Still vulnerable: the euro area’s small and medium-sized banks

In our recent research we show that the small and medium-sized banks (SMBs) – and among them the unlisted banks – remain under considerable stress.

This op-ed was originally published on VOXEU.

The European Central Bank’s 26 October 2014 publication of the results of a comprehensive assessment of 130 banks under its oversight (ECB, 2014) identified problems in terms of non-performing assets and capital shortfalls. Nevertheless, the outcome brought a sense of relief to financial markets. Unlike stress tests conducted in July and December 2011 by the European Banking Authority, the ECB’s assessment was considered broadly credible.

The assessment showed that the largest banks appear to be out of the woods. However, in our recent research we show that the small and medium-sized banks (SMBs) – and among them the unlisted banks – remain under considerable stress (Mody and Wolff, 2015). The ECB data covers 130 banks in 19 countries, which can be divided into three size categories: small (assets below €100bn), medium (assets between €100bn and €500 billion) and large (assets more than €500 billion). Of the €22 trillion in assets in total, the ‘small’ group has 84 banks with €3.1 trillion, the ‘medium’ group has 33 banks with €6.3 trillion, and the ‘large’ group has only 13 banks with aggregate assets of €12.5 trillion. Thus, ‘small’ banks have about 14% and ‘medium’ banks have 29% of total bank assets in the euro area.

SMBs thus control a sizeable share of the euro area’s bank assets. They have also received substantial bail-outs. During recent periods of market pressure, SMBs have become closely interconnected in the market’s perception, thereby posing a broader systemic risk. Though there is no cause to believe that the vulnerabilities of SMBs will lead to widespread banking distress, their weakness could delay the recovery.

To measure the vulnerability of individual banks, we conducted a simple ‘stress test’ which asks the following question: if 65% of a bank’s non-performing loans have to be written off, then after accounting for provisions, what would the bank’s equity/assets ratio be? Contrary to the ECB, we look at non risk-weighted equity. If the ratio falls below 3%, we consider the bank to be ‘under stress’. This, we acknowledge, is very crude. It is intended only to assess where the current trouble spots are without claiming to detect all problems.

Stress tests

In December 2013, euro-area banks had non-performing exposures (NPEs) of €879 billion, representing 4% of the total assets of the directly supervised banks. The banks have provisions that cover 42% of these NPEs, but the distribution of NPEs and coverage varies considerably for different countries and banks. Cyprus and Greece are clear outliers but problems are also serious in other countries. For example, Italian non-performing loans are about 11.4% of assets with about half (45%) provided for.

There is also considerable variation for different sizes of bank. Large banks have relatively low NPE ratios and high rates of coverage for the NPEs. Their relatively low equity-asset ratios are thus not a concern. But the small banks have a relatively high average equity-assets ratio (6.4%), and also a very high NPE ratio (9.8%) and a low coverage ratio (39.2%). The mid-sized banks fall in-between for the NPE ratio but have the lowest coverage and equity ratios.

