The European Deposit Insurance Scheme

Statement prepared for the European Parliament’s ECON Committee Public Hearing of 23 May.

It is welcome that the European Union and the euro area in particular discuss the topic of a European deposit insurance. In fact, to complete banking union, three pillars are indispensable: banking supervision, bank resolution and deposit insurance. In terms of institution building, I would argue that supervision is now fully in place while the European Resolution Mechanism with its funds is still only a half-way done. Deposit insurance, in turn, is still national at this stage.

What is the role of deposit insurance? The primary role of deposit insurance is to build and maintain trust. The trust of depositors into the safety of their deposits in banks is fundamental to financial stability and fundamental to banking stability in a monetary system based on fiat money. Banks themselves have the primary responsibility in ensuring that trust but in certain situations, they cannot provide that trust themselves. This is where a deposit insurance becomes fundamental. Its pure existence can already prevent bank runs and ensure that depositors keep their deposits in the bank. This, in turn, makes it actually less likely that the insurance will have to disburse.

Why is there a need for a European deposit insurance system? There are three basic arguments:

- The first one is about size. Insurances work better, the larger the number of banks included. Especially small countries will find it difficult to provide an effective insurance to its bank deposits. Certainly, if one bank in a small country is affected and needs a pay-out from the deposit insurance, this will have lasting costs on all the other banks’ deposits in the country as they would have to be charged more strongly to replenish the insurance fund. The cost of deposit insurance will become materially differentiated across countries after a one-time event in a small country in particular.

- The second is about consistency. One cannot keep a system in which supervision is centralised while deposit insurance is decentralised. Ultimately, such a system would mean that national deposit insurance and in extremis national tax-payers would have to stand ready to address problems that have arisen because of potentially inadequate European supervision.

- The third is about decoupling banks from sovereigns. The stated aim of banking union is to decouple banks from sovereigns. Since the ultimate backstop to deposit insurance is the tax payer and the government, the trust a deposit insurance provides will depend on the country in question. The quality of the sovereign will materially influence the trust in the banking system. Without a European deposit insurance system, the decoupling of banks from sovereigns will therefore be incomplete.

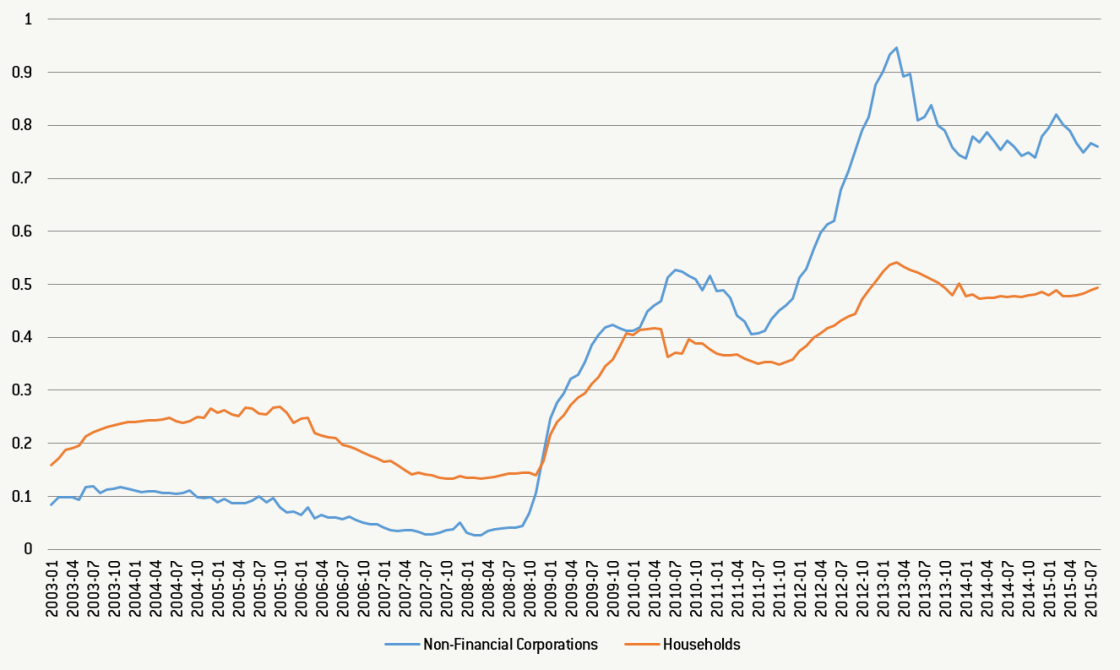

Empirically, one can observe that the cost for banks to attract deposits has diverged substantially across the euro area. For corporate deposits, that divergence is greater as corporate clients have larger deposit, are less covered by insurance and have a greater ability to move deposits in other countries. But also for household deposits that fall largely below the threshold of what is insured, a clear differentiation across euro area countries is visible (see chart).

