The aging dollar peg: time for the PBC to bid it farewell

The Chinese renminbi (RMB) depreciated 2.5 percent against the US dollar in 2014. This was the first depreciation since 2005, when Beijing timidly sta

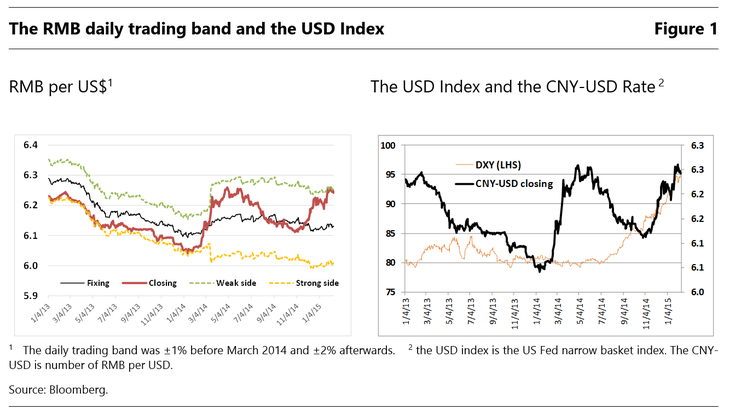

The Chinese renminbi (RMB) depreciated 2.5 percent against the US dollar in 2014. This was the first depreciation since 2005, when Beijing timidly started loosening its tight dollar peg. Recently, the RMB has repeatedly tested the weak side of its daily trading band, despite attempts by the People’s Bank of China (PBC) to signal its preference for a steadier bilateral RMB-USD rate via its daily fixing (Figure 1, left panel). What has led to the changing fortunes of the RMB? What lies ahead for the currency in 2015?

I can think of several possible factors leading to the most recent bout of weakness in the bilateral RMB-USD exchange rate.

The most obvious culprit is the broad strength of the US dollar (Figure 1, right panel). For instance, since start-2014, the euro and yen have weakened by 15 percent against the dollar, respectively. Consequently, the Chinese ‘redback’ has also weakened slightly against the almighty American ‘greenback’, though the RMB is still outperforming most other major and emerging market currencies. According to BIS statistics, the RMB gained some 7 percent in effective terms in 2014 and has remained one of the few strong currencies globally.

The second and related factor is the monetary policy divergence between China and the US. Whereas the US Fed is expected to start raising its policy rate and has already stopped further unconventional (net) bond buying, the PBC has embarked on a cycle of monetary easing. Hence the anticipated interest rate differential between the two currencies is narrowing.

There are now questions about whether the RMB is already fairly valued or even somewhat overvalued.

The third factor concerns the underlying currency valuation. Over the past decade, the RMB has gained 50 percent on a broad real effective basis, a strength few major advanced or emerging market currencies can match. Even allowing for fast Chinese productivity growth, there are now questions about whether the RMB is already fairly valued or even somewhat overvalued. Simply put, the once broad-based market consensus of an undervalued RMB is gone, after its massive cumulative appreciation.

Fourth, more market participants are becoming worried about signs of increased stress in the Chinese financial system. As the exchange rate is one of the most important financial asset prices, how can one expect an ever-stronger RMB on top of a more fragile Chinese financial sector? It makes little sense to dread Chinese shadow banking and to preach meaningful RMB appreciation at the same time.

Finally, the PBC appears to have taken a more hands-off approach towards managing the RMB. Since early 2014, it has intervened less in the FX market and widened the daily trading band. But it has also occasionally stepped in to restore market functioning, disrupting carry trade and successfully injecting some 2-way volatility. A growing offshore RMB market in Hong Kong also adds to its interactions with the onshore RMB market, with risk sentiment possibly playing a bigger role in RMB exchange rate dynamics. We estimate the offshore RMB turnover to have more than doubled in the past two years.

The PBC appears to have taken a more hands-off approach towards managing the RMB.

Hence a mighty US dollar, monetary policy divergence, currency valuation concerns, and less PBC intervention all combine to sway currency expectations, raise volatility and narrow interest rate differentials. Thus the implied Sharpe ratio declines, prompting an increase in Chinese corporate hedging of dollar liabilities, with rising dollar deposits and a more rapid extinguishing of Chinese corporate dollar debts, estimated at more than US$1trillion in 2014. Added to Chinese demand for US dollars have been the growing overseas acquisitions by Chinese companies.

In balance-of-payments terms, the fourth quarter of 2014 saw the largest Chinese capital outflow in 16 years, and official foreign exchange reserves have fallen steadily since mid-2014, though this is in part due to valuation effects. In short, demand for US dollars by Chinese residents has risen, weakening the RMB-USD exchange rate.

What will happen next? It depends a lot on how the PBC will respond to Chinese corporate dollar buying. I envision three possibilities.

First, the PBC could cling more tightly to the dollar peg in ‘stormy weather’, just like it did in the 2008 Global Financial Crisis and the 1998 Asian Financial Crisis. The result will be a heavy deflationary blow to the Chinese economy in an environment of persistent dollar strength, a PBC put on the RMB firmly instilled into market expectations and some brief sense of stability. In this case, the looser dollar peg could tighten again.

Second, the PBC could take a ‘laissez faire’ approach, completely stepping back from the currency market to let it clear itself, perhaps in a wider trading band. This would result in sharp volatility and even some corporate stress unless capital controls were tightened considerably. In this case, the loose dollar peg could vanish fast.

A third and more likely scenario would be for the PBC to let the RMB move more freely against the dollar but prepare to lean against the wind by selling dollars out of its official reserves from time to time while keeping a watchful eye on cross-border capital flows. In this case, the loose dollar peg would start fading gradually.

This last approach makes sense for a number of reasons. In the short term, it would help deliver a warranted Chinese monetary easing by helping stabilise the effective exchange rate and an orderly unwinding of the Chinese corporate carry trade. In the longer term, it would help enhance two-way currency flexibility ahead of fuller interest rate deregulation and greater capital account liberalisation.

The 20-year old but increasingly loose dollar peg has served the Chinese economy well as a simple nominal anchor, but its time is up.

This 20-year old but increasingly loose dollar peg has served the Chinese economy well as a simple nominal anchor, but its time is up. First, as the biggest trading nation and second largest economy on earth, China is simply too big to be anchored to any single currency, even in a loose fashion. Second, a much more flexible RMB is needed before full interest rate liberalisation and substantial capital opening. Third, a dollar peg has often amplified external shocks to the Chinese economy rather than absorbing them, in part because of the dollar’s safe haven role. Finally, the US no longer welcomes a renewed Chinese peg to its currency and yet demands nothing but ‘one-direction flexibility’.

It's high time the PBC starts seriously letting the aging dollar peg go.