Demographic changes and structural deflation

What’s at stake: A view has appeared arguing that the low-inflation environment experienced by advanced economies may be structural, rather than cycli

Motivation and empirical link

Derek Anderson, Dennis Botman, Ben Hunt write that a view appears to have emerged that exiting deflation has become more challenging due to aging. Edward Hugh writes that if deflation is a product of lower potential GDP that comes with lower population growth, all the ongoing attempts to reflate economies may be simply working against history.

In their Population History of England, Wrigley and Schofield (chapter 10) write that when Malthus wrote his Essay on the principle of population he made the tension between population growth and food production (and prices) the central thesis of the work. 'An increase of population without a proportional increase food [...] The food must necessarily be distributed in smaller quantities, and consequently a day's labour will purchase a smaller quantity of provisions. An increase in the price of provisions would arise, either from an increase of population faster than the means of subsistence; or from a different distribution of the money of society.’ The population and price dynamics of the 250 years preceding the appearance of his Essay in 1798 provides suggestive evidence about that link: population doubled while prices more than tripled (suggesting an elasticity of prices to population growth is 1.5).

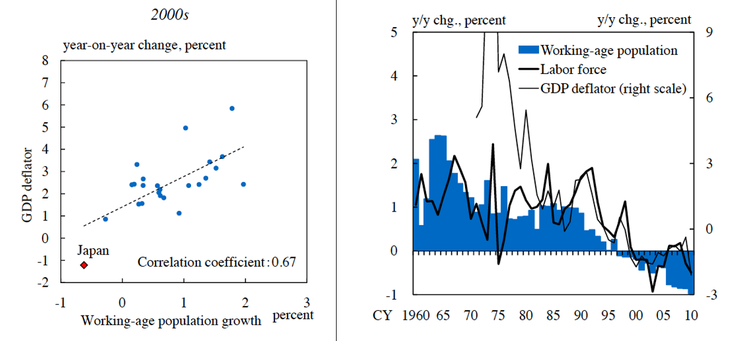

Former Bank of Japan governor Masaaki Shirakawa writes that, seemingly, there should be no linkage between demography and deflation. But it may not be the case. A cross-country comparison among advanced economies reveals intriguing evidence: Over the decade of the 2000s, the population growth rate and inflation correlate positively across 24 advanced economies. That finding shows a sharp contrast with the recently waning correlation between money growth and inflation.

Edward Hugh writes that the correlation may be just an odd coincidence, but it is striking.

Source: BoJ

Mechanisms

The BIS (HT Blog-Illusio) writes that Governor Shirakawa (2011a, 2011b, 2012 and 2013) has argued that population ageing can lead to deflationary pressures by lowering expectations of future economic growth. The resulting loss of demand and investment might not be easily offset by monetary policy, especially if inflation is already low and policy rates are close to the zero lower bound. President Bullard of the St Louis Federal Reserve Bank has suggested a different explanation focusing on the political economy of central banking. Bullard et al (2012) argue that the old might prefer lower inflation than the young due to the redistributive effects of inflation. Thus, to the degree their policies reflect voter preference, central banks might engineer lower inflation when populations age.

Patrick Imam writes that a declining and aging population could put deflationary pressures on the economy through lower aggregate demand, a negative wealth effect from falling asset prices, and changes in relative prices reflecting different consumption preferences. Katagiri (2012) investigated the effects of changes in demand structure caused by population aging on the Japanese economy and found that population aging—modeled as unexpected shocks to its demand structure— caused about 0.3 percentage point deflationary pressure using a multi-sector new Keynesian model.

Derek Anderson, Dennis Botman, Ben Hunt use the IMF’s Global Integrated Fiscal and Monetary Model (GIMF) and find substantial deflationary pressures from aging, mainly from declining growth and falling land prices. Dissaving by the elderly makes matters worse as it leads to real exchange rate appreciation from the repatriation of foreign assets. The deflationary effects from aging are magnified by the large fiscal consolidation need.

Monetary pessimism or aggressiveness

Edward Hugh writes that it’s hard not to draw the conclusion that something structural and more long-term is taking place and that this something is only tangentially related to the recent global financial crisis. One plausible explanation is that Japan’s long-lasting malaise is not simply a debt deflationary hangover from the bursting of a property bubble in 1992, but rather with the rapid population ageing the country has experienced.

Derek Anderson, Dennis Botman, Ben Hunt write that the scant theoretical and empirical work on the potential relationship between these factors – with most research on aging focusing on the effects on growth and fiscal sustainability – may be due to the monetarist doctrine: whether or not aging exerts downward pressure on prices is irrelevant as a central bank committed to do whatever it takes should remain capable of anchoring inflation expectations at the target. ECB Board member Benoit Coeure recently repeated the long-held view that inflation is and remains a monetary phenomenon. And that, as such, doubts about the ability of central banks to deliver on their inflation targets in the medium run are just misplaced.

The BIS writes that, though unconventional, if right, a link between demography and inflation may have significant implications for monetary policy. Christina Romer and David Romer write that such arguments were already made in the 1970s when economists of the Federal Reserve “regard[ed] continuing cost increases as a structural problem not amenable to macroeconomic measures”. These views led monetary policymakers to advocate nonmonetary steps to combat inflation.

Derek Anderson, Dennis Botman, Ben Hunt argue, indeed, that that deflation risk from aging is not inevitable as ambitious structural reforms and an aggressive monetary policy reaction can provide the offset. Calibrating monetary policy appropriately may, however, de difficult. Jong-Won Yoon, Jinill Kim, and Jungjin Lee write that there is little empirical evidence to date on whether, and to what extent, monetary policy changes have different effects on various cohorts and, therefore, on whether monetary policy effectiveness changes in an ageing society.