Oil prices and inflation expectations

The price of crude oil has fallen even further in recent weeks, as have financial market measures of inflation expectations in the euro area, the US a

The link between oil prices and inflation expectations has been established by a number of studies. Alejandro Badel and Joseph McGillicuddy from the Federal reserve Bank of St Luis and Nathan Sussman and Osnat Zohar from the Bank of Israel use an econometric technique to disentangle aggregate demand shocks, oil supply shocks and other oil-specific shocks.

They found that market-based measures of inflation expectations have correlated quite well with oil-related shocks since the onset of the global financial crisis, while the correlation was weaker before.

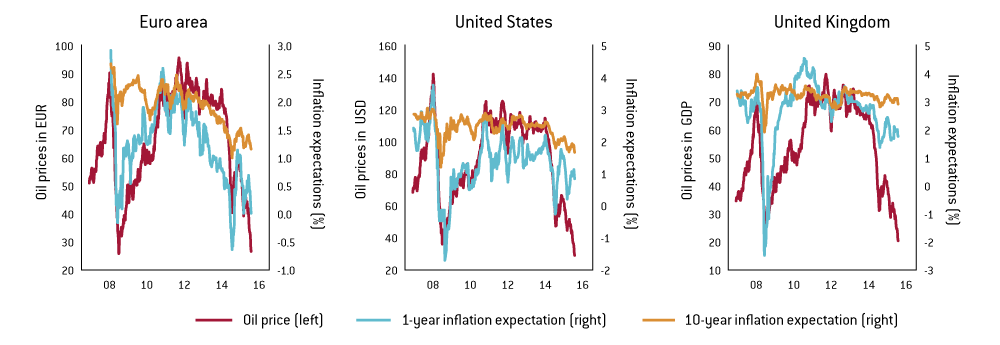

There is indeed a correlation, as shown in Figure 1. This is especially the case when considering short-maturity (for example 1 year) inflation expectations. 10-year maturity inflation expectations also appear to correlate with the oil price, but to a lesser degree.

Figure 1: Oil price and financial market-based inflation expectations (inflation swaps), weekly data, July 2007 – January 2016

Source: Thomson Reuters Datastream. Note: Market based inflation expectations refer to zero-coupon swaps over a time horizon of 1 and 10 years. Weekly average data; for the most recent week the average of 18-20 January 2016 is used.

Oil-related products account for about 10 percent of consumption, and so it is straightforward that they have an impact on short-term inflation expectations. They also have an indirect impact on core inflation (see article).

However the impact on longer term expectations is more puzzling. David Elliott et al from the Bank of England show that even the expected 5-year inflation 5 years from now (5y5y inflation expectation) is influenced by current oil price movements, at least in the euro area and the United States.

Elliott and his co-authors carry out a simple regression for the daily changes in inflation swap rates on constant, contemporaneous and lagged daily percentage changes in spot oil prices, and lagged inflation swap rates (see annex). They studied the impact of oil prices on 3-year and 5y5y expectations. We use their regression model for weekly data to look at:

- the impact of oil prices on expected average inflation for up to 10 years, and

- the duration during which current oil price changes impact expected annual inflation in later years.

A 10 percent increase in oil prices lifts 1-year inflation expectations by 25 basis points and lifts 10-year inflation expectations (expected average inflation in the next 10 years) by about 10 basis points in the United States, as shown in Figure 2.

That is, if oil prices permanently increased by 10 percent (e.g. from 30 dollars/barrel to 33 dollars/barrel), then 1-year inflation expectations would increase by 0.25 percentage points from 0.78 percent to 1.03 percent and the 10-year inflation expectation figure would increase by 0.10 percentage points from 1.62 per cent to 1.72 per cent.

The estimated impact is slightly smaller in the UK than in the US for shorter-term expectations, but practically the same for longer-term expectations. The impact is smaller in the euro area than in the US and UK for all durations, but is still sizeable.

The recent oil price fall is the major determinant of the fall in inflation expectations. For example, the 5-year inflation swap rate for the euro area fell from 1.05 percent in late November 2015 to 0.69 percent on 20 January 2016: according to our regression result, this fall was entirely the result of falling oil prices. With unchanged oil prices from late November, the 5-year inflation swap would have marginally increased from 1.05 in late November to 1.06 on 20 January 2016 according to our regression result.

