The Deutsche Bank Frenzy and what it says about European banks

What’s at stake: The IMF recently published its Fall Global Financial Stability Report, which points to a decrease in short-term risk but building of

The IMF released their Global Financial Stability Report (GFSR), which finds that short-term risks to global financial stability have abated since April 2016, but that medium-term risks continue to build. Financial institutions in advanced economies face a number of cyclical and structural challenges and need to adapt to low growth and low interest rates, as well as to an evolving market and regulatory environment. Weak profitability could erode banks’ buffers over time and undermine their ability to support growth and a cyclical recovery will not resolve the problem of low profitability. The IMF stresses that more deep-rooted reforms and systemic management are needed, especially for European banks.

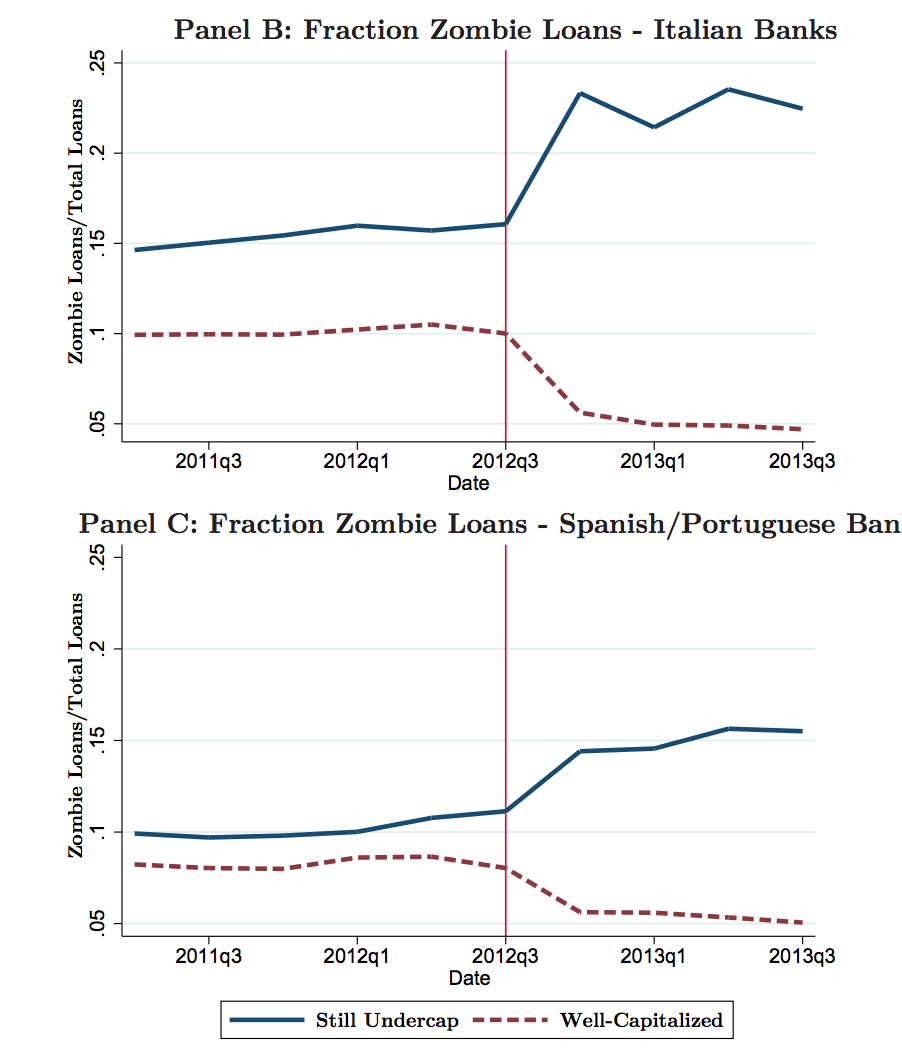

A recent paper by Acharya, Eisert, Eufinger and Hirsch looks at why the regained stability of the European banking sector has not fully transferred into economic growth. They show that this development can at least partially be explained by zombie lending motives of banks that still remained undercapitalized after the OMT announcement (see figure below). While banks that benefited from the announcement increased their overall loan supply, this supply was mostly targeted towards low-quality firms with pre-existing lending relationships with these banks. As a result, there was no positive impact on real economic activity like employment or investment. Instead, these firms mainly used the newly acquired funds to build up cash reserves. Finally, they document that creditworthy firms in industries with a prevalence of zombie firms suffered significantly from the credit misallocation, which slowed down the economic recovery.