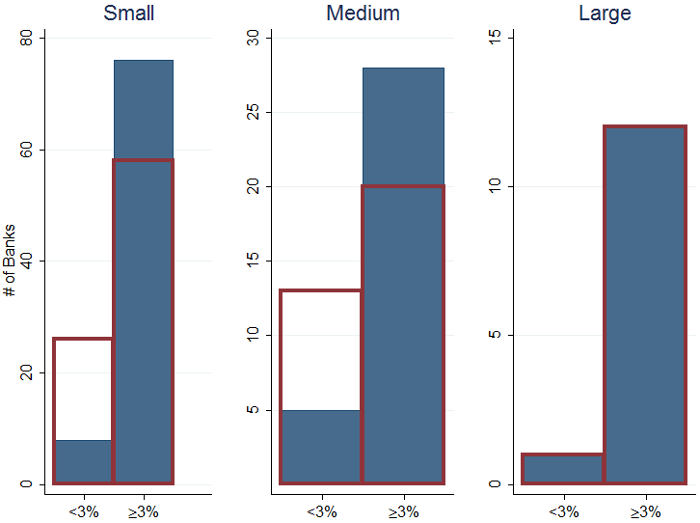

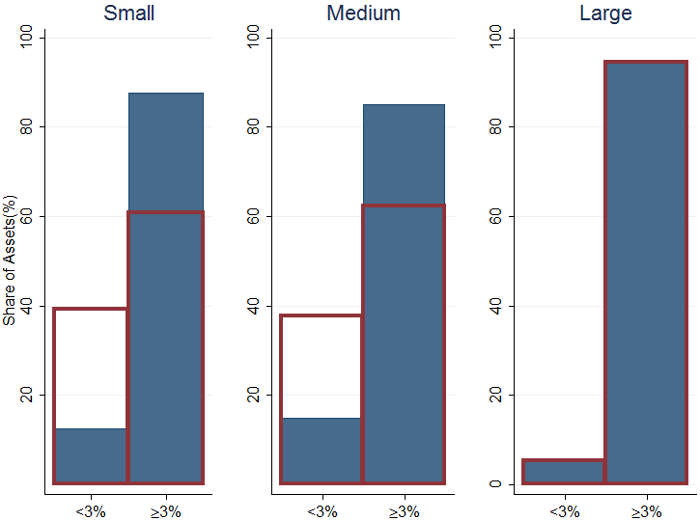

Figures 1a and 1b show the distribution of equity after this stress is applied. As might be expected, despite their relatively low equity ratios, only one of the large banks is placed under stress under our test. Their NPEs are low and coverage is high. However, several small and medium banks fall below the 3% equity/assets threshold. They have high NPEs and low provisions. Hence, even their relatively high equity ratios could prove insufficient in the event of a shock.

Figure 1a: Distribution of banks before and after stress test, number of banks

Figure 1b: Distribution of banks before and after stress test, share of assets, %

Source: Bruegel based on SNL Financial and ECB data. Note: The red histogram shows the distribution after the stress test while the blue before the stress test.

Fewer than one in ten of the small banks currently has an equity ratio below 3%. But after the stress, just over a third of small banks would fall below the 3% equity ratio (Figure 1a). More importantly, the banks that would be stressed are the larger of the small banks, so the share of distressed assets would increase from 12.4% to 39.2% (Figure 1b).

Similarly, the share of medium-sized banks with an equity ratio under 3% would increase from 15.2% to about 40.0%; and the share of stressed assets in this group of banks will increase from about 14.9 to 37.7%.

Applying these ratios to the assets of SMBs, about €1.2 trillion (about 39%) of small bank assets and €2.4 trillion (about 38%) of medium bank assets could come under stress. Together, the questionable assets amount to 38.2% of small and medium banks’ assets and 16.4% of banking system assets. Some countries would be particularly affected. Alongside Cyprus and Greece, Portugal, Finland and Ireland would have about half or more of their assets under stress. Italy and Spain show lower shares of assets under stress mainly because they have large banks that are safe under these metrics. However, their share of small and medium banks’ assets under stress would also be sizeable, 47 and 52% respectively for Italy and Spain.

Stock price movements of ‘stressed’ and ‘non-stressed’ banks

To corroborate our findings, we examined the stock market performance of the banks in the different groups, though several banks are unlisted. Among SMBs, unlisted banks hold about 68% of total assets. Unlisted banks (in both the small and medium categories) have lower NPE ratios than the listed banks; but they also have lower equity ratios and, for medium-sized banks, they also have lower coverage ratios. For this reason, much of the increase in stress will be in unlisted banks.

