Is the economy stationary?

What’s at stake: The question of whether capitalist economies are self-correcting and will eventually revert to mean growth has received renewed inter

Tyler Cowen writes that the most crucial issue is whether economies will return to normal conditions of steady growth, or whether we are witnessing a fundamental transformation, unveiled in bits and pieces. One relatively optimistic view is that observed deficiencies — like slow growth in real wages and the overall economy, persistently low interest rates and low levels of labor participation — are merely temporary. Another commonly heard view is that we made the mistake of letting the last recession linger too long, allowing some of its features to become entrenched.

Unit roots, random walks and stationary series

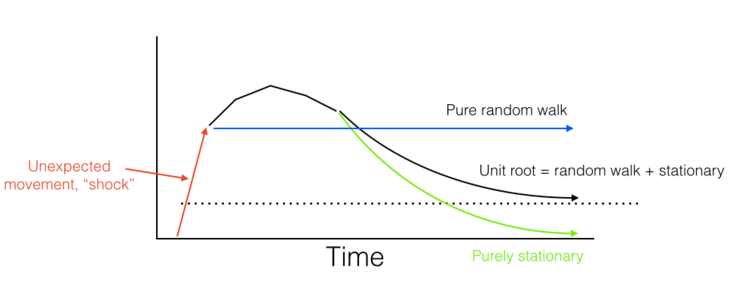

John Cochrane provides a simple illustration of the different concepts. Suppose there is an unexpected movement in a series. How does this "shock" affect our best estimate of where this variable will be in the future? The graph shows three possibilities. First, green or "stationary." There may be some short-lived dynamics. But, given enough time, the variable will return to where we thought it was going all along. Second, blue or "pure random walk." If the price goes up unexpectedly, your expectation of where the (log) price will be in the future goes up one-for-one, for all time. Third, black, "unit root." This option recognizes the possibility that a shock may give rise to transitory dynamics, and may come back towards, but not all the way towards your previous estimate. As you can see the "unit root" is the same as a combination of a stationary component and a bit of a random walk.

Source: John Cochrane

John Cochrane writes that the pure question whether the series will come back in an infinite time period is not really knowable. It could be that the series will come back eventually, but take a very long time. It could be stationary plus a second very slow moving stationary component. This is a statistical problem but not really an economic problem. The appearance of unit roots are economically interesting as they show a lot of "low frequency" movement, series that are coming back slowly - even if they do come back eventually.

History of an idea: high unemployment as a persistent equilibrium

Roger Farmer writes that classical economists from David Hume, through to Adam Smith, David Ricardo and John Maynard Keynes’ contemporary, Arthur Pigou, viewed the economy as a self-regulating mechanism. In the third edition of his undergraduate textbook, Samuelson replaced Keynes’ notion, of high unemployment as an equilibrium, with a new idea: the neoclassical synthesis. According to that idea, the Keynesian high unemployment equilibrium is only temporary. It applies in the short run, when prices and wages are sticky, but in the long run, when all wages and prices have had time to adjust, the economy reverts to a classical equilibrium with full employment.

Roger Farmer writes that Keynesians and monetarists adopted the Phillips curve as the missing equation that explains the transition from the short run to the long run. If the neoclassical synthesis is correct then the economy will always return to full employment as wages and prices adjust to clear markets. Unemployment cannot differ permanently from its natural rate and Keynes’ original vision of high unemployment, as a persistent steady state, must be fatally flawed.

The data: stationary or not?

Arnold Kling writes that if you think of the economy as ultimately self-correcting, then what it corrects to is potential GDP. If the economy is not self-correcting, then the concept of potential GDP can have no objective basis.

Roger Farmer writes that there is no evidence the economy is self-correcting. If, as Robert Gordon believes, it is caused by random technology shifts then there is not much that monetary policy or macro prudential policies can do about it. If, however, it is caused by random movements from one inefficient equilibrium to another, we should be thinking very hard about how to design a monetary/macro-prudential policy that keeps the economic train on the tracks.

John Cochrane writes that the "unit root" is most plausible and verified in the data for log GDP. Recessions and expansions have a lot of transitory component that will come back. But there are permanent movements too. Unemployment, being a ratio, strikes me as one that eventually must come back. But it can take a longer time than we usually think, which is interesting.

Paul Krugman writes that clearly, models with rational expectations, markets continuously in equilibrium, and unique equilibria don’t cut it. But which pieces of such models would you want to modify or replace? Farmer wants to preserve rational expectations and continuous equilibrium, while introducing multiple equilibria. That strikes me as a bizarre choice. Why not appeal to behavioral economics, behavioral finance in particular, to make sense of bubbles? Why not appeal to the clear evidence of price and wage stickiness — perhaps grounded in bounded rationality — to make sense of market disequilibrium?