Meanwhile, the European markets were agitated last week by the news of a bigger than expected fine imposed by the US Department of Justice on Deutsche Bank, which some seemed to think could put the bank in difficult position. Martin Wolf at the Financial Times says that Deutsche Bank offers a tough lesson in risk. A first lesson from the Deutsche turmoil is that banks remain highly fragile businesses. By their nature, banks are highly leveraged entities with ultra-liquid liabilities and far more illiquid assets. The high pre-crisis returns on equity promised by banks depended on their ultra-high leverage and so on the taxpayer support in the resulting crash.

A second lesson is that the way in which regulators have gone about punishing banks for their many wrongdoings is unsatisfactory. It is reasonable to punish shareholders for the misdeeds of the banks whose shares they own, yet it must be doubted whether it makes sense to impose a penalty so large that it imperils the survival of an institution. Far more important, the idea that shareholders control banks is a myth: it is management that is responsible, and it is disheartening that shareholders have been punished, but the decision makers who ran these institutions escaped more or less unscathed.

A third lesson is that banks are still undercapitalised, relative to the scale of their balance sheets. More immediately, we lack reliable means of rectifying this. So, while governments insist bailouts are ruled out, few believe this, particularly in the case of a bank of Deutsche’s importance. Overall, Wolf says, the approach taken to punishing banks for their failings is more like firing a blunderbuss than a rifle; and it is still hard to recapitalise banks without public money. Above all, more than nine years after the start of the global financial crisis, worries over the health of the financial system remain significant, especially in Europe. This should not be surprising. But it should be disturbing.

In his piece, Martin Wolf refers to a research note by Adam Lerrick of the American Enterprise Institute, who proposes an alternative form of resolution which he names “temporary bail-in”. This is intended as a response to the idea of “precautionary recapitalisation” that is part of the Bank Resolution and Recovery Directive (BRRD) and which allows government to provide the needed capital temporarily until private sector investors can step in and replace the public funds. Lerrick argues that temporary bail-outs create perverse incentives for regulators and investors and, too easily, become permanent. He argues that if the capital shortfall is really temporary, the bank’s debt holders will be temporarily bailed in and their claims temporarily converted to equity.

Under his proposed framework, the bank would be immediately recapitalized but given time to develop a viable business plan and raise the needed capital from private sector sources. Once new capital is raised from private sources, the former debt holders will have the option of retaining their shares or re-converting them back to their original debt claims. If the funds are truly needed temporarily, the debt holders will be only temporarily bailed in. If the bank cannot raise new capital from private sources, the debt holders will be permanently bailed in. Lerrick proposes that only the excess of each investor’s debt holding above EUR 200,000 would be temporarily converted to shares - so as to protect small investors - and for banks with large numbers of retail investors, 95% of retail bondholders should be completely protected from the temporary bail-in and keep their entire original debt claim. Lerrick argues that under this arrangement, the bail-in may be temporary but the increase in Common Equity Tier 1 (CET1) capital is permanent. He is convinced that the temporary bail-in is a logical extension of the concept of Contingent Capital, it will not have a significant effect on the bank’s cost of funds, it will create stabilizing incentives and will pressure banks to raise needed capital quickly.

Frances Coppola writes on Forbes that talks of “another Lehman” is way overdone. If ever there were a case of market irrationality, this is it. Deutsche Bank needs to raise more capital, that has been evident for quite some time, but Lehman was suffering from much more than a mild shortage of regulatory capital. The Department of Justice’s proposed fine makes the need for Deutsche Bank to raise capital more urgent, while a tanking share price makes it more difficult. So news that the eventual fine could be a lot less than the $14bn that shocked the markets comes as a welcome relief. But even if the fine were imposed in full, it wouldn’t push Deutsche Bank into a Lehman-style collapse because a regulatory capital shortfall is not insolvency. So even if some combination of the DoJ’s fine and other disasters that we haven’t yet heard about did bring Deutsche’s regulatory capital below the ECB’s minimum, it would need a capital plan, not a bailout. Moreover, disasters like Lehman are fundamentally about liquidity, but Deutsche Bank has a strong cash position, and in a crisis it would be backed by the ECB. So Coppola thinks that one should expect no disorderly collapse, no dramatic bailouts and emphatically no financial crisis (which makes American schadenfreude misplaced).

