German wage negotiations

In the beginning of January I wrote about the impact of persistently low inflation on collectively bargained wages in Germany. Concluded negotiations

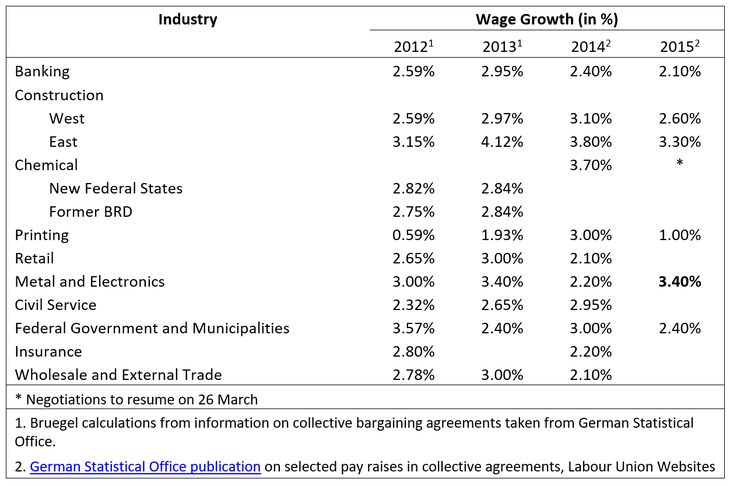

In the beginning of January I wrote about the impact of persistently low inflation on collectively bargained wages in Germany. Concluded negotiations in the banking, construction, printing, and federal state and municipalities sectors at the time pointed to lower wage increases in 2015 than in 2014, as did suggestions from employers’ associations that stagnating productivity and a low inflation environment would factor into the negotiation process.

On 24 February 2015, however, IG Metall, the largest union in Germany that often paves the way for wage agreements in the other sectors, concluded their 2015 bargaining round in Baden-Württemberg with a 3.4% wage increase starting in April and a one-off payment of €150 in March for 800,000 workers. The agreement will last for 12 months, and comes after the union first requested a 5.5% increase. IG Metall then reached a subsequent and similar agreement for 115,000 Volkswagen employees, and secured the Baden-Württemberg agreement for the metal and electrical industry across all regions. As seen in the updated table below, the wage hike represents a sizeable increase over the wage agreement from the previous year, which was 2.2% for a period of 8 months.

In the chemical industry, however, wage negotiations are at a standstill after a third round of bargaining came to a close on 12 March with no agreement reached. IG BCE, the union that represents 550,000 chemical workers, is asking for a 4.8% increase over a contract of 12 months. In the latest round of negotiations, the employers’ association countered with a 1.6% increase to last 15 months. Another round of negotiations is set to commence on 26 March, and it will be interesting to see if the chemical industry can follow the metal industry’s lead in securing a sizable wage hike.

The civil service union is also in the midst of bargaining for a 5.5% wage increase with a third round of negotiations that began yesterday, 16 March. Meanwhile, the Insurance sector, demanding a 5.5% increase as well, begins negotiations on 20 March.

If German collective bargaining agreements can resist the influences of the current low inflation environment (0.1% in February) it would be a boon for a deflation-wary Euro area. Indeed, last July even the Bundesbank backed the idea of wage developments that would support price stability in the Eurozone, noting that Germany has “close to full employment in a number of sectors and regions, and [is] seeing more and more reports of labour shortages. It is therefore only natural, and also to be welcomed that wages and salaries are rising more strongly than in the days when the German economy was in much poorer shape.”

While higher wages may be a hindrance for Germany’s export-oriented sectors, higher wages in Germany could compliment the ECB’s new efforts to increase inflation. It is also important that German wages grow more strongly to address the imbalances plaguing the Euro area and to support ongoing adjustment in Southern Europe.