The oil-price slump: crisis symptom or fuel for growth?

The low oil price will benefit oil importing countries, but is also a symptom of slowing global growth. Georg Zachmann explores the reasons for the oi

The oil price dropped to a new 11 year low at the beginning of the year. Oil price movements are the result of three factors: changes in oil supply; changes in the importance of oil in the economy and changes in the global economic climate.

Oil supply

Oil supply is outstripping expectations, as US shale oil production appears more resilient than previously thought, and countries like Iran are coming back to the market. In addition, OPEC, a cartel of oil exporters, is not managing supply.

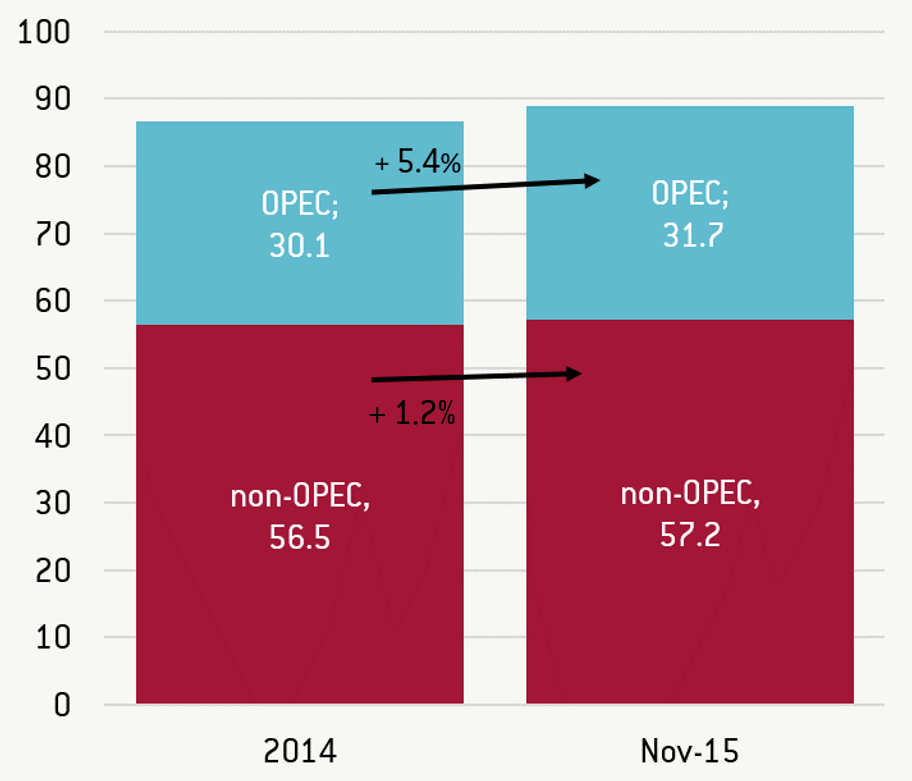

As a result, at the end of 2015 oil production had increased by about 3 percent compared to the 2014 average, from 86 to 88.5 million barrels per day. This increasing supply puts downward pressure on oil prices.

Figure 1: Oil production in million barrels per day 2014 vs. Jan-Nov 2015 in million barrels per day.

Source: OPEC

The importance of oil in the economy

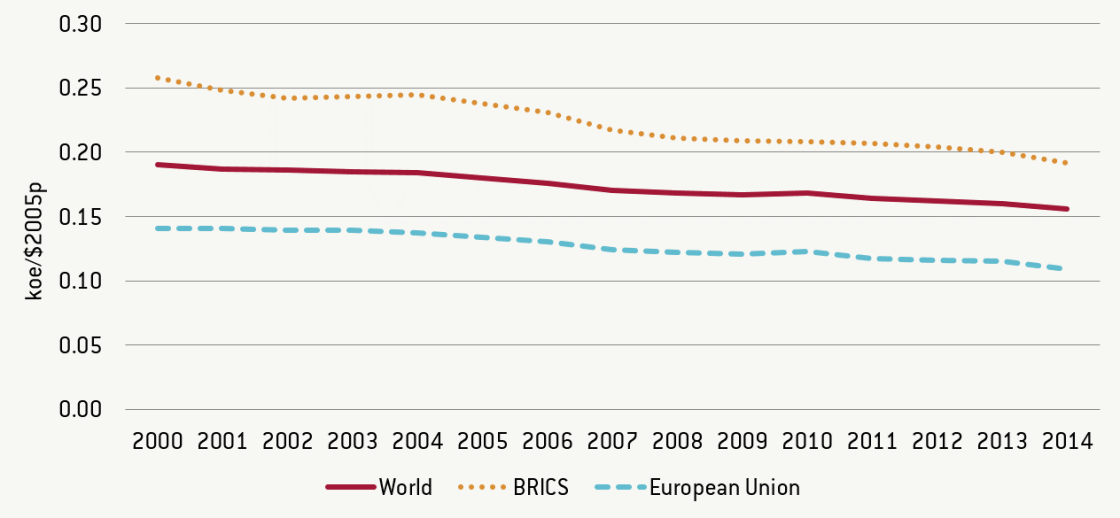

The amount of oil necessary to produce one dollar of GDP has decreased globally thanks to renewables and more efficient energy use. In addition, more GDP is now generated in the service sector, which is less energy intensive.

