Should other Eurozone programme countries worry about a reduced Greek primary surplus target?

In this post Zsolt Darvas assesses the possible reaction of other Eurozone programme countries to a reduction in the Greek primary surplus target from

Policymakers in other Eurozone countries that received financial assistance are concerned about giving concessions to Greece. They fear that their domestic audiences will question the fiscal and structural adjustments they implemented under the pressure of the Troika, and that thereby the popularity of anti-austerity parties may increase.

In this post I do not assess what should be the primary surplus target for Greece: this will be the result of a bargaining between Greece and its official lenders and the decision will be ultimately political. While I see a case for a somewhat lowered primary surplus (see my earlier posts on this issue here and here), in my view a proper long-term solution to the Greek problem should include a new ESM loan (with appropriate conditionality and safeguards). However a lowered primary budget surplus target would necessitate a larger ESM loan and the willingness of euro-area partners to agree to that.

In this post I assess the possible reaction of other Eurozone programme countries to a reduction in the Greek primary surplus target from the current 4.5% of GDP to a lower value, say to somewhere in the range of 2-4% of GDP.

I show the following points:

· Even after a reasonable lowering of the Greek primary surplus target,

o the primary surplus will be still higher in Greece than in other Eurozone programme countries;

o total fiscal adjustment in 2009-15 will continue to be much larger in Greece than in other Eurozone programme countries;

· Other Eurozone programme countries also underperformed relative to their programme targets and therefore Greece is not an exception in this regard.

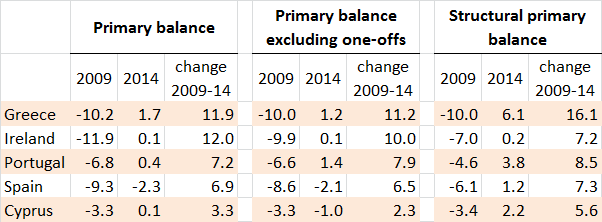

Table 1 shows that from 2009-2014, the change in the headline primary balance (as % of GDP) was about the same in Greece and Ireland and much lower in Portugal, Spain and Cyprus. Yet the headline primary balance is not a good indicator for measuring fiscal effort, because it is impacted by one-off measures, like bank recapitalisation costs and one-off revenues (privatisation and the exceptional Eurosystem profit transfer to Greece may also be recorded among one-offs). It is also affected by the economic cycle (in a recession tax revenues fall and unemployment benefit payments increase). Excluding one-off measures (the middle data panel of the table) and both one-off measures and the impacts of the economic cycle (i.e. the structural balance, the right data panel of the table), Greece has clearly implemented the largest fiscal adjustment among Eurozone programme countries.

For 2014, I use the European Commission’s February 2015 estimate, which may be imprecise, especially since more recent data suggests that fiscal revenues fell towards the end of the 2014. Yet even if the Commission’s estimate overstates the primary surplus in 2014, my main conclusions remain valid as Greece has undergone so much more fiscal adjustment than other Eurozone programme countries.

Source: Winter 2015 forecast of the European Commission. The structural primary balance is available only from 2010 onwards in this forecast. For 2009, we used the Spring 2014 forecast adjusted by the average difference in 2010-11 between the estimates of the Winter 2015 and Spring 2014 forecasts.

Table 1: Primary budget balance of the general government (% GDP)

In terms of the structural primary balance, in 2009-14 fiscal adjustment in Greece was about twice as large as in Ireland, Portugal and Spain and three times as large as in Cyprus. Nicolas Carnot and Francisco de Castro developed a more suitable measure of fiscal adjustment that they call “discretionary fiscal effort”, which suggests the same picture.

Certainly, Greece had more public debt and a larger structural deficit in 2009 than the other four countries, so it had to adjust more. But if the primary balance target of Greece is reduced somewhat, total fiscal adjustment will still remain much larger in Greece than in other Eurozone programme countries and its new target primary surpluses in 2015 and later years will also likely remain larger than in other programme countries, where the primary balance is expected to be in the range from -1.3% (Spain) to 1.6% (Portugal); see the Annex.