Figure: Standard deviation of interest rates on deposits from non-financial corporations and households normalized by the German rate

Note: The normalized standard deviation was calculated as the standard deviation of interest rates on outstanding amounts across Eurozone countries in a given year divided by the German interest rate in the same year.

Source: ECB Statistical Data Warehouse, Bank interest rates – deposits from non-financial corporations and households (on outstanding amounts)

Deposit insurance and crisis management. There is a further important reason why European deposit insurance is advisable in monetary union: it is about the ability to manage sovereign crisis. The ESM is the main instrument to deal with sovereign debt crisis. Its treaty explicitly allows to bail-out only solvent countries. In case a country is not solvent, however, ESM resources cannot be provided to the country and at least conceptually a bail-in of sovereign bond holders is required. This gives rise to two difficulties: The first one is that is such a situation depositors are likely to panic and since they are in a monetary union they may move deposits to other countries. This, in turn, forces the ECB to provide large amounts of liquidity to the banks of the concerned country. And while central banks should provide liquidity to solvent but illiquid banks, it still increases the exposure of the central bank to banks concentrated in one country. A European deposit insurance, by creating trust, will likely minimize national bank runs and thereby also reduce central bank exposure. The second problem is the concentration of sovereign debt in banks of the same country. This renders a bail-in more difficult as the banking system will be much more affected than if the sovereign debt was spread over the entire euro area banking system. Moreover, the concentration of sovereign debt in national banks also creates a problem for the European deposit insurance in case the potential losses were to be so sizeable that the deposit insurance would have to step-in.

A European deposit insurance with a reduction of national sovereign bond holdings would make crisis management easier. In particular, it would be easier to bail-in sovereign bond holders, thereby providing more fiscal breathing space to governments. Bail-in of sovereign debt will never be easy. It cannot be a standard instrument but it is rather a measure of last resort. However, in certain extreme circumstances, such a bail-in is preferable to financial assistance programmes that would require self-defeating austerity. Full banking union is thus a necessary prerequisite for rendering soft bail-in in case of ESM programme possible

Design of European deposit insurance

Full insurance or re-insurance? How could a European deposit insurance system be designed. Does it require full insurance or only a re-insurance. This question is discussed in Schoenmaker and Wolff (2016) and the below summarizes the piece. To achieve a full decoupling of banks from sovereigns, a full insurance needed. Re-insurance can achieve that only partially.

It makes sense, however, to start EDIS with re-insurance. There are currently many country specificities such as special treatments of which deposits are covered under what circumstances. Another country specificity in Germany is how cooperative banks and savings banks have created their own special deposit insurances (pillar-based deposit insurance system).

Full European deposit insurance and sovereign exposure rules. A full European deposit insurance is only advisable when sovereign debt exposure of banks is being diversified and country specificities as regards depositor treatments are harmonized. Conversely, it is not justified to reduce national sovereign bond holdings through exposure rules without the existence of a full European deposit insurance. In Benassy, Ragot and Wolff (2016), we argue that one may want to consider removing any risk weights in case banks hold a portfolio of all sovereign debts of the euro area.

A few conceptual points: Liquidity insurance is not a deposit insurance but a credit line. Deposit insurance is about mutualizing and insuring against fall-out. It is also important to clarify that even with BRRD bail-in rules, a deposit insurance is needed. In fact, while bail-in rules and depositor preference may make it less likely that depositors will be affected by bank losses, not every depositor knows the exact balance sheet composition of his or her bank. The insurance serves the purpose of increasing trust, even if no disbursement may be needed.

The creation of a European deposit insurance system needs to be well done and be based on sound legal and political foundations. Without a sound basis, it will not provide the credibility and trust it is supposed to create and may actually be a step back compared to national deposit insurances that are generally tested and trusted. Addressing certain technical points early on, such as performing a wide-ranging impact assessment and analysis whether the foreseen re-payments from the national DGS to banks is legally possible when transiting to a European co-insurance is of great importance.

In summary, it is advisable to have a European deposit insurance. Deposit insurances are rarely used. Their main function is to build trust. In a systemic crisis, trust building would need to come from politics together with ECB. A European deposit insurance would make it more credibly that there is a European common ultimate backstop for systemic crises. Moreover, a European deposit insurance would be a strong signal that the integrity of Europe’s monetary union is firmly established.