European banking union: should the 'outs' join in?

To address coordination failures between national institutions regulating banks, we need supranational policies. Banking union encourages further int

The ultimate rationale of banking union

Banking union was conceived as a reply to one of the root causes of the European debt crisis: the sovereign-bank loop. To break the loop, euro-area leaders decided to move responsibility for banking supervision and resolution to the European level.

Banking union consists of the SSM (Single Supervisory Mechanism) and the SRM (Single Resolution Mechanism). While euro-area members have been included in the banking union by default, the SSM and the SRM allow non-euro EU countries to participate.

For these countries, if and when to join the banking union is an important strategic question, but opposing positions have emerged (Figure 1).

Sweden declared in 2014 that it would not join banking union in the foreseeable future, and has stuck to this position since, remaining the United Kingdom's most sceptical ally.

In contrast, Denmark's government declared in April 2015 that it wanted to become part of the banking union, which it viewed as being in the interests of its financial sector.

In central and eastern Europe, the Czech Republic, Hungary and Poland have adopted a ‘wait-and-see’ approach, while Bulgaria and Romania are more positive about joining banking union.

The ‘wait and see’ countries fear that joining banking union might imply joining the euro beforehand. However, as we argue in our policy contribution,the long-term rationale of banking union is linked to cross-border banking in the single market, which goes beyond the single currency.

The long-term rationale of banking union is linked to cross-border banking in the single market, which goes beyond the single currency

Following this argument, the debate surrounding the question of opting-in is not necessarily a debate about joining the full package of economic and monetary union and banking union.

When banks are supervised and regulated by national institutions, but operate across borders, authorities do not take into account the cross-border externalities of their actions. This can lead to coordination failures between national authorities,

To address these coordination failures, we need supranational policies. The coordination failure argument is related to the EU single market, which allows unfettered cross-border banking.

Banking union encourages further integration of banks across borders, deepening the single market. Cross-border banking is thus the ultimate rationale for banking union. Banking union could also benefit countries outside the euro, which have a high degree of cross-border banking.

Cross-border banking exposure in the euro-zone ‘outs’

The international reach of a country’s banking sector can be captured by dividing cross-border banking into outward and inward banking claims. Outward banking captures the exposure of multinational banking groups to other countries, beyond the domestic market, while inward banking is defined as the banking claims from abroad on the country in question.

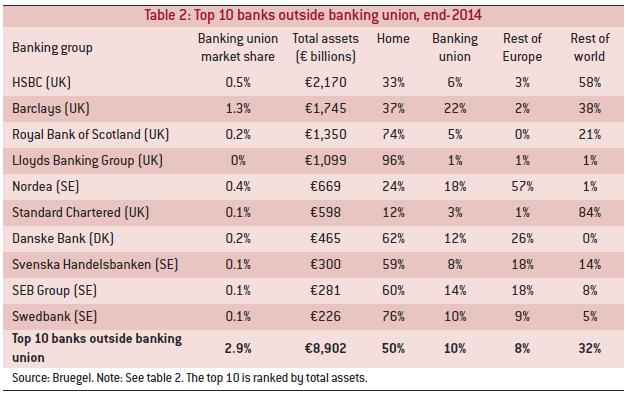

Outward banking of the largest banks is captured in Table 2, which indicates the geographic segmentation of the top 10 banks outside the banking union. Overall, these banks hold 50 percent of their assets in their home country, 10 percent in the banking union market, 8 percent in other European countries and 32 percent in the rest of the world.

One bank with large operations in the banking union is Barclays (UK), which holds 22 percent of assets in the banking union, mainly in Italy (5.1 percent), Spain (3.7 percent), Germany (3.4 percent) and France (2.9 percent). But the British bank has announced that it will soon sell its Italian and Spanish operations.

The euro-zone ‘outs’, in particular the Scandinavians, have a large share of outward banking claims to the rest of Europe.

Nordea (Sweden), SEB Group (Sweden) and Danske Bank (Denmark) have assets amounting to 18 percent, 14 percent and 12 percent, respectively, in the banking union (in particular Finland and the Baltics). These three banks are pan-Nordic banks.

This indicates that the euro-zone ‘outs’, in particular the Scandinavians, have a large share of outward banking claims to the rest of Europe. If all of the ‘outs’ joined banking union, the potential improvement in supervisory coverage would be the 10 percent of assets held in the banking union and the 8 percent of assets held in other European countries that are not yet part of the banking union.

