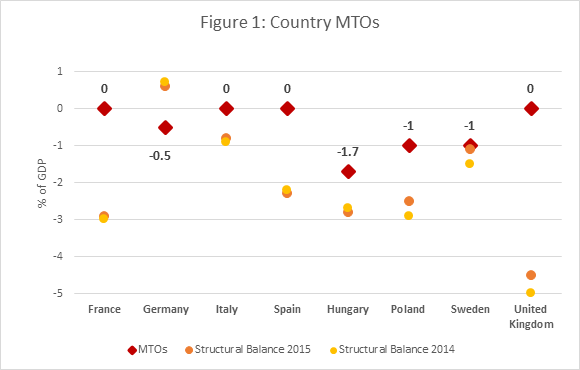

Source: Country Stability and Convergence Programmes for MTOs, AMECO for forecast of 2014 and 2015 Structural Balances

Notes: Data labels are for the MTOs. According to the Treaty on Stability, Coordination and Governance (TSCG), signed by all euro area members in March 2012, all signatory Member States must have an MTO higher than -0.5% of GDP (or -1% for countries with a debt/GDP ratio lower than 60%). The “fiscal” part of the TSCG is often called the ‘Fiscal Compact’.

The Fiscal Compact is not binding for non-euro area Member States, which therefore have more freedom in setting their MTOs. For example, Hungary has an MTO of -1.7 percent, the Polish and Swedish MTO is -1 percent, while it is zero for the United Kingdom.The fundamental variables used to assess compliance with the preventive arm of the SGP are the country-specific medium-term budgetary objectives (MTOs), which are defined as structural balances (a measure of the government budget balance adjusted for the economic cycle and one-off revenue and expenditure items; this blogpost by Zsolt Darvas explains the estimation methodology and why it has some drawbacks). MTOs are chosen by each Member State following strict guidelines set out by the Commission, in order to ensure sustainability in its public finances (a higher MTO is required from countries with a high debt ratio or with a rapidly-ageing population faced with increasing age related expenditure for example, while the ‘Fiscal Compact’ limits the MTO for euro area member states, see the notes to Figure 1). A few examples of MTOs can be found in Figure 1: France, Italy and Spain have an MTO of 0 percent of GDP, while Germany’s MTO is -0.5 percent. This means that in the case of Germany, for example, a structural deficit of 0.5 percent of GDP is deemed enough to ensure the sustainability of its public finances.

To comply with the preventive arm of the SGP, all Member States must be at their MTOs or be on a path to reach them, with an annual improvement of their structural balance of 0.5 percent of GDP towards the MTO as a benchmark.

A higher effort might be required for countries with high debt/GDP ratios and pronounced risks to overall debt sustainability. A higher effort is also required in good economic times, and a lower effort in economic downturns. A Member State could also be allowed to deviate from the adjustments if it experiences “an unusual event outside its control with a major impact on the financial position of the general government”.

Therefore compliance with the preventive arm is not defined by the Member State’s structural balance, but by its path towards the MTO.

Italy

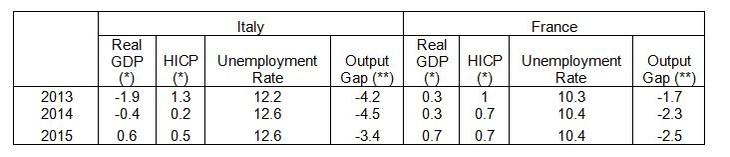

Structural balance pillar: Table 1 shows the recommended path for Italy. On the 28th of November 2014 the Commission decided that “severe economic conditions” (namely a real GDP contraction and a large negative output gap: see Table 3) justified that Italy is not required to adjust its structural balance towards the MTO by the 0.5 percent of GDP benchmark in 2014. This is why the required change in the structural balance for 2014 is 0. Italy had originally planned a large correction of its structural budget for 2014 in its 2013 Stability Program, of 0.7 percentage points. In its Draft Budget Plan for 2014 Italy revised this adjustment to 0.3. Finally it invoked Article 5 of Regulation 1175/2011 in its 2014 Stability Program which allows a deviation from the required adjustment “in the case of an unusual event outside the control of the Member State concerned which has a major impact on the financial position of the general government”. The required adjustment is also 0 in 2013 for the same reason: negative real output growth makes Italy eligible to the escape clause. In 2015 real GDP is forecast by the Commission to increase by 0.6 (see Table 3), which means that Italy can no longer apply for the escape clause regarding economic downturns.

