The day after Brexit: what do we know?

With the UK referendum on EU membership on 23 June, Europe is contemplating the practical consequences of a vote to leave.

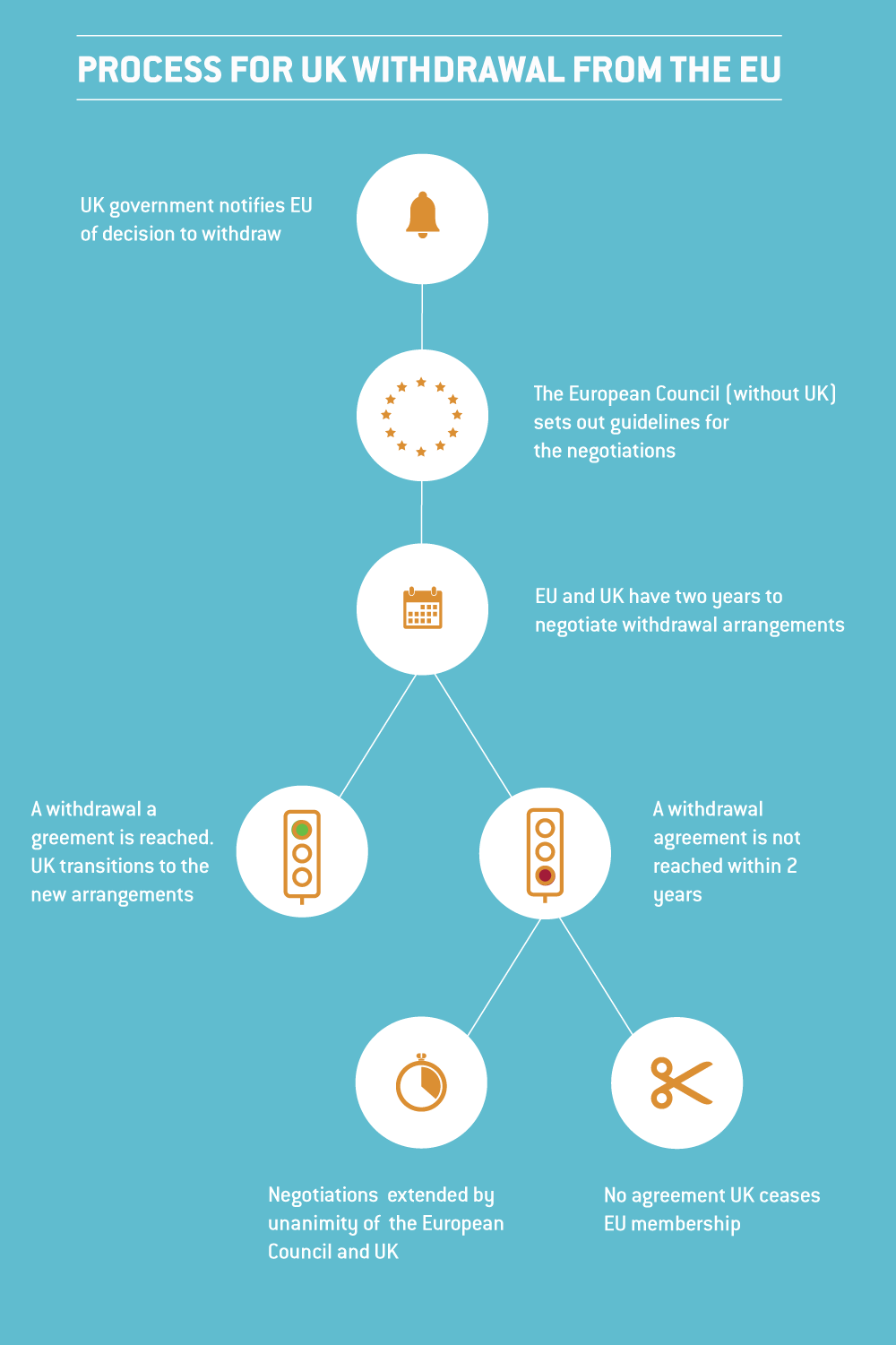

Article 50 of the Treaty of the European Union (December 2009) sets out the procedural requirements for a member state to terminate its membership. Legal withdrawal would mean that EU Treaties and their Protocols would no longer apply, and EU financial programmes would be phased out.