Dan Davies of Frontline Analysts has a rather funny Deutsche Q&A and a longer Deutsche explainer. Davis refers to a recent story by Bloomberg, according to which some hedge funds would have started reducing their Deutsche exposure. Davies says that we should not be worried by hedge funds moving excess derivatives collateral or prime brokerages: basically this is surplus cash that hedge funds have which isn’t invested, or surplus treasury bills that they don’t need to pledge against their trades, but keep in their collateral account anyway. Big hedge funds always have more than one prime broker, and they’re always moving their surplus around. But because these balances are so volatile, they’re basically unusable by the bank as a funding source, so no real funding for Deutsche has been pulled, so far, only excess balances. What would be worrying, Davies says,is if we saw corporate, retail or payments system accounts being moved, because these balances very much are part of the funding of Deutsche Bank’s business, and they do rely quite a lot on “behaviourally stable funding”.

It’s also important to remember that it is not 2008, and Deutsche is no Lehman Brothers. The bulk of Deutsche’s short term funding is secured against securities pledged as collateral, and differently from 2008, nearly all of the short term funding these days is against genuinely risk free instruments. There’s a lot less uncertainty surrounding the valuation of Deutsche Bank’s unpledged assets, if they needed to be pledged to support further funding, then there were about Lehman. The uncertainty all relates to the liabilities side of the balance sheet: the capital might not be sufficient, and the equity might be impaired by a big charge for DoJ fines. Both of these threats come from somewhere other than the asset side of Deutsche Bank’s balance sheet. Moreover, there are significantly many more ways for a bank to get hold of short term liquidity 2016 than there were in 2008. This being said, it is a state of clear and accelerating franchise damage, which could become severe. The worry that ought to be on management and the market’s minds is not a fast and catastrophic collapse, but a gradual transition to a run-off situation in which no long-term funding can be raised and therefore no new business can be initiated. This company needs to raise equity, fast, and settle its litigation, as fast as it can.

The Macro Men agrees: this is not a Lehman moment and will not become a Lehman moment. For one thing, there is a veritable ocean of liquidity available today through various programs (LTROs, etc.) that were not in place during 2008. It is therefore difficult to see DB running out of money as swiftly as Lehman did. More importantly, there has been a change in the structure of the market that makes it more difficult for a systemically-important bank to be as systemically important as Lehman was. Macro Men thinks this is attributed to a decline in the velocity of collateral, which is in turn due to the fact that collateral re-hypothecation is not nearly as prevalent as it used to be. As a result, any failure of Deutsche Bank would not result in the complete freezing up of the financial system that we observed eight years ago. But just because DB isn't Lehman doesn't mean that a failure wouldn't hurt, particularly given that other banks are looking ropy on their own accord.

Jacob Kirkegaard at the Peterson Institute for International Economics says that whatever its outcome, the recent debacle of Deutsche Bank will mean dramatic changes at the bank itself and could well stress test the new euro area single supervisory mechanism (SSM). While recent events underline that Deutsche Bank’s current business model is unsustainable, this should not be seen as another Lehman Brothers. It is not credible that Deutsche Bank, which has access to essentially unlimited liquidity from the European Central Bank, could run out of cash to repay counterparties anytime soon. At the same time, given that a collapse of Germany’s largest bank would surely lead to a serious economic disturbance, Berlin could issue guarantees for new Deutsche Bank bonds or inject equity capital into the bank, within the BRRD framework. Kirkegaard argues that Deutsche’s market route will serve as a stress test of the new SSM: if the situation deteriorates and the bank were to require public support, this would be a serious blow to the credibility of the SSM, as the bank passed the recent stress tests. That Deutsche has been allowed to operate with a balance sheet this vulnerable should serve as a broader warning sign about the need for the SSM to strengthen its supervision of the largest euro area bank balance sheets.

Jim Brundsen on Brussels Blog thinks that the woes of Deutsche Bank demonstrate that Europe’s banking crisis is still not settled, but the troubles at Germany’s biggest lender have not deterred Brussels from pushing back forcefully against stringent new banking rules. He cites Dombrovskis’ statement that he would be prepared to break with Basel, unless it backs down over its latest set of reform proposals which would lead to increase the amount of loss-absorbing capital banks are required to have. For those with long memories, this can seem quite odd: once upon a time, EU regulators’ prime concern was to force banks to have more capital. It was seen as a safeguard for stability, not an unnecessary burden. After years of sluggish recovery, things seem to have changed. While supporters of the new Basel plans, notably the US and Switzerland, argue that the measures are simply a cleaning up exercise designed to avoid any rule-dodging by banks, the EU sees the exercise as re-opening a book it would rather keep closed. Underneath the technical discussions, there is a conundrum for Europe: how to convince investors that its banks are solid while dodging international rules intended to make them so. With Deutsche in the wars, the challenge is all too real.