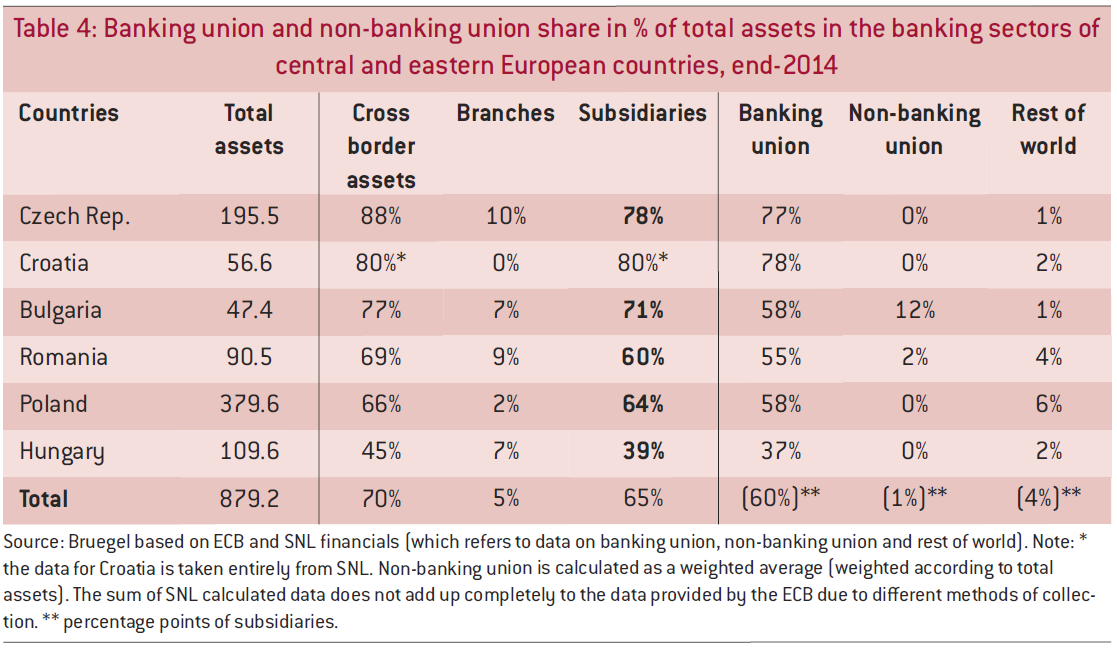

In terms of inward banking, the share of cross-border subsidiaries in central and Eastern Europe is very high, with inward claims ranging from 39 and 80 percent, as shown in Table 4.

The vast majority of these subsidiaries come from banks headquartered in the banking union (60 out of 65 percent), often Western European banks such as ING, KBC Group, Erste Group and UniCredit.

In contrast, Sweden and Denmark have only moderate inward claims (not in the table). The United Kingdom is a special case. It is the only EU country which has more inward claims coming from banks in the rest of the world than from banks headquartered in the rest of the European Union.

As for the share coming from the rest of the world, major US and Swiss investment banks form a substantial part. These banks use their London offices as a springboard to conduct business across the European Union, reflecting the importance of London as an international financial centre.

Conclusion

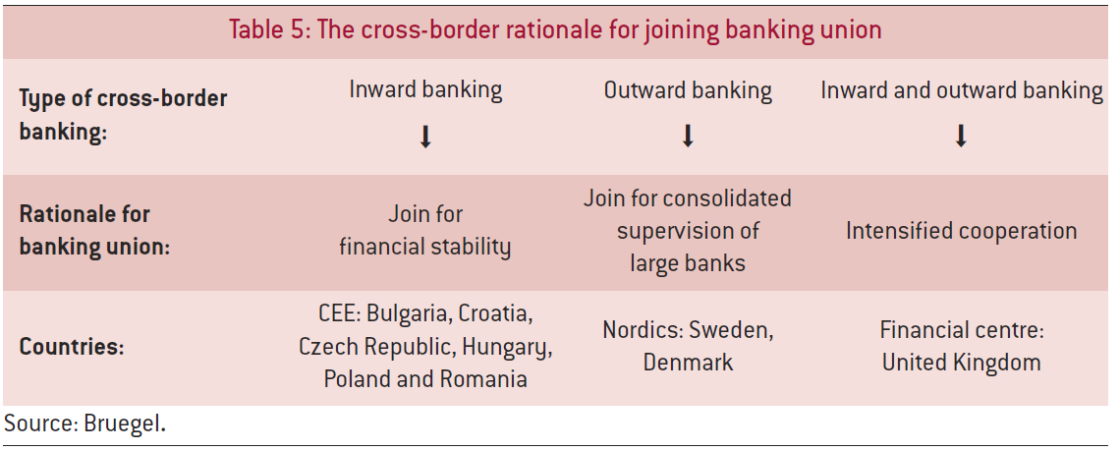

The Nordic countries are characterised by extensive outward banking towards the banking union area, while inward banking from the banking union is particularly important for the six ‘outs’ located in central and eastern Europe. Taken together, this indicates that these ‘outs’ might benefit from banking union membership (see Table 5).

For the Nordics, joining banking union would increase the effectiveness and efficiency of the supervision and resolution of the larger European cross-border banks, allowing supervision and resolution at the supranational level.

While the SRM is a complicated coordination mechanism, the Single Resolution Board has to take a wider perspective for the resolution of banking union banks. This banking union wide mandate should prevent the splitting of banks on national lines in the resolution process, as happened during the great financial crisis.

For the ‘outs’ in central and eastern Europe, the banking union would be a more stable arrangement for managing financial stability and maintaining lending capacity than the Vienna Initiative, which was used on an ad-hoc basis during the crisis.

Finally, for the United Kingdom, joining banking union would also be beneficial, but there is strong political opposition. Given the strong financial links within the banking union, the Bank of England and the ECB will have to cooperate closely in order to ensure financial stability.