Mobile roaming, Brexit, and unintended consequences

The intermediate and long-term consequences of the UK “Brexit” referendum of 23 June 2016 are numerous and far-reaching. There has been much discussio

The impacts of Brexit on mobile roaming are by no means large in overall economic terms, but they provide an example of the breadth of ripple effects that can be expected after the UK referendum result, and also of the degree to which the end results are difficult to predict with certainty.

The overall approach to regulation of telecommunications within the UK will not necessarily change much. The Regulatory Framework for Electronic Communications (RFEC) that the European Union enacted in 2002 was largely based on procompetitive UK ideas in the first place.

Certain international aspects are, however, likely to change. The most obvious examples are (1) the relationship of the UK and its national regulatory authority (NRA) Ofcom to its European counterparts; (2) the wholesale payments that UK network operators make to their European counterparts for interconnection; and (3) wholesale and retail arrangements between the UK and the European Union. Our focus here is on roaming.

If the UK were to become a member of the European Economic Area (EEA) (comprised of all EU Member States plus Norway, Liechtenstein, and Iceland), the applicability of the European regulatory framework for electronic communications would be clear.

Joining the EEA could be expected to oblige the UK to accept most of the burdens of EU membership (including freedom of movement), with fewer of the privileges than the UK currently enjoys. In the discussion that follows, we assume that a UK membership in the EEA will not happen, but it cannot be categorically ruled out.

The UK might still selectively conclude bilateral agreements with the EU (and also with its member states). The implications for telecommunications regulation would depend on exactly which agreements were concluded.

Since Switzerland is in precisely this position (having rejected membership in the EEA in a referendum in 1992), it is perhaps useful to draw a few comparisons.

The Swiss choose to voluntarily participate in the EU’s Board of European Regulators of Electronic Communications (BEREC). In this role, they also participate voluntarily in BEREC’s collection of statistics on international mobile roaming; however, they are not subject to the various EU Roaming Regulations, and consequently do not benefit from them.

The prices that consumers pay for roaming reflect wholesale international payments between the mobile network operators, since the actual service has to be provided in the visited country. Among EU/EEA members, these payments at wholesale level are subject to price caps. Since Switzerland is neither an EU nor an EEA member, Swiss mobile operators are not entitled to the benefits of these price caps. If the EU were to offer these advantageous wholesale arrangements to a third country such as Switzerland or the UK in the absence of a comprehensive free trade agreement, it would likely raise WTO concerns.

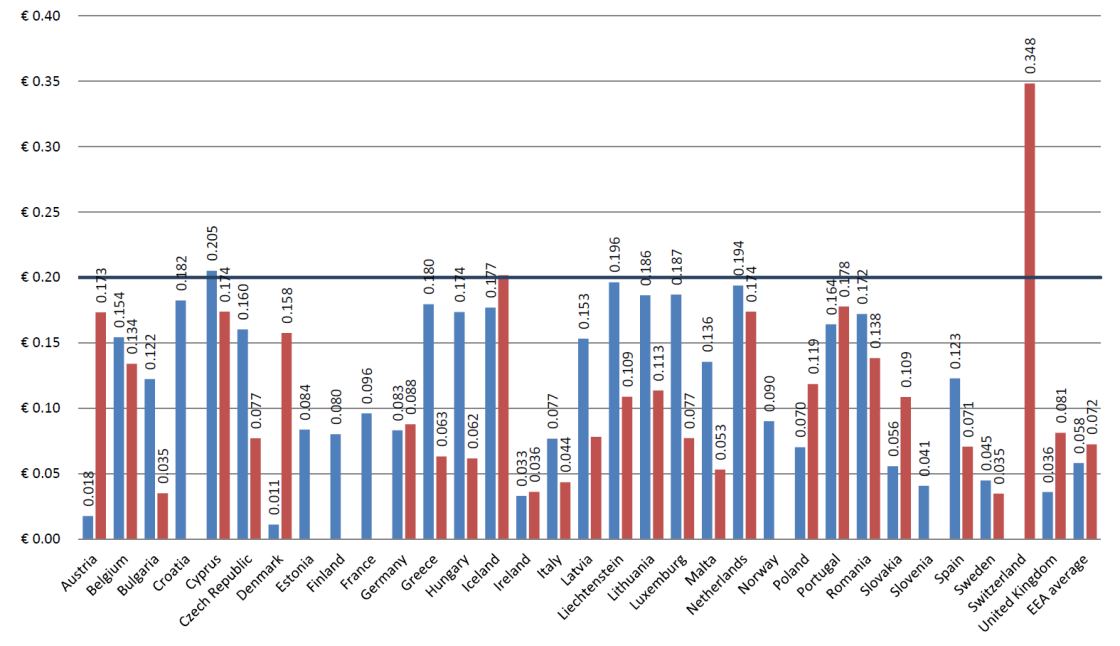

Since the higher prices that Swiss mobile operators pay are a real cost, their retail prices are also higher than for mobile network operators in EU/EEA countries, as is visible in the figure below. The high price of roaming in the EU has been a constant source of irritation for Swiss consumers, and has frequently been featured in the Swiss press. One can argue that their retail prices in Switzerland are elevated more than the wholesale charges would strictly require; be that as it may, it is clear that the prices of Swiss mobile network operators cannot be the same as those of mobile network operators in EU/EEA countries.

As long as Swiss mobile network operators (MNOs) pay more at wholesale level for roaming in the EU/EEA than MNOs in EU/EEA Member States, retail prices in Switzerland for EU/EEA roaming can be expected to remain higher than those in EU/EEA Member States. It appears that the UK will shortly find itself in the same position.

Figure 1. Average retail price per MB of roaming data.[1]

Source: BEREC (2016)

The EU is expecting to migrate over the next year to so-called Roam Like at Home (RLAH) arrangements over the next year, where international roaming prices will be the same as domestic prices. If this indeed comes into play, roaming prices will be even lower than they are today; however, the basic linkages between wholesale charges and retail prices will remain.

To the extent that UK mobile network operators such as Vodafone and O2 (Telefónica) have international affiliates, they have some ability to internalise these wholesale costs. It is nonetheless the case that no MNO covers all EU/EEA Member States; moreover, the ability of MNOs to steer traffic onto their preferred network in the Visited Country is good, but not perfect. The cost of the roaming service will in the end be somewhat higher for UK mobile network operators than for EU/EEA mobile network operators.

Taking all of this into account, it is a safe bet that UK residents with UK mobile subscriptions will pay more for use of the mobile services when roaming in EU/EEA countries than will EU/EEA residents.

[1] Based on both prepaid and postpaid usage in Q2 2015.