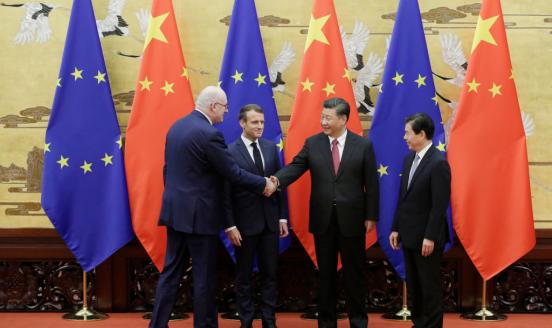

What does China’s ‘belt and road initiative’ mean for EU trade?

Much has been written about the Belt and Road initiative since Xi Jinping made it Beijing’s flagship initiative in September 2013. There are many inte

Indeed, the regional potentially affected covers as many as 63 countries (even if vaguely defined), sixty percent of the world’s population and thirty percent of global GDP.

This massive project is centered in two main routes, along which connectivity is to be fostered: land and sea. On land the focus is on transportation infrastructure and energy. For the sea, investment in ports and new trade routes are the main pillars. Both routes will have a major impact on Europe. In fact, the land route ends up in Europe, while the sea route is currently the most heavily used for trade between Europe and China. Undoubtedly, the belt and road initiative will affect Europe and the European Union (EU).

More specifically, the huge investments in infrastructure have the potential to ease bottlenecks in cross-border transportation. Among the many benefits of improved connectivity, trade stands out. The idea that improved transport infrastructure should generally foster trade is of course very intuitive. However, it is less sure that such benefits can be spread across countries and, more specifically, which countries stand to win/lose the most depending on their proximity to/distance from the improved infrastructure, among other considerations. In a working paper recently published by Bruegel, we addressed exactly this question by assessing empirically how the belt and road initiative, through a substantial reduction in transportation costs, may foster trade. Beyond the relevance of trade for Europe, our results show that a reduction in transportation cost can indeed increase international trade. A 10 percent reduction in railway, air and maritime costs would increases trade by 2 percent, 5.5 percent and 1.1 percent respectively (see on this scenario and others below).

While the current belt and road initiative is centered on building infrastructure, there are other ways in which it may evolve. One obvious objective, as far as trade is concerned, is dismantling trade barriers. In fact, Chinese authorities have started considering free trade agreements (FTA) with the belt and road countries[1]. Because most of the EU countries are not directly included in the initiative, and it is only possible for China to jointly strike an FTA with all EU countries, the chance for the EU to benefit from an FTA is slim. The previously mentioned Bruegel working paper also develops this scenario by focusing on the impact on EU trade of China-centered free trade bloc among belt and road countries. As one could imagine, a scenario where the belt and road initiative focuses on trade barriers is much less appealing than the previous one in which only transport infrastructure is built. In fact, the EU would no longer benefit from a free lunch (we are assuming that China and the belt and road countries will finance the infrastructure and not the EU – indeed, this is the case so far) and would be excluded from a very large free trade area just outside its borders.

Finally, the paper develops a third scenario in which both transport infrastructure is improved and a FTA is agreed among belt and road countries. This scenario is relatively neutral for the EU as a whole, although there are clear winners and losers within EU.

Our analysis has special policy implications for the EU. China has been advocating for the EU’s involvement in the project since 2013. We believe it is in the EU’s interest to actively take part in the initiative and push for more emphasis on cooperation in transportation and infrastructure. This makes sense, as it stands at the other end of the road from China and there are clear gains to be made. In a nutshell, if we focus on trade, the belt and road is very good news for Europe under the current set up, namely one in which the EU benefits from the infrastructure without a financial cost attached to it, because it is so far being financed by China and other belt and road countries.

It is, thus, quite striking that the discussion on the impact of the belt and road on Europe is still very embryonic. It goes without saying that more research is needed on the topic, as trade is only one of the many channels through which the belt and road initiative may affect Europe. Financial channels, such as FDI and portfolio flows are also very relevant and should also be analysed.

Some more details on our three scenarios

Scenario I: Simulating the impact on EU trade of a reduction in transportation costs with the belt and road

From a regional perspective, the EU is the largest winner from the belt and road initiative, with trade rising by more than 6%. Trade in the Asian region is also positively affected by the reduction in transportation costs, with trade increasing 3%, but this is only half as much as for the EU. In fact, Asian countries are found to be neither the top winners nor losers. This is probably explained by the fact that the estimated reduction in maritime transportation costs is quite moderate. Conversely, the cost of railway transportation is halved, which is behind the large gains for rail transit to Europe — in particular for landlocked countries. The rest of the world suffers from the deviation of trade towards the belt and road area but only with a very slight reduction in trade (0.04%). As a whole, our results point to the belt and road being a win-win in terms of trade creation, as the gains in the EU and Asia clearly outweigh the loss in the rest of the world.

Scenario II: Simulating the impact on EU trade of an FTA within the belt and road area

If China established a FTA zone in the belt and road area, the EU, which would be the biggest winner from the reduction in transportation costs, now suffers slightly. This result is intuitive, because we assume that EU members are left out of this trade deal and that no bilateral trade agreement with China is signed either. The rationale for such negative impact is that EU trade with China and other belt and road countries would be substituted by enhanced integration among them. This is true even for countries within the EU which are formally included in the belt and road initiative, such as Hungary and Poland, because they will not be able to enter any belt and road FTA without the rest of the EU joining. The Asian region thus becomes the biggest winner, followed by non-EU European countries since they can also benefit from the elimination of trade tariffs. If we consider countries one by one, the top winners are all from Middle Eastern and Central and East Asian countries, who would see their trade increasing by more than 15%. This compares favorably with the trade gains of 3% stemming from a reduction in transportation costs previously estimated for this group of economies.

Scenario III: Simulating trade gains for both transportation improvement and FTA

Lastly, we consider a combined policy package including both transportation improvement and establishment of an FTA within the belt and road region. Most Asian countries now become the biggest winners since they benefit from both the reduction in transportation costs and the elimination of trade tariffs. Some EU countries also benefit quite significantly but less than Asian ones. This is specially the case for some landlocked countries, such as Slovenia and Hungary. Also Germany benefits slightly more than France or Spain. This is actually very intuitive because these EU countries benefit from the transportation cost reduction but not from the FTA as they are not part of it. Also, as is in the previous two scenarios, there are always some slight losses for countries far from the belt and road project. The biggest loser is Japan, while the impact on the USA and Canada is close to zero.

[1] Ministry of Commerce of China, http://fta.mofcom.gov.cn/article/fzdongtai/201601/30116_1.html.