Energy intensity has fallen globally by 1.4% each year on average since 2000. In addition all countries agreed to move away from fossil fuels, including oil, over the course of the century at the Paris climate summit. So expect a further decoupling of oil consumption and growth. Again, reduced demand for oil causes downward pressure on prices.

Figure 2: Energy intensity of GDP at constant purchasing power parities

Source: http://bru.gl/22Vhzlj

Global economic environment

Current aggregate demand is sluggish. Growth in emerging market economies is slowing and macroeconomic risks in developed countries persist.

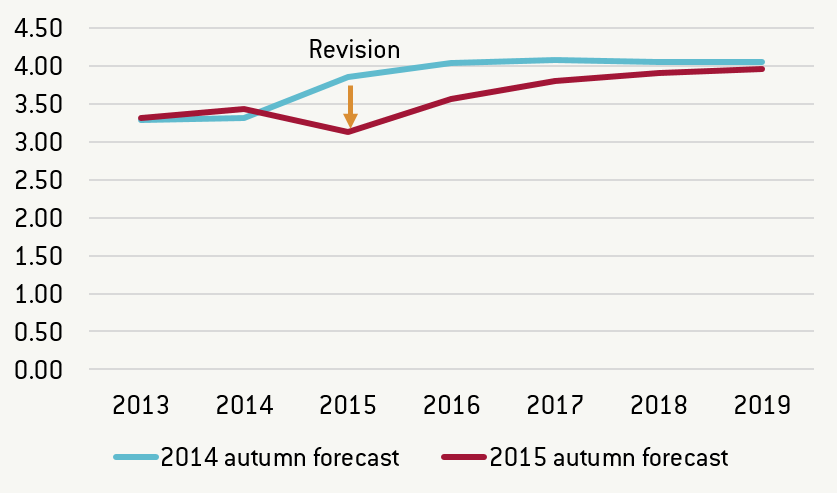

The IMF revised down its global economic growth forecasts for 2015 twice, in July (from 3.5% to 3.3%), and October (from 3.3% to 3.1%). Consequently, lower than anticipated economic activity will lead to lower demand for oil and so oil prices fall.

Figure 3: IMF global GDP growth forecast 2014 vs. 2015

Source: http://bru.gl/1Omjo0J

Oil price outlook

These developments are already largely taken into account in the currently observed low oil price. However, it is impossible to foresee price developments in 2016, as each of the drivers described above could move in any direction.

Geopolitical factors, such as growing tensions in the Middle East, could lead to higher or lower oil production. Low oil prices might stimulate a partial switch back to oil in transport and heating, but alternatively the trend for energy efficiency and renewables could accelerate the move away from oil, thanks to the Paris climate agreement. Finally, global GDP might pick up as China’s economy proves more resilient, or may fall if investors lose confidence in the Chinese economy.

Consequences of low oil prices

The second question is what the low oil price means for the economy. As for almost all economic questions, the answer is, it depends. First, it depends on whether you are an oil exporting country or not. If you are, export revenues from selling oil and hence GDP will go down (see article on the impact on oil exporters).

We observed this phenomenon in 2015 in many oil exporting countries. Several oil-exporters, such as Russia, Kazakhstan and Azerbaijan, decided to move to more flexible exchange-rate regimes, rather than exhaust their reserves defending an indefensibly overvalued currency.

The low oil price might also be a catalyst for more prudent economic policies. Some oil exporting countries started to reduce wasteful spending. Reducing energy subsidies, as Saudi Arabia has done, is a wise step for oil exporting countries in this situation – consumers will continue to pay a similar price as oil prices are going down, and such reform benefits the stretched government finances of oil exporters.

For oil importing countries, the economic impact of low oil prices depends on the reasons for the drop in price. If the oil price falls because of an increase in oil supply, consumers have more money to spend on domestic products instead of imported oil, boosting the domestic economy.

The same is true if oil prices go down because consumers need less oil, having better alternatives. If oil prices fall because of troubles in the global economy, however, then the low oil price is more a symptom for problems than a reason to rejoice.

Consequently, some modest stimulus can be expected from low oil prices for oil importing countries. But low oil prices are also a reason to worry, as they are partly a symptom of slowing global growth.

The author would like to thank Marek Dabrowski and Simone Tagliapietra for useful comments.