Table 1: Italy’s compliance with the preventive arm and the debt criterion

Source: Commission Staff Working Document: Analysis of the draft budgetary plan of Italy (28 November 2014), European Commission Autumn Forecast (November 2014), Italy’s Stability Programme April 2014, Italy’s Stability Programme April 2013, Vade Mecum on the Stability and Growth Pact (May 2013)

Note: ΔSB denotes the percentage point change in the structural balance. MLSA: minimum linear structural adjustment. DBP: draft budget plan

(1): Deviation of the growth rate of public expenditure net of discretionary revenue measures and revenue increases mandated by law from the applicable reference rate in terms of the effect on the structural balance. A negative sign implies that expenditure growth exceeds the applicable reference rate.

Concretely, Italy’s medium-term budgetary objective is a structural balance of 0 percent of GDP, whereas the European Commission forecasts a structural balance of -0.8 percent of GDP in 2015. Thus Italy is required to adjust its structural balance towards its MTO by 0.5 percentage points of GDP (while a higher adjustment than 0.5 is required for countries with debt exceeding 60 percent of GDP, a lower effort is allowed in economic “bad times”). The forecast adjustment from 2014 to 2015 is of 0.1 pp. according to the Commission (taking account of additional measures announced on 27 October), which is considered to pose a risk of “significant deviation from the required adjustment”.

Expenditure balance pillar: Member States in the preventive arm of the SGP also have to comply with the expenditure benchmark pillar, which complements the structural balance pillar. It requires countries that are not at their MTO to contain the growth rate of expenditure net of discretionary revenue measures to a country-specific rate below that of its medium-term potential GDP growth. This medium-term potential GDP growth is calculated as a 10-year average (of the 5 preceding years, the current year and forecasts for the next 4 years), and in the case of Italy it is 0 percent in 2014 and 2015. Had Italy been at its MTO it would have had to contain net expenditure growth to 0 percent. However, not being at its MTO, it is required to contain net expenditure growth to a reference rate below medium-term potential GDP growth: -1.1 percent in 2015 (which is calculated so that it is consistent with a tightening of the budget balance of 0.5 percent of GDP when GDP grows at its potential rate). The applicable reference rate in 2014 is 0 because of the “severe economic conditions”. In 2013 the applicable reference rate was 0.3, which is different to that in 2014 and 2015 because it is revised every three years. The commission allows one-year and two-year average deviations of a maximum of 0.5 pp of GDP in terms of their impact on the structural balance. In 2015 the deviation in terms of its effect on the structural balance is forecast to be of 0.7 pp. of GDP, which is a deviation larger than the allowed 0.5 pp.

Debt Criterion: Countries which have recently left the EDP are subject to a 3-year transition period aimed at ensuring that the debt level is being reduced at an acceptable pace. Italy is in such a transition period, since it left the EDP in 2013. It is thus subject to required medium-term linear structural adjustments (MLSAs) aimed at ensuring that it will comply with the debt criterion. These MLSAs are formulated in terms of adjustments to the structural balance. Since Italy is in the preventive arm and therefore also subject to required adjustments towards the MTO, the largest one is applicable. The 2.5 pp. MLSA in 2015 (larger than the 0.5 pp. required change under the preventive arm) is at serious risk of not being met according to Commission forecasts. This violation of the debt criterion could lead to a reopening of the Excessive Deficit Procedure.

Commission’s view: In its opinion on Italy’s Draft Budget Plan released at the end of November 2014, the Commission points to risks of non-compliance with the requirements of the SGP, and “invites the authorities to take the necessary measures […] to ensure that the 2015 budget will be compliant with the Stability and Growth Pact”. It then says that “The Commission is also of the opinion that Italy has made some progress with regard to the structural part of the fiscal recommendations issued by the Council in the context of the 2014 European Semester and invites the authorities to make further progress. In this context, policies fostering growth prospects, keeping current primary expenditure under strict control while increasing the overall efficiency of public spending, as well as the planned privatisations, would contribute to bring the debt-to-GDP ratio on a declining path consistent with the debt rule over the coming years.”

