Is the ECB sacrificing reforms on the altar of inflation?

This blog post explores whether the European Central Bank (ECB)'s large programme of sovereign bonds purchases (QE) could slow down ref

Roughly one month ago, Mario Draghi announced that the European Central Bank (ECB) would activate a large programme of sovereign bonds purchases (QE), in an effort to re-anchor euro area inflation expectations to the 2% target. In the run up to that decision one of the main naysayer arguments was that, by doing so, the ECB was reducing pressure on governments to engage in painful, but necessary, structural reforms (German Council of Economic Experts, 2014). At the time, the argument was dismissed on the grounds that the ECB’s mandate is to control inflation, not foster reform efforts. The question however remains as to whether QE will slow down reform efforts in the coming months and therefore, in boosting short-term demand, risks inadvertently shrinking long-term supply.

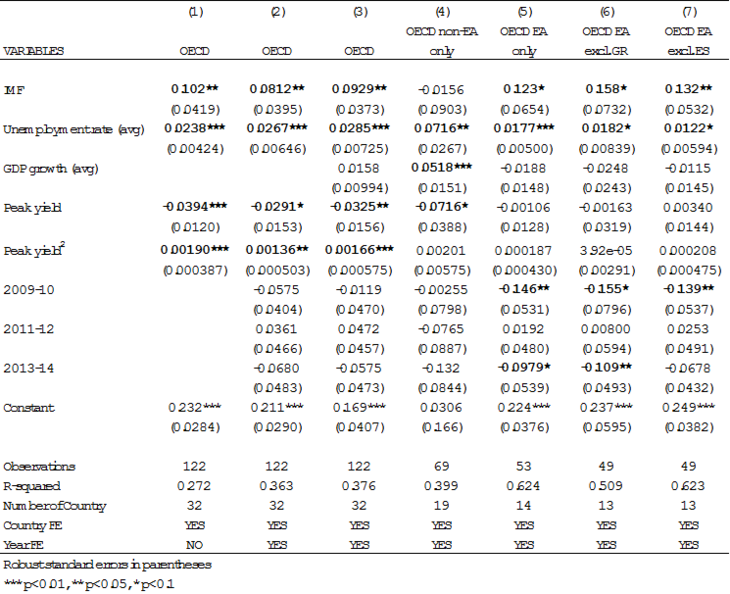

In order to explore the determinants of reform efforts in advanced economies, and in the euro area more specifically, I analysed a highly balanced panel dataset of the OECD’s reform responsiveness rate[1], an indicator of whether wide-ranging reform packages were adopted. The data is available for all 34 OECD members, with biannual frequency, for the time span 2007-2014. The technical results are illustrated in Table 1 (at the bottom).

The main findings can be summarised as follows:

1. Countries under an IMF programme significantly step up structural reform efforts. This should come as no surprise, given the carrot-and-stick structure of IMF lending, involving frequent reviews that need to be approved in order to access the Fund’s payment tranches[2].

