Income convergence during the crisis: did EU funds provide a buffer?

Did EU funds play an important role in limiting the hit of the crisis on regional income?

Economic convergence is at the heart of European Union integration. Cohesion policy was born in the 1980s with the aim of complementing the creation of a single European market and fostering the economic development of less advantaged EU regions. This objective is especially relevant in light of the economic crisis that has exacted a heavy toll on many EU countries and regions, and created scepticism about the merits of EU policies.

In a recent paper, I look at how income convergence evolved in EU regions during the crisis, and assess the role played by the EU funds that are provided to the more disadvantaged regions with the aim of facilitating their convergence to average EU income levels. I find that EU funds did play an important role in limiting the hit of the crisis on regional income, providing an anchor for convergence.

Income convergence in the EU during the crisis

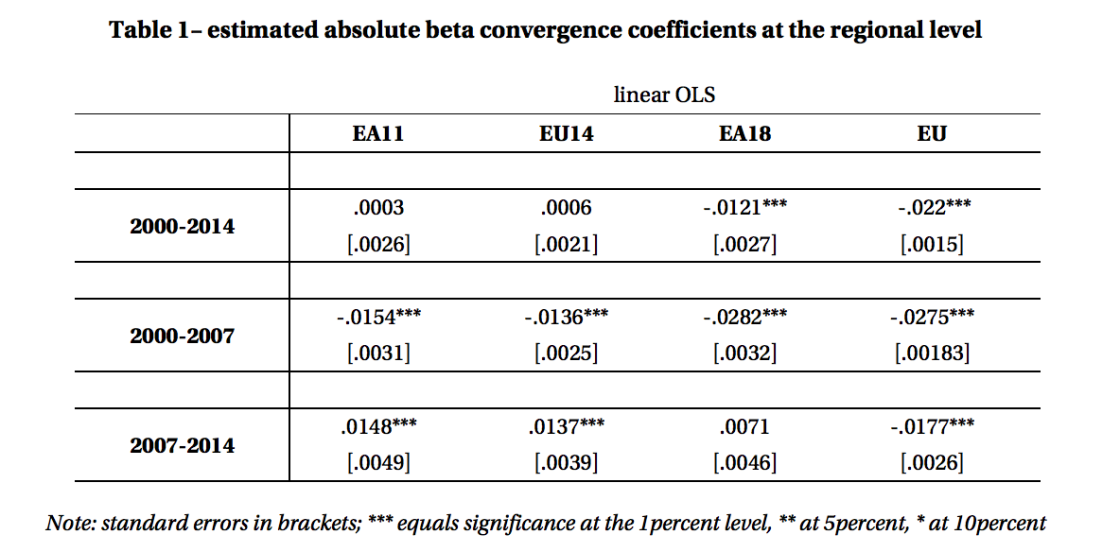

The starting point to assess the role of EU convergence funds during the crisis is to understand what happened to regional income convergence across the EU, over the last 15 years. To this end, I start from an absolute and a conditional income convergence analysis. The idea is simple: I regress income growth over a certain time period on an initial level of income, and a negative estimated coefficient will suggest that relatively poorer regions grow faster than richer ones. If this is the case, we can conclude that there has been income convergence.

When considering the EU as a whole, regions are found to have convergenced at pace of 2 percent per year over 2000-14. When looking at EU14 or EA11, no significant convergence is detected over the same period. The reason for this becomes clear when breaking the time series into subperiods. From 2000-07, all three groups show very significant evidence of convergence, but when looking at 2007-14 there is no evidence of convergence for either the EU14 or the EA11, suggesting the crisis altered the previous path of income convergence.

The eligibility rules for EU convergence funds

On the basis of this evidence, I then investigate the role played by those funds (‘Objective 1’) that the EU provides to regions whose per capita GDP in purchasing power standard (PPS) is below 75 percent of EU average. These funds have the aim to foster convergence to average EU income levels. I focus on the 2007-13 allocation period, which includes the crisis years.

Eligibility for Objective 1 funds is determined at the regional level. The EU has a hierarchical regional classification named NUTS (Nomenclature of Territorial Units for Statistics), with NUTS1 being the most aggregate and NUTS3 the most detailed level. Objective 1 funds’ allocation is decided at the NUTS2 level.

This eligibility rule creates a threshold: NUTS2 regions below 75 percent are entitled to the funds, while regions above are not. As a result, it is perfectly possible that some NUTS3 regions in eligible NUTS2 areas have a per-capita GDP level higher than the threshold for eligibility at the NUTS2 level. These NUTS3 regions would not qualify to receive Objective 1 transfers if they had been assessed as independent entities, but in practice they qualify, because they are part of a relatively poor NUTS2 region. Similarly, some NUTS3 areas might be below the threshold if looked at individually, but the fact of belonging to a relatively rich NUTS2 region makes them ineligible for Objective 1 funds.