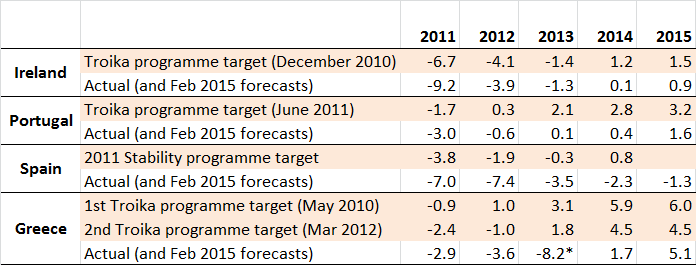

Finally, Table 2 demonstrates that other programme countries also underperformed relative to their programme targets in terms of their primary budget balances, so Greece is not an exception in this regard. Portugal and Spain consistently underperformed relative to the programme requirements in 2011-2015 (Troika programme for Portugal, national stability programme for Spain), while Ireland was on track only in 2012-13 but underperformed in 2011 and 2014-15.

Sources: Programme targets: Table 2 on page 27 of IMF (2011): 'Portugal: Request for a Three-Year Arrangement Under the Extended Fund Facility' ( http://www.imf.org/external/pubs/cat/longres.aspx?sk=24908.0), Table 3 on page 36 of IMF (2010) 'Ireland: Request for an Extended Arrangement' (http://www.imf.org/external/pubs/cat/longres.aspx?sk=24510.0) and Table 5.1 on page 22 of Spain (2011) 'Stability Programme, Spain, 2011-2014 (http://ec.europa.eu/europe2020/pdf/nrp/sp_spain_en.pdf). The actual values are from the Winter 2015 forecast of the European Commission.

Table 2: Ireland, Portugal and Spain: primary balance targets and actual outcomes (% GDP)

Therefore, if Greece’s primary surplus target were lowered somewhat, I would suggest that policymakers in other Eurozone programme countries justify this to their electorates by explaining that fiscal adjustment and the level of primary surplus would remain higher in Greece. They should also admit that they missed their own fiscal targets. Furthermore, Greece is clearly a special case: form peak to trough, Greek GDP collapsed by 26%, while the fall in output was much smaller in the other countries: 9% in Ireland, 7% in Portugal and Spain and 10% in Cyprus.

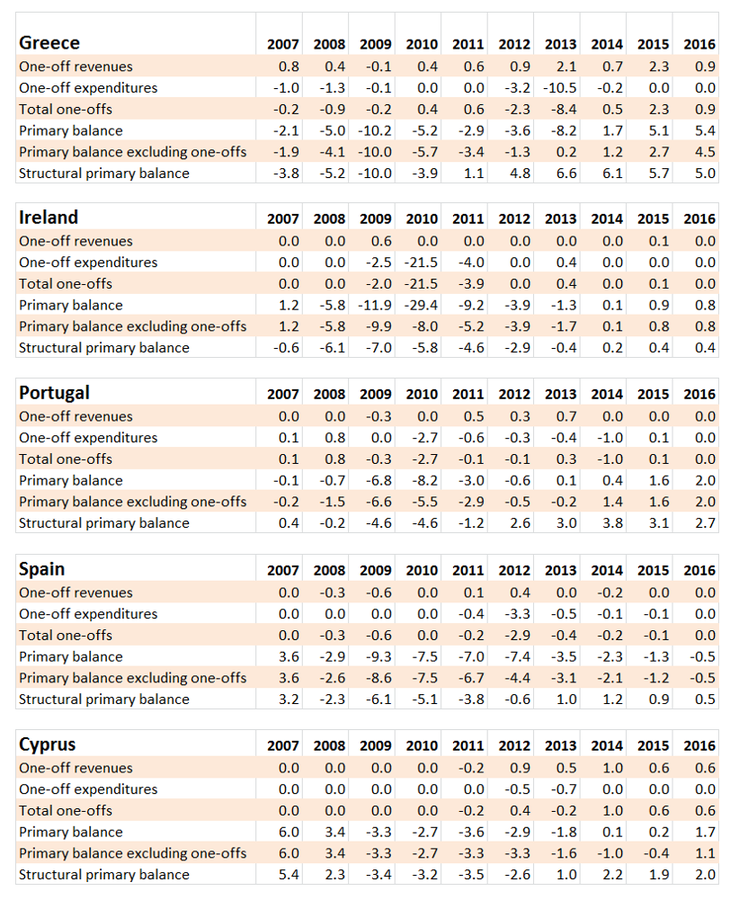

Annex: Annual fiscal data (% of GDP)

The following tables include annual data from the European Commission’s February 2015 forecast. The structural primary balance is available only from 2010 onwards in this forecast. For 2007-09, we use the May 2014 forecast adjusted by the average difference in 2010-11 between the estimates of the February 2015 and the May 2014 forecasts.

Related Blog Articles