Beyond hard, soft and no Brexit

There is still a certain degree of fuzziness about what the different degrees of Brexit entail. We attempt to fill this gap by setting out the options

Recent declarations by political leaders suggest that a hard Brexit is the most likely outcome of the negotiation between the European Union and the United Kingdom that will start next spring after the UK government triggers Article 50. In Britain, several cabinet members have made statements pointing in this direction. And in Brussels, Donald Tusk, president of the European Council, declared last week that “it is useless to speculate about ‘soft Brexit’…[T]he only real alternative to a ‘hard Brexit’ is ‘no Brexit’”.

But there is still a certain degree of fuzziness about what the different degrees of Brexit actually entail. Clearly, no Brexit implies that the UK would remain a member of the European Union, presumably on the terms that prevailed before the referendum. There is less clarity, however, on what a hard or soft Brexit would imply.

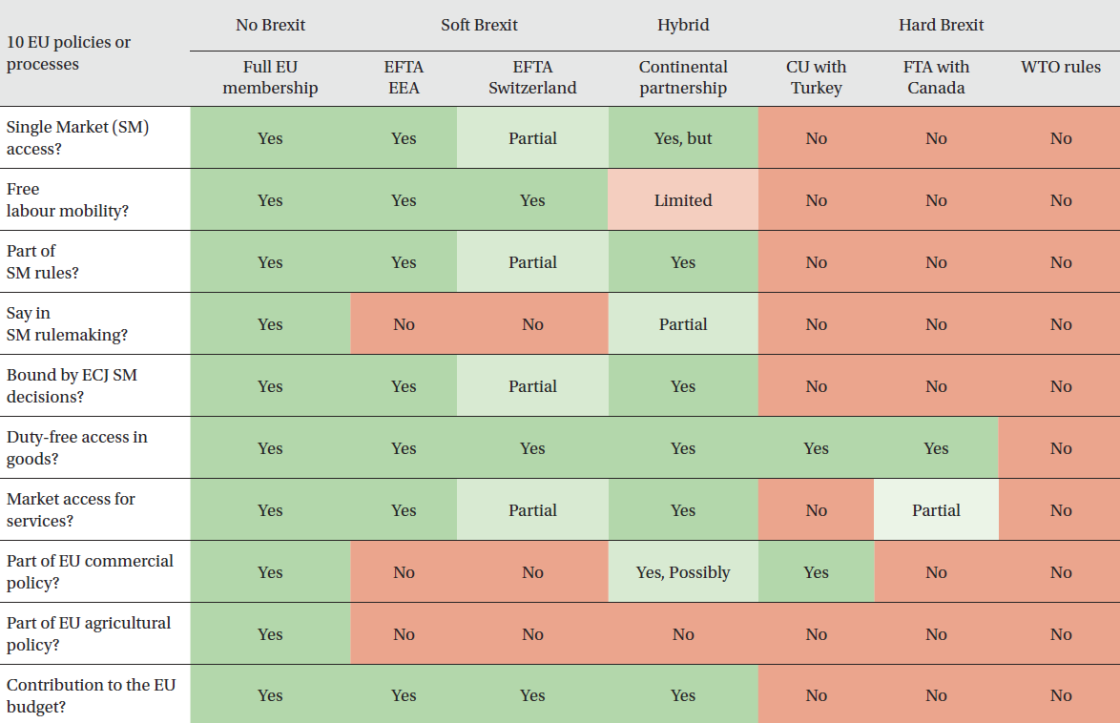

We attempt to fill this gap by setting out the options for the future EU-UK relationship (see table). In doing this, we have borrowed heavily from the work of three economists at HSBC[1] on the degree of Brexit, going from no Brexit to the hardest possible form of Brexit. We consider:

- ‘Full EU membership’ (‘no Brexit’);

- ‘EFTA EEA’: a soft Brexit option, which would be like the situation of the three European Free Trade Area (EFTA) members (Iceland, Liechtenstein and Norway) which belong to the European Economic Area (EEA);

- ‘EFTA Switzerland’: also a soft Brexit option, which would be equivalent to the situation of Switzerland, an EFTA member which does not belong to the EEA;

- ‘Continental Partnership’: an hybrid between soft and hard Brexit, proposed by Jean Pisani-Ferry, Norbert Röttgen, André Sapir, Paul Tucker and Guntram Wolff (LINK) as a model for the relationship between EU and non-EU European countries (not only the UK, but also the EFTA members, Ukraine, Turkey and others);

- ‘CU with Turkey’: a hard Brexit option, which would be like the EU-Turkey customs union (CU);

- ‘FTA with Canada’: another hard Brexit option, which would be like the situation of Canada if the proposed EU-Canada Comprehensive Economic and Trade Agreement (CETA), a sophisticated free-trade area (FTA) agreement, goes ahead;

- ‘WTO rules’, the hardest version of hard Brexit, which would give the UK access to the EU market (and the EU access to the UK market) on purely WTO terms, with no preferential arrangement.