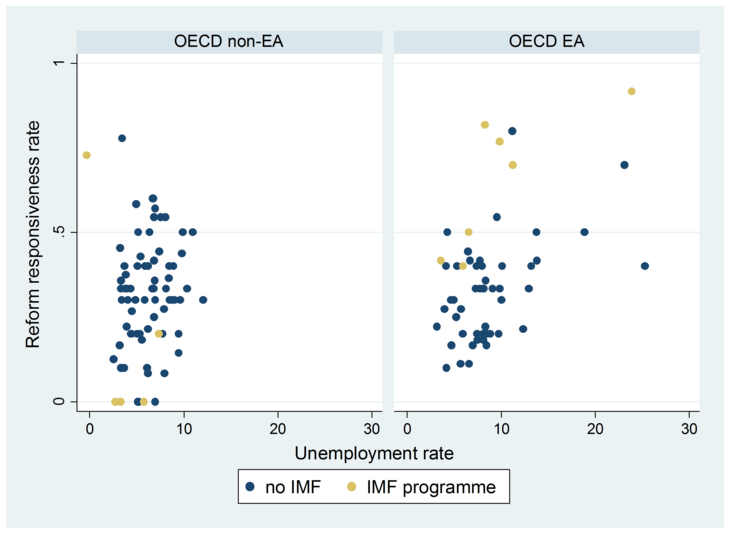

2. Countries with a high unemployment rate tend to implement significantly more reforms. This result is in line with what Williamson (1993) calls the “crisis hypothesis”: the public perception of a crisis is needed to create the conditions under which it is politically possible to undertake extensive policy reforms. As we see in Figure 1 (below), the relationship does not seem to be dictated by the programme countries.

Figure 1. Relationship between reform effort and unemployment rate

Source: OECD, Bruegel calculations

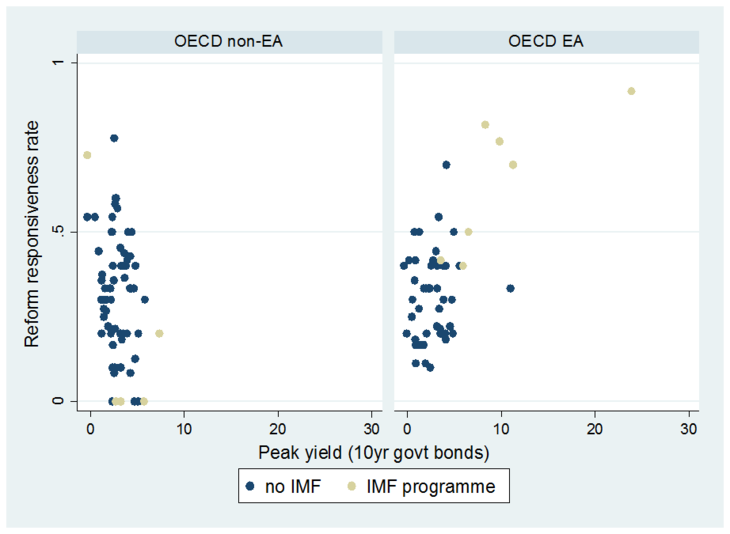

3. Advanced economies tend to implement fewer reforms when under financial market pressure and the relationship becomes insignificant when zooming in on the euro area. In OECD countries, the statistical relationship between financial market pressure - proxied by the 10-year government bond yields - and reforms seems to be at best U-shaped: as financial market pressure mounts, governments are less likely to implement reforms[3]. However, above a certain threshold, this effect might be reversed. Evidence for this non-linear relationship does not seem to be highly compelling, judging from a joint reading on the two panels in Figure 2 (below). When looking at euro area countries only, any effect of financial market stress on reforms disappears. As can be seen in Figure 2 (rhs), although there seems to be a positive correlation between financial market stress and reform efforts in the euro area, this is driven by IMF programme countries, which in any case have typically lost financial market access.

Figure 2. Relationship between reform effort and market stress

Source: OECD, Bruegel calculations

Although it is true that this analysis lends itself to clear methodological challenges, some concerns can be immediately addressed.

First, the results do not seem to be dictated by extreme outliers. Models 6 and 7 in Table 1 (below) show how financial market stress continues to be a non-significant determinant of reform efforts in the euro area even when Greece is excluded (as a country which underwent an economic collapse), or when Spain is excluded (as the other country where unemployment soared to unprecedented levels). High unemployment rates continue to be significantly associated with reform drive.

Second, and possibly more concerning, is the potential for reverse causality. The claim here would be that what the analysis above is capturing is not that high unemployment rates lead the electorate to push governments to reform, but rather that reforms have short-term negative effects on the economy and therefore lead to temporarily higher unemployment.

