The Fed’s rethinking of normality

What’s at stake: As we approach Jackson Hole, monetary policymakers are considering how to redesign monetary policy strategies to better cope with a l

The new murky economics

Paul Krugman writes that we’re no longer in the simple, depressed-economy world anymore. Early in the crisis, liquidity-trap macroeconomics had become the story of the day. And the basic message of the models — that everything changes when you hit the zero lower bound — was being overwhelmingly confirmed by experience. It was all beautifully hard-edged: a crisp boundary at zero, a sharp change in the impact of monetary and fiscal policy when you hit that boundary.

Paul Krugman writes that things have now gotten a bit murky. We’re no longer in a liquidity-trap macroeconomic situation, but we’re not either in what we used to call a normal macroeconomic situation. We are, if you like, half-out of the liquidity trap, with one foot on dry land — but the other foot is still hanging over the edge, and it wouldn’t take much to topple us right back in.

The new environment

Gavyn Davies writes that when the FOMC increased rates last December they seemed fairly sure that they knew what “normal” meant. Now, they seem to have lost that certainty, and have simultaneously shifted their central assessment of the “normal” level for short rates sharply downwards. Ylan Q. Mui writes that for years, the central bank’s top officials pointed to “persistent headwinds” emanating from the Great Recession as the culprit for the tepid pace of the economy’s expansion: Government spending cuts were depressing growth. Households were paying off debt, spending less and saving more. Borrowing money got harder. Once those trends turned around, they argued, the economy would get back to normal. Seven years after the recession officially ended, many of the headwinds have indeed dissipated — yet normal remains elusive.

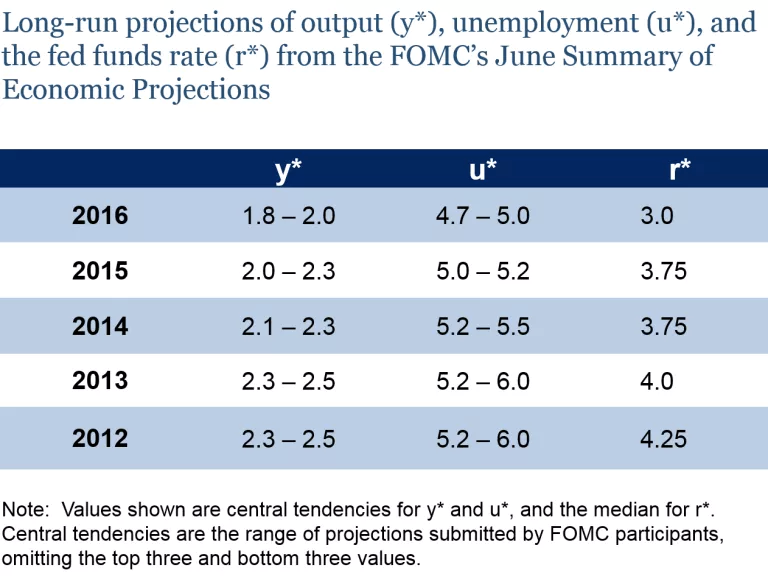

Ben Bernanke writes that the world looks significantly different in some ways than Fed policymakers thought just a few years ago, and that the degree of uncertainty about how the economy and policy will evolve may now be unusually high. FOMC participants have been shifting down their estimates of all three variables—y*, u*, and r*—for some years now. Downward revisions in the estimates of the terminal or neutral fed funds rate (r*) have multiple sources. Slower potential output growth implies lower returns to capital investment, and thus a lower r*; and indeed the pace of business investment has been disappointing, especially recently. A lower value of r* could also help explain the relatively sluggish pace of actual output growth, since it would imply that current policy is not as stimulative as previously thought (i.e., the current policy rate is not as far below r* as was believed). FOMC participants also pay attention to market signals: Low longer-term market interest rates imply that investors see a continuation of low real returns, low inflation, and low risk premiums on safe forms of debt, all of which point to a lower federal funds rate in the long run.

Source: Ben Bernanke

Gavyn Davies writes that Bernanke is right that domestic fundamentals have changed, but there is another significant reason for the Fed’s shift, which is a dawning realization that events in foreign economies are far more important in determining the equilibrium level of US rates than has previously been accepted. Brad DeLong writes that the Fed should, in addition to rethink its estimate of long-run potential output growth, be rethinking its estimates of:

- the long-run real natural rate of interest,

- the natural rate of unemployment,

- the slope of the Phillips Curve, and

- the gearing between recent past deviations of inflation from its target and expectations of future inflation.

Low r-star and strategies for mitigation

Larry Summers writes that everything we know about business cycle history suggests an overwhelming likelihood that there will be downturns in the industrial world sometime in the next several years. Nowhere is there room to cut rates by anything like the normal 400 basis points in response to potential recession. This is the primary monetary and indeed macroeconomic policy challenge of our generation.

Paul Krugman writes that in this murky, fragile situation we should be conducting policy largely as if we were still in the trap. Brad DeLong writes that the last eight years have taught us that as long as the distribution of near-term possible outcomes includes at least a 10% or so chance of landing back at the zero nominal safe interest rate lower bound, the policies we should follow now are pretty much the policies we ought to follow at the bound. Of course, this is the situation we will be in until the trend and expected inflation rate hits 4%/year: we are going to be in this situation for a looooooonnnngggg time.

John Williams writes that central banks and governments should critically reassess the efficacy of their current approaches and carefully consider redesigning economic policy strategies to better cope with a low r-star environment. This includes considering fiscal and other policies aimed at raising the natural interest rate, as well as alternative monetary and fiscal policies that are more likely to succeed in the face of a low natural rate.

John Williams writes that monetary policy frameworks should be critically reevaluated to identify potential improvements in the context of a low r-star. Although targeting a low inflation rate generally has been successful at taming inflation in the past, it is not as well-suited for a low r-star era. There is simply not enough room for central banks to cut interest rates in response to an economic downturn when both natural rates and inflation are very low.