France

Once a country has been identified as having an excessive deficit, which was the case for France in 2009, it is turned over to the corrective arm, the EDP, the purpose of which is to correct such a deficit.

Headline budget deficit criterion: Once a country has been identified as having an excessive deficit, which was the case for France in 2009, it is turned over to the corrective arm, the EDP, the purpose of which is to correct such a deficit. France has now been under the EDP for 5 consecutive years, and is subject to requirements set out in the latest Council recommendation to end the excessive deficit situation (June 2013). The recommendation released in 2009 originally planned a correction of the deficit (below 3 percent) by 2012, which was then postponed to 2013 in view of the actions taken and the “unexpected adverse economic events with major unfavourable consequences for government finances”. In June 2013, the Council again postponed the correction of the deficit to 2015 for the same reasons: France fell slightly short of the required 1 percent average annual fiscal effort for the period 2010-2013 (the actual average annual fiscal effort was 0.9 percent), but this was again against a backdrop of “unexpected adverse economic events”.

Source: Commission Staff Working Document: Analysis of the draft budgetary plan of France (November 28, 2014), Council recommendation to end the excessive deficit situation (June 2013), European Commission Autumn Forecast (November 2014)

Note: ΔSB denotes the percentage point change in the structural balance

Table 2: France’s compliance with the corrective arm

The latest Council recommendation (June 2013) sets out a path for France’s headline government balance, which you can see in Table 2. By 2015, the headline balance should be reduced to -2.8 percent of GDP. The forecast headline balance of -4.5 percent falls significantly short of this requirement.

Structural balance criteria: Additionally the adjusted change in the structural balance from 2014 to 2015 is forecast to be of 0.0 pp., and its cumulative change from 2012 to 2015 is forecast to be 1.6 pp., falling short of the requirements of 0.8 pp. and 2.9 pp. respectively (1). The structural budget also deviates from the requirements for 2014.

Commission’s view: Thus France is “at a risk of non-compliance” with the SGP, and, contrary to Italy, the Commission “is also of the opinion that France has made limited progress with regard to the structural part of the fiscal recommendations issued by the Council […] and thus invites the authorities to accelerate implementation”. In his letter to the President of the European Commission, France reiterated its determination to go ahead with reforms, most notably in the labour market. It remains to be seen whether progress by March 2015 will be assessed to be sufficient by the Commission.

Table 3: France and Italy: main macroeconomic indicators in 2014 and 2015

Source: European Commission Autumn Forecast (November 2014), AMECO database (November 2014)

(*): year-on-year percentage changes

(**): as a percentage of potential GDP

Sanctions

Non-compliance with the SGP can lead to sanctions. In the preventive arm, a Council recommendation which is not respected can lead to an interest-bearing deposit of 0.2 percent of GDP. A euro-area country in the corrective arm of the SGP may be required to make a non-interest bearing deposit until the deficit has been corrected, after which it can also be sanctioned with a fine worth up to 0.5 percent of GDP (with a fixed component of 0.2 percent of GDP and a variable component (2)). France and Italy are both at a risk of non-compliance with the requirements of the SGP. Failure to meet the required efforts in terms of fiscal consolidation and structural reforms by March 2015 could bring them closer to possible sanctions, unless the flexibility of the SGP is stretched further. Recent growth and inflationary figures suggest continued weak economic activity, and if economic data of 2014 qualified for “severe economic conditions”, 2015 may qualify too, especially if growth and inflation will disappoint relative to the November 2014 ECFIN forecasts. And in the preventive arm, structural reforms which have a verifiable positive impact on the long-term sustainability of public finances (such as by raising potential growth) could be considered when assessing the adjustment path to the medium-term objective.

Notes:

(1) The adjusted changes in the structural balance correct for the negative impact of the changeover to ESA 2010 as well as for changes in potential growth and revenue windfalls/shortfalls.

(2) This variable component is equal to "a tenth of the absolute value of the difference between the balance as a percentage of GDP in the preceding year and either the reference value for government balance, or, if non-compliance with budgetary discipline includes the debt criterion, the government balance as a percentage of GDP that should have been achieved in the same year according to the notice issued"