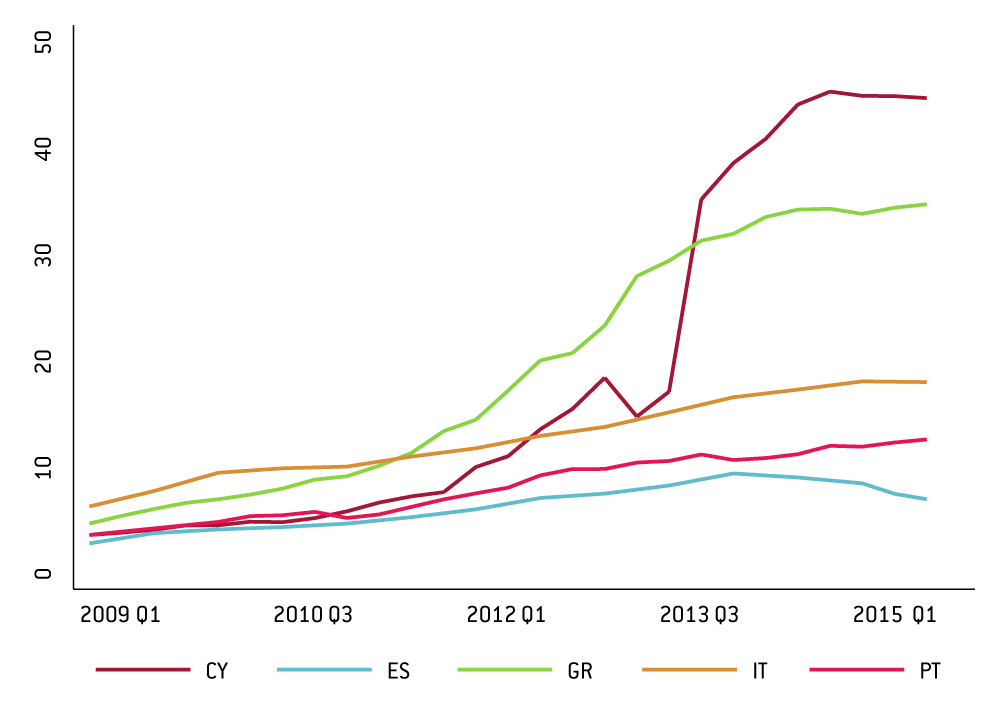

Non-performing loans in Italy and selected European countries

Vulnerabilities in the Italian banking system are causing fears of a banking crisis to surface.

Fears of a banking crisis in Italy are surfacing after four small Italian banks were rescued in November.

The rescue plan involves transferring the banks’ bad loans to a single bad bank. Non-performing loans (NPLs), loans in default or close to being in default, continue to raise doubts about the health of the banking sector in Italy and several other European countries. NPLs are shown to have negative implications for growth (Aiyar et al. 2015).

In Italy, the share of NPLs in total loans has increased from six percent at the end of 2008 to 18 percent now, totalling more than EUR 300 billion.

Although Italy suffers from a higher proportion of NPLs than Spain and Portugal, which have also experienced trouble in their banking sectors, Italy has not experienced a sharp rise in NPLs as occurred in Greece and especially in Cyprus.

Non-performing loans (NPLs) as a percentage of total loans

Source: Financial Soundness Indicators (IMF)

Vulnerabilities in the Italian banking system were exposed in 2014 when nine out of the 15 major Italian banks failed the stress test in the ECB Comprehensive Assessment. Those that fared particularly badly, Banca Monte dei Paschi di Siena and Banca Carige, also have particularly large shares of NPLs: 31 percent (2014Q4) and 28 percent (2015Q3) respectively, according to data from SNL Financial.