Is the UK’s role in the European supply chain at risk?

Will the UK’s engagement in European supply chains be at risk once the UK exits the EU?

Over the past decades the UK economy has become a party to global production chains in a number of sectors. Benefiting from tremendous investment by many of the world’s major multinational corporations, the UK has become an export leader, especially for automobiles and pharmaceutical products. We ask whether the UK’s engagement in European supply chains might be at risk once the UK exits the EU.

Admittedly, measuring the impact of Brexit on the supply chain is not easy, in particular because we still do not have enough information about the future economic relationship between the EU and the UK.

If the UK continues to be part of the EU single market, we would expect no major changes in UK participation in European supply chains. However, if the current zero-tariff rate for all trade in services and goods is no longer maintained and the mobility of labour and capital is hampered (what is generally described as a hard Brexit), the UK’s participation in European supply chains would undoubtedly be affected.

We first describe how to measure the European supply chain, in manufacturing and in services. We then assess the extent to which the UK is involved, breaking down our analysis by sector, both for manufacturing and services. Finally we draw conclusions about how the UK’s participation in the European supply chain might be affected sector by sector.

We find that the UK’s automobile sector and related services, especially transport and storage, could be severely affected. However, another important sector – pharmaceuticals – should suffer less, because the expected increase in tariffs outside a trade agreement with EU would be negligible.

The UK’s most important service sector within the European production chain, research and development, might also be negatively affected. A hard Brexit could be especially damaging, because company headquarters could move out of the UK. The wholesale and retail service sectors and the transportation and storage sector will also confront challenges under such circumstances, but the effects might not necessarily be negative if firms in these sectors are well prepared.

Concepts and measures of the supply chain

To provide a quantitative assessment of the UK’s engagement in the European supply chain, we use the latest OECD Trade in Value Added dataset to derive indicators for global value chain (GvC) activities for the UK, at aggregate level and for different sectors. We rely on indicators of upstream linkages and downstream linkages.

The first indicator is the share of imported intermediate goods over GDP. This measure tracks the international intermediate goods that the UK sources in order to produce output. Because agricultural products and personal services (for example tourism) are not directly linked to the production chain, we focus on intermediate goods for the manufacturing and business service sectors.

Our second indicator is the share of exported intermediate goods and final goods over GDP, capturing the UK’s provision of goods and business services to trade partners. Because our analysis focuses on the European supply chain, we calculate intra-EU exports and intermediate imports for the UK unless otherwise stated.

Additionally, to obtain welfare implications, we also derive the value added embodied in the supply chain for the UK and the rest of the EU. Specifically, we calculate the value added embodied in exports and domestic final demand separately.

The UK plays an important role in the global supply chain, especially within the EU

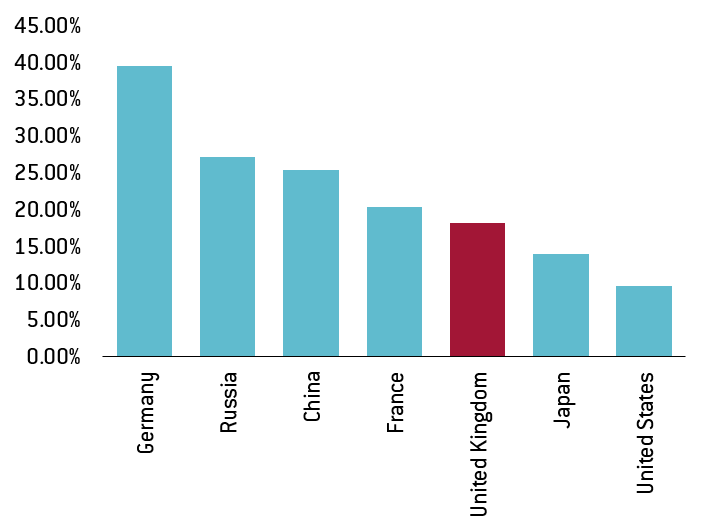

These indicators of upstream and downstream linkages offer a clear picture of the UK’s active integration into the global supply chain (Figures 1a and 1b). The UK’s exports of global goods and business services (downstream integration) account for 18.16 percent of its GDP. This is higher than Japan and the United States, but relatively lower than many countries, including Germany, China, Russia and France.

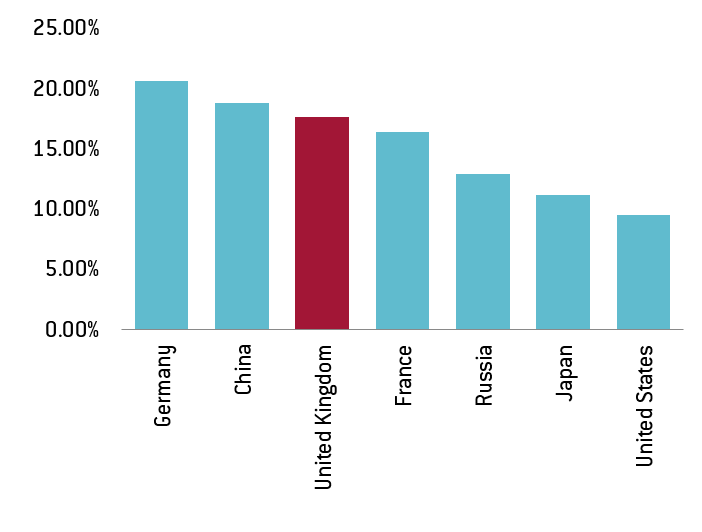

At the same time, the UK’s share of imported global intermediate goods and business services (upstream integration) constitutes 17.6 percent of the UK’s GDP, which is higher than most other major economies, although lower than Germany and China. This shows that the role of the UK in the global production chain is more as a receiver than a provider of goods and business services.

Figure 1a: Exports as a share of GDP

Source: OECD Trade in Value Added (TiVA) Database.

Figure 1b: Imported intermediate as a share of GDP

Source: OECD Trade in Value Added (TiVA) Database.

The data shows very clearly that the UK’s value chain integration is mainly with the EU. Nearly half of the UK’s intermediate imports and exports are with other EU countries. The EU supply chain also relies on the UK but to a much lesser extent: 10 percent of both EU intermediate exports and EU imports are traded with the UK. This actually compares quite unfavourably with the relative size of the UK economy (about 17 percent of the EU). The asymmetric exposure of the UK’s production chain to the EU points to a larger negative impact from Brexit on the UK’s production chains, compared to those of other EU countries.

Disruption of the European supply chain will be more harmful for the UK than for the EU