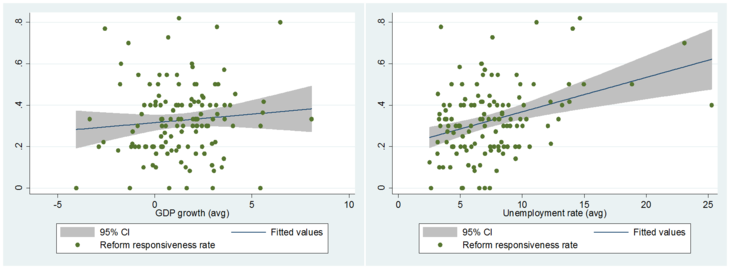

Although reverse causality cannot be directly tackled in this setting, I attempt to take this problem into account by controlling for GDP growth. If a problem of reverse causality was at play, then the relationship between reform implementation and GDP growth should be negative. However, Table 2 shows how in all specifications the coefficient of GDP growth remains insignificant.

Actually, when looking at non euro area countries only (model 4), the relationship is positive and significant. This is illustrated further in Figure 3 and 4 (below), which shows how GDP growth (lhs) displays no clear relationship with reform implementation, whereas unemployment (rhs) does.

Figure 3 and 4. Relationship between reform effort and GDP growth (lhs) and unemployment rate (rhs)

Source: OECD, Bruegel calculations

Note: Greece excluded as an extreme outlier. Results however are only reinforced by its inclusion.

Two main conclusions can be drawn from this short analysis. First, the crisis mechanism put in place by the euro area, composed of the ESM + OMT, seems to be well equipped to step up reform efforts and hence boost competitiveness in crisis countries. However, as seen lately in Greece, programmes risk producing popular backlashes and can therefore not be seen as the sustainable way to foster competitiveness in the euro area on a long-term basis. As such, alternative mechanisms of euro area economic governance should be devised, as argued recently, inter alia, by Sapir and Wolff (2015).

Second, the ECB’s bond buying programme seems unlikely to lead to a disproportionate setback in reform efforts in stressed countries. In particular, economies affected by large unemployment rates are expected to continue facing pressure from the electorates to enact reforms and should do so benefiting of the temporary boost in aggregate demand offered by a weaker euro and lower oil prices (as I have argued here).

Fostering structural reforms is not only outside the ECB’s mandate, but apparently also outside its direct influence. It is for euro area governments, and EU institutions, to ensure that reforms continue progressing in the months to come, laying the foundations of sustainable long-term growth.

Table 1. Panel regression results

Source: OECD, Bruegel calculations

Technical Notes

IMF is a dummy variable taking value 1 when an IMF programme is in place, 0 otherwise.

Source: IMF

Unemployment rate (avg) is the average monthly unemployment rate over each two-year period.

Source: OECD

GDP growth (avg) is the average yearly growth in real GDP for each country over each two-year period.

Source: OECD

Peak yield is the maximum value of the quarterly 10-year government bond yield experienced by each country over each two-year period. All regressions allow for the possibility of a non-linear relationship between the yields and reform efforts (hence the inclusion of peak yield-squared). Main results are confirmed when allowing only for a linear fit.

Source: OECD

All regressions are run using country fixed effects, to control for time-invariant country-specific characteristics like political systems, cultural characteristics, etc.

All regressions (but Model 1) include time fixed effects to control for uniform shocks affecting all countries in a given year. Results seem however to be all but weakened by their exclusion.

All specifications adopt clustered standard errors at country level, hence allowing for heteroskedasticity.

[1] The reform responsiveness rate indicator is based on a scoring system in which recommendations set in the previous year’s issue of Going for Growth take a value of one if “significant” action is taken and zero if not. An action is considered as “significant” if the associated reform addresses the underlying policy recommendation and if it is actually legislated: announced reforms are not taken into account (OECD, 2015).

[2] This result is confirmed in all specifications, except model 4 (OECD non-EA only). However, there are reasons to suppose this result is driven by the poor reform track record of Iceland, which is the only non-EA OECD country to have undergone an IMF programme over the period 2007-2014.

[3] This result can be rationalised by the fact that, as yields increase, governments are likely to be pushed to consolidate their finances. OECD (2006) finds that budget consolidation appears to retard structural reforms, possibly reflecting the corresponding call on political capital.