Implications of various options for the future EU-UK relationship

Source: Adapted from HSBC (2016).

For each of these seven options, the table shows whether the UK would participate in 10 different EU policies or processes – some identical to those examined by the HSBC economists and some that are different from theirs. The table asks, for each option, whether the UK would:

- Have access to the EU single market;

- Abide by the free mobility of labour;

- Abide by related single market rules (competition, labour, environment, etc);

- Have a say in EU rulemaking;

- Be bound by European Court of Justice (ECJ) rulings on the single market;

- Have duty-free access to the EU for goods;

- Have access to the EU market for services;

- Be part of the EU commercial policy;

- Be part of the agricultural policy (and the fisheries policy);

- Contribute to the EU budget.

For ease of reading of the table, the cells where the answer is Yes (implying that the UK would participate in the relevant EU policy or process) are coloured dark green and those where the answer is No (indicating that the UK would not participate in the relevant policy or process) are coloured red; the cells in light green or light red are areas in which the UK would participate partially in the pertinent policy or process.

Close scrutiny of the table and of the colours of its cells suggests the following:

- ‘No Brexit’ and ‘WTO rules’ are indeed two extreme and opposite cases. The former would imply continued EU membership and therefore full participation in all 10 EU policies or processes. By contrast, an EU-UK relationship based on mere WTO rules would turn the UK into a ‘third country’ with respect to the EU, with zero participation in its policies or processes, the hardest form of Brexit.

- Participating in a Turkey-like customs union or in a Canada-like free trade agreement with the EU would also qualify as hard Brexit. In both instances the UK would only participate in two of the 10 EU policies or processes considered here: duty-free access for goods plus the EU commercial policy (in the CU case) or (partial) market access for services (in the CETA-like case).

- Participating in the EEA arrangement would be the softest possible form of Brexit because the UK would still participate in seven of the 10 policies or processes. The three excluded areas fall into two categories. First, some EU policies: the common commercial policy and the common agricultural policy (plus the fisheries policy). Second, single market rules: EEA countries are full participants in the single market, have to abide by all single market rules but have little or no say in the rulemaking process. This form of soft Brexit would certainly be welcomed by the EU27 but most likely rejected by the UK.

- Participating in a Swiss-type arrangement would also qualify as a soft Brexit, though slightly less soft than the EEA arrangement. Under the Swiss arrangement, as under the EEA arrangement, the UK would not participate in the common commercial policy, in the common agricultural policy (or the fisheries policy) and would have no say in EU rulemaking. In addition, the UK would only partially be bound by ECJ rulings. The price it would pay for this, like Switzerland, is that it would only be a partial member of the single market: it would only have partial access to the EU market for services and in particular it would not enjoy passporting rights for financial services. Whether or not the EU27 would be willing to offer this option to the UK and whether the UK would be interested is a moot question at this stage. An important issue that will need to be resolved first is the fate of the free labour mobility clause between the EU and Switzerland. This clause was rejected by Swiss voters in 2014 and is considered as a ‘sine qua non’ condition by the EU. If no agreement between the two parties can be found soon, this option may simply not be available any more by the time Article 50 is triggered.

- Finally, the Continental Partnership option is ‘sui generis’: it belongs neither to the hard nor soft Brexit categories. Instead, the Continental Partnership:

- Shares some important features with soft Brexit: the UK would have full access to the single market for goods, services and capital in exchange for respecting all single market rules, abiding by pertinent ECJ rulings and contributing to the EU budget;

- Shares an important feature with hard Brexit: the UK would not maintain free labour mobility with the EU, but contrary to hard Brexit which would have no mobility at all, the Continental Partnership would have controlled mobility;

- Shares two features with both hard and soft Brexit: the UK would have duty-free access to the EU goods market, but it would not participate in the EU agricultural and fisheries policies;[2]

- Is different from both hard and soft Brexit in one important respect: the UK would have a voice – though not a vote – in the EU’s single-market rulemaking process.

In conclusion, assuming that despite the current mood – which was well encapsulated by President Tusk’s recent speech – there will eventually be some appetite for an arrangement with the UK that is neither hard Brexit nor no Brexit, the Continental Partnership option is likely to prove more attractive than soft Brexit because it combines elements of both soft and hard Brexit while adding an element that exists in neither category. The Continental Partnership option offers another advantage over alternative options under which the UK would maintain a close tie with the EU. Because they are premised on free circulation of workers in order to grant free circulation of goods, services and capital, neither no Brexit (ie EU membership) nor soft Brexit (ie the EEA and Swiss models for non-EU countries) seem realistic templates for dealing with countries like Turkey. By contrast, the Continental Partnership model without free labour mobility could be applied not only to the UK post-Brexit but also to Turkey and to other EU neighbours.

[1] Simon Wells, Liz Martins and Douglas Lippoldt, ‘Brexit getting harder: reassessing the prospects for a complex divorce’, HSBC Global Research, 6 October 2016.

[2] It may, however, participate in the EU commercial policy.