A financial side to a macroeconomic story: macro imbalances and financial integration in the euro area

In a recent paper, I looked at the evolution of financial cycles in the euro area and at their link with capital flows. Here, I focus on how those fin

Back in 1980, Feldstein and Horioka (1980) highlighted the existence of an economic “puzzle” for financial integration. Running a cross-country regression of domestic investment rates on domestic savings rates, they found a large, positive coefficient suggesting strong and positive correlation of national savings and investment, resulting in more or less balanced current account positions. They interpreted this as a sign of sizable financial frictions in international capital markets, hindering capital flows and indirectly limiting risk sharing.

In 2002, Blanchard and Giavazzi (2002) documented persistent current account divergences and a significant drop in correlation of national investment and national savings, across euro area countries. The finding was consistent with what theory would predict for countries undergoing a strong process of financial integration, and was welcomed as a sign that capital was finally flowing “downhill”. But the paper ignored the potentially negative effects that flows can eventually have in allowing bubbles to flourish.

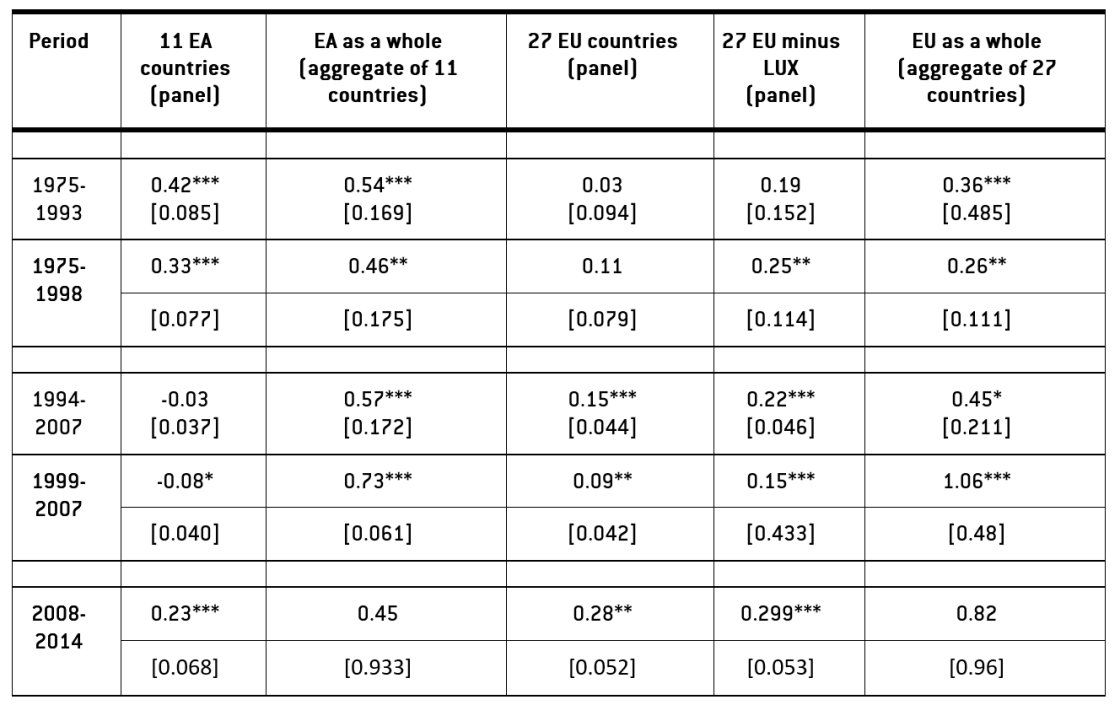

Table 1 updates and extends the analysis in Blanchard and Giavazzi (2002) and yields interesting results. The first column shows the coefficients of a regression of national investment on national savings in percentage of GDP, estimated on a panel of 11 Euro area countries, over sub-periods between 1975 and 2012. As a comparison, the same analysis is also run for a panel comprising all the 27 EU Member States and for the EU as a whole.

Table 1: Correlation of national savings and investments

Source: own calculations using data from AMECO ESA 2010.

Using as an alternative time threshold the entry into force of the Maastricht Treaty (end-1993) rather than the introduction of the euro (1999), the results hold for the euro area and the EU as a whole, as well as for the EU panel. For the EA panel, the result is a negative coefficient over the period 1994-2007, but the coefficient is not significant. This suggests that the signing of the Maastricht Treaty, which established the completion of the EMU as a formal objective, created a significant anticipation effect connected to financial integration and the single currency. The correlation between savings and investment correlation started to decline, but it became negative only from 1999. For the euro area as a whole, considered as a single country, the picture is very different: at the aggregate level, no decoupling of savings and investment is evident from 2000-2008. The break of the link between savings and investment from 1999 -2007 is stronger for the euro area than for the EU.Source: own calculations using data from AMECO ESA 2010.

The regression shows a positive correlation between cross-country savings and investment for euro area members until 1998. The correlation became negative and significant between 1999 and 2007, and it again became positive and significant during the crisis.

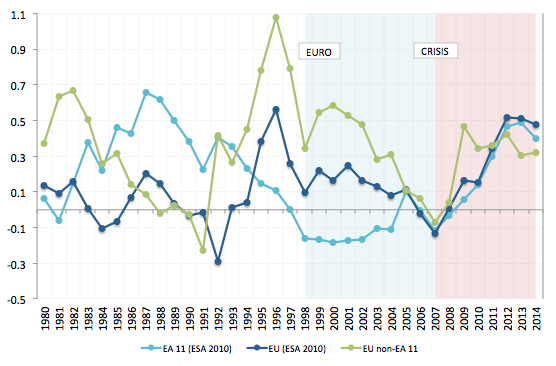

Figure 1 Savings-Investment Correlation in EA and EU, 1980-2014 (Estimated correlation coefficients)

Source: author’s calculation based on data from AMECO.

A negative correlation between savings and investment between 1998 and the crisis was characteristic of euro area countries, as shown in figure 1. This followed a gradual decline in correlation, starting in the early nineties.

The correlation started to increase again in 2008 both in euro-area and non euro-area countries, and returned to positive in 2009. By 2012 it had returned to 1993 levels. This is consistent with the disruption in financial integration that occurred in the euro area since 2008, and with the consequent rapid adjustment of southern countries’ current (and financial) account positions, which reverted from large external deficits back to the positive territory.

The belief that current account imbalances within a monetary union would be harmless was proven wrong by the crisis. The reason for this is twofold. Firstly, models establishing the optimality of a succession of current account deficits implicitly assume that the intertemporal budget constraint is satisfied, so that the accumulation of foreign liabilities is matched by future surpluses.

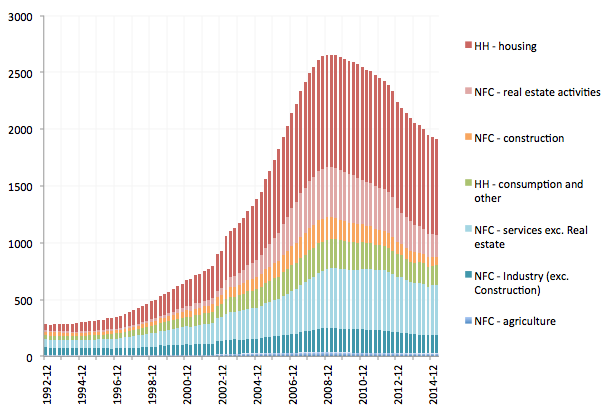

Giavazzi and Spaventa (2010) show that fulfilment of that condition constrains the destination of foreign capital inflows even in a currency union. In the EA, the bulk of this credit ended up into non-tradable construction and real estate, casting doubts on the fulfilment of this intertemporal solvency constraint (figure 3).

Second, the fact that the growth of macroeconomic imbalances was financed mostly via capital flows internal to the monetary union, which could not be limited with explicit capital controls, made the outflows especially easy and fast. This became evident in 2010-2012, when countries in the south of the euro area effectively underwent a balance of payment crisis with capital flights that would have qualified as a fully fledged “sudden stop”, a sudden and disruptive halt in the inflows of foreign capital (as discussed here).

Figure 2 South: Bank credit to private sector by sector and purpose (euro bn)

Source: author’s calculations based on data from National Central Banks

Note: South=ES; GR; IE; PT. Last available data is 2015 Q1.

Current account imbalances - embodying the disconnection of national savings and investment - have been widely discussed since the outbreak of the crisis. The acknowledgement of their importance has led to the EU (belatedly) setting up a dedicated Macroeconomic Imbalance Procedure.

Part of the literature has attributed them to southern countries’ loss of competitiveness. In a recent paper, I argue that in order to understand the real nature of these imbalances it is key to include financial integration into the picture.

Monetary policy unification in 1999 caused interest rates to converge to very low levels; this translated into the divergence of credit cycles across countries, with credit demand booming in the South; the elimination of the exchange rate risks spurred massive intra-euro area capital flows that allowed credit supply in the South to expand beyond the domestic deposit base and meet credit demand.

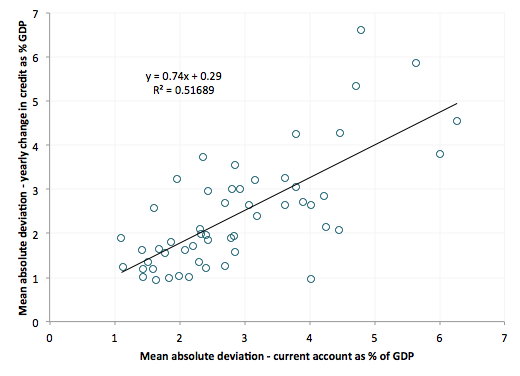

In these countries, the inflow of foreign capital allowed investment to dis-anchor from national savings and expand significantly beyond it. As a result, the current account balance (which represents the difference between national savings and investments) went persistently deeper into negative territory and imbalances grew. There is indeed a strong correlation between pre-crisis dispersion of credit growth and pre-crisis dispersion in current accounts, across euro area countries, as figure 4 shows.

Figure 4 – Dispersion in credit vs. dispersion in current account

According to this narrative, the euro-related interest rate shock triggered divergence in financial cycles across euro area countries, and financial integration (and the capital mobility that came with it) ultimately allowed savings and investment to dis-anchor.

The current account divergence is the macroeconomic counterpart of an underlying financial imbalance, and the loss of competitiveness was the result of the fact that capital inflows ultimately financed an increase in credit mostly to non-tradable sectors.

While the pre-crisis financial cycle divergence can be very much retraced to the interest rate shock that followed the currency unification, which might not be repeated in the future, the euro area will likely remain heterogeneous, and financial and economic cycles may still deviate in different member states.

Monetary policy cannot be country-specific and might even reinforce the build-up of imbalances in some parts of EMU while being too restrictive in others (see here), the rationale for an effective macro-prudential policy is especially strong.

The inclusion of this financial integration side in the macroeconomic imbalance story provides a strong ground in support of the importance of macroprudential policy in the Euro area, but it also highlights the importance of the MIP.

If effectively run, the macroeconomic imbalance procedure could be synergised with preemptive macroprudential policy, as it is supposed to address the underlying macroeconomic roots of financial imbalances.