As convincingly pointed out by Becker et al (2008), this rule creates a quasi-experimental setting that can be exploited for empirical investigation. I exploit this rule to construct a treatment/control framework based on two groups of comparable regions.

I apply to each NUTS3 region the eligibility criteria that is normally applied to NUTS2 regions. In this way, I can identify all those NUTS3 regions that would be eligible if the threshold were applied to their individual income rather than that of their parent NUTS2 region.

Then, I match this ‘actual’ measure of eligibility with the ‘formal’ eligibility status of the same NUTS3 regions. This allows me to identify two sub-groups of regions: one group includes those NUTS3 regions that would be eligible based on their individual income and were also formally eligible based on their parent region’s income; a second group includes those NUTS3 region that would be eligible based on their individual income but were not deemed formally eligible based on their parent’s level of income.

We can think of these two groups as a treatment and control group: regions in both groups have an individual income level that is below 75 percent of the EU average, but depending on their parent region’s income, some of them have been “treated“ (ie deemed eligible for convergence funds) while others have not.

The role of EU convergence funds during the crisis

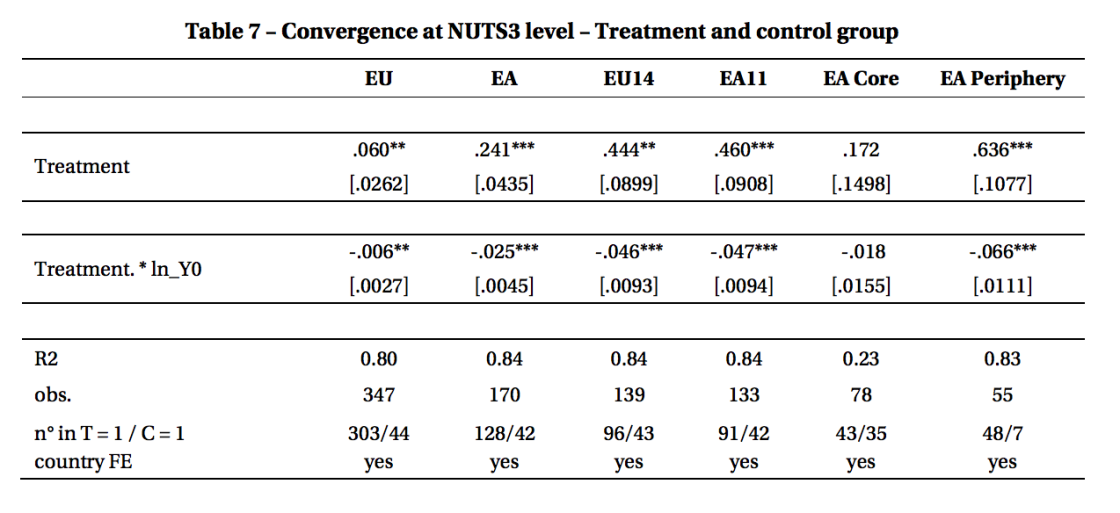

Once these treatment and control groups have been defined, I do an income convergence analysis similar to the one for the full sample, but adding one dummy that identifies the “treated” regions and one interaction term of this dummy with the initial level of income.

The sign and significance on the ‘treatment’ dummy suggests that during the crisis, those regions that were “treated” grew faster than those regions that had a comparable level of income but were not deemed eligible for funds. The effect is particularly strong for region in the EA11 and particularly in the euro-area periphery. The sign and significance of the interaction term suggests that among those regions that were ‘treated’, per capita income in poorer regions grew faster (or decreased less fast). This is again evidence of convergence.

Conclusions

While this model is very simple, the evidence is relevant from a policy perspective. It suggests that convergence funds did play an important role in helping income convergence during a time of crisis, within the group of disadvantaged regions that were entitled to receive the funds, and especially in comparison to equally disadvantaged regions that were not eligible. This holds not only at the EU level, but especially for regions in those euro-area countries that were hardest hit by the crisis and/or underwent EU/IMF macroeconomic adjustment programmes, suggesting that the role of convergence in counteracting the effect of the crisis on income dynamics was particularly important there, possibly because of the stricter financial constraints that regions in those countries were facing. At a time when the merit of EU policies is often criticised, and Europeans are increasingly sceptical of the domestic economic implications of EU membership, I believe this is a very relevant message.

References

Becker, S. O., Egger, P. H., von Ehrlich, M. and R. Fenge (2008) ‘Going NUTS: The Effect of EU Structural Funds on Regional Performance’, CESIFO Working Paper No. 2495, December