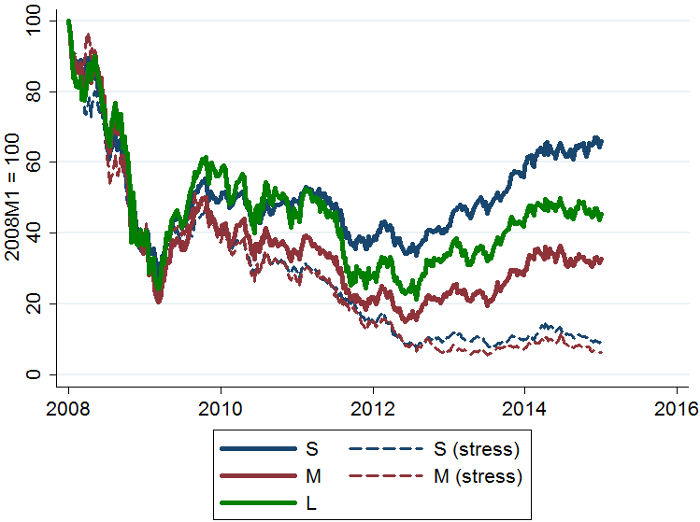

Figure 2: Evolution of banks’ stock market pricesAll types of banks have substantially lower stock prices than in the first quarter of 2008. However, the stock prices of unstressed banks, especially the small and the large banks, bottomed-out around mid-2012. In contrast, the banks identified as ‘stressed’ by our simple test have experienced much larger falls in stock prices (down to about one-tenth of the prices at the start of the crisis), and their stock prices have continued to fall even while the healthier banks regained some ground (Figure 2).

Figure 2: Evolution of banks’ stock market prices

Source: Bruegel using data from Thomson Reuters Datastream. Note: Number of listed banks: 45 (23 Small, 12 Medium, 10 Large).

Altogether, the evidence suggests that the most serious vulnerabilities lie in the medium-sized banks. They have experienced a decline in deposits while large banks have reduced their debt and derivatives, and small banks have reduced their debt. On the asset side, the stressed medium-sized banks reduced their net loans much more significantly than other banks, suggesting they have had to adapt their businesses substantially to deal with the pressures they face. This is not to suggest that large banks cannot pose risks. But crisis management has allowed them to emerge from the deep shock the euro area experienced in a healthier way.

Resolution without delay

In the European policy context, these findings are important for three reasons. First, the SMBs serve domestic markets and their continued stress impedes the flow of credit and limits the potential for economic recovery. The weakness of these banks is one reason why bank lending in Europe remains weak. Second, to the extent that these banks are unable to lend because of lack of demand, they might be subject to a deflationary (or low inflation environment) risk: lenders might struggle to repay their loans. In combination, banks and the corporate sector could (continue) to drag each other down.

Third, the geographical distribution of the banking stress is worrying. Countries that have experienced increased unemployment also have many stressed small and medium-sized banks. While their large banks are healthier and can to some extent compensate for that weakness, the slow resolution of bank problems in the small and medium-sized sector can delay the recovery further.

To tackle these issues, the focus should be on how and when to restructure and resolve banks. The ECB’s comprehensive assessment and stress tests focused on capital shortfalls but so far, under the euro area’s Single Supervisory Mechanism, no banks has been forced into recovery and resolution. We believe it is a pressing requirement to aggressively restructure, consolidate and close the weakest banks. Our analysis suggests that 38% of the assets of SMBs (16% of the assets of the entire banking system) very likely deserve to be subjected to this. The aim would be to remove NPEs from balance sheets as much as possible. In some cases, it would involve closing the banks. In other cases, bad assets might have to be separated and then be transferred to a bad bank or traded in markets for distressed assets. In still other cases, asset separation might have to be followed by consolidation and mergers with stronger banks. EU mechanisms to facilitate bank restructuring and resolution, such as the Bank Recovery and Resolution Directive, should be put to use without delay.

References

Mody, Ashoka and Guntram Wolff, 2015, “The Vulnerability of Europe's Small and Medium-Sized Banks,” Bruegel Working Paper 2015/07.