Now we turn to our second analysis: finding out how long current oil price changes impact expected annual inflation in later years. We note that the 10-year inflation expectation figure can be seen as the average of annual inflation expectations in the next 10 years, that is, the average of the current 1-year inflation expectation (e.g. from January 2016 to January 2017), the annual inflation expected between 1 year and 2 years from now (e.g. from January 2017 to January 2018), the annual inflation expected between 2 years and 3 years from now (e.g. from January 2018 to January 2019), and so on, until the annual inflation expected between 9 years and 10 years from now (e.g. from January 2025 to January 2026).

Using different maturity inflation expectations, we calculate these expected future annual inflation rates. For example, using 1-year and 2-year inflation expectations we calculate expected annual inflation one year from now. After calculating these implied annual inflation rates in future years, we use the model to assess the impact of oil prices on these expected future annual inflation rates.

Figure 3 shows rather persistent effects: we find that current changes in oil prices significantly influence annual inflation expectations up to five years in the euro area and up to six years in the US and UK.

It is puzzling that the oil price has such a persistent effect on expected future inflation. Elliott and his co-authors discuss some factors that may explain this phenomenon beyond changes in inflation expectations, such as changes in the risk premia that investors demand when trading with inflation swaps, changes in investor behaviour and market structure.

Yet it is difficult to envision a mechanism which systematically moves in parallel with the changes in oil prices. For example, it is not very likely that risk premia concerning inflation 5-6 years ahead always fall when current oil price falls, while this risk premia increases when current oil price increases. It may be possible too that a low oil price now increases the likelihood that oil price and inflation will increase in the future, in which case a current low oil price may be associated with a higher risk premia about future inflation.

Another explanation for this puzzle may be that there is a common factor behind current oil price and expected future inflation changes, as Elliott and his co-authors argue. For example weak expected future demand may drive down oil prices now, and simultaneously expectations about future inflation.

In any case, we can draw two key conclusions.

First, since falling oil prices are strongly associated with falling inflation expectations, falling market-based inflation expectations (even at long maturities) cannot be taken as evidence against the effectiveness of the ECB’s quantitate easing.

This is because oil price changes are rather exogenous to ECB’s quantitate easing (we say “rather” and not “fully”, because if QE is able to revive the euro area economy, then it also increases European demand for oil, which may increase oil prices, yet we believe this channel is rather weak compared to the other factors influencing oil prices and even a more aggressive monetary policy would have not been able to prevent the recent falls in oil prices). Therefore, this conclusion is analogous to the conclusion we draw in a blog post last week analysing the impact of oil prices on core inflation.

Second, financial market-based inflation expectations should be assessed cautiously, because they are very sensitive to oil prices even for puzzlingly longer maturities, and can also be influenced by various other factors.

Annex: the regression

David Elliott, Chris Jackson, Marek Raczko and Matt Roberts-Sklar present a simple regression model for the daily changes in inflation swap rates on constant, contemporaneous and lagged daily percentage changes in spot oil prices, and lagged inflation swap rates.

We use the very same model, but we use weekly data for two reasons. First, euro-area data is rather noisy and the use of weekly average data reduces the noise. Second, for daily data we found that additional lags of changes in oil prices are also significant for all three economies and therefore amendments to the model would be justified. But for weekly data we found that the contemporaneous and one lag for the oil price change is sufficient.

Therefore, the regression model we estimate is the following:

,

where

is a market-based measure of inflation expectations (annualised rate in percent),

is the difference operator, i.e.

,

is the weekly percent change in the price of oil measured in local currency,

is the error term and

are parameters to be estimated.

We also looked at whether expectations about future oil prices influence inflation expectations, by using forward rates for Brent oil price (and in the case of the euro area and UK, forward rates for exchange rate against the US dollar to calculate the Brent forward rate in domestic currency). However, the expected change in oil price never worked in our regressions: the estimated parameters were either statistically non-significant, or they were negative, counter-intuitively implying that an expected increase in oil prices leads to a decline in expected inflation.