If the UK votes to leave the EU on Thursday, legal experts at the UK's Constitution Society argue that the result will not immediately have a binding legal effect. The UK government would need to launch a proposal to activate Article 50, and according to the lawyers at the Constitution Society this proposal would have to pass through Parliament. Once this proposal had passed, the UK could then formally notify the EU of its intention to withdraw.

What would Brexit mean for the EU budget?

The UK enjoys a special reduction in its contribution to the EU budget, known as the rebate. Even after this, the UK is the fourth largest net contributor (after Germany, France and Italy). In 2014, after application of its rebate, the UK contributed £13 billion to the total EU budget of £118.9 billion. This was 0.52% of its Gross National Income (GNI). However, out of that £13 billion, the UK received back around £4 billion in “public sector receipts” —mostly as subsidies to its agricultural sector. Therefore, if the UK votes to leave the EU, there will be consequences for the EU budget in both size and distribution. But the overall impact would depend on the agreement reached between the EU and the UK.

What are the UK’s capital contributions to the European Central Bank?

The national central banks of euro-area states have made capital contributions to the ECB amounting to €7.6 billion. Meanwhile, non-euro area central banks contribute €120 million to the ECB, of which the UK contributes €55 million. The nine non-euro area central banks are not entitled to receive any shares of profits, nor are they liable to fund any losses that the ECB incurs. However, the UK and other non-euro area central banks are required to contribute to the ECB’s operational costs by paying at least 3.75% of their subscribed capital. This means that the UK’s contribution to the ECB is tiny, and it should be easy to disentangle it.

What would happen to EU regulations in the UK?

An immense body of EU legislation has accrued during the 40 years of UK membership, which is both directly and indirectly applicable to the UK. The UK Government estimates that 50% of UK legislation with a significant economic impact comes from the EU legislation. In the event of an exit, the UK would possibly need to re-examine the entire body of EU law to determine just how much influence EU legislation has had on UK domestic law. There are 6,987 directly applicable EU regulations, at least some of which would need to be replaced by equivalent UK laws.

How long do trade negotiations take?

The EU currently has Preferential Trade Agreements (PTAs) with 52 countries and is negotiating trade agreements with another 72 countries. If the UK exits it will need to renegotiate with the EU and with 124 other countries to redefine its own trade status (Huettl and Merler, 2016).

Moser and Rose (2012) estimate the average duration of trade negotiations (length of time from the start of talks to its application) for 88 regional trade agreements between 1988 and 2009. The authors conclude that regional trade agreements take 28 months on average. The EU experience is quite varied. The EU is currently in the midst of major trade negotiations with the US which started in 2013. It started negotiations with Canada in 2009, Japan in 2012 and India in 2007, which have not been concluded. Trade negotiations indeed take long to conclude.

What could happen to UK and EU migrants?

5.2 million people born in the UK are living outside the UK, of which 1.3 million are living in another EU member state. On the other hand, 8.3 million people born overseas are living in the UK and 3 million of these people come from another EU member state.

By the end of 2015, migration from the other 27 EU countries to the UK reached the same level as migration from the rest of the world to the UK. Conversely, around 300,000 UK nationals live in Spain, followed by Ireland with 250,000 and France 180,000.

If UK votes to exit the EU, UK citizens will no longer have EU citizenship status, as the status was created by EU Treaties. However, unlike the status, the rights derived from the EU citizenship are harder to determine, such as the rights to reside and terms of access to public services in the residing country. The rights that EU migrants enjoy in the UK and similarly the rights of UK migrants living in the EU will depend on the nature of the withdrawal negotiations and the final agreement.

Note: The original version of the article included an infographic with some small errors. This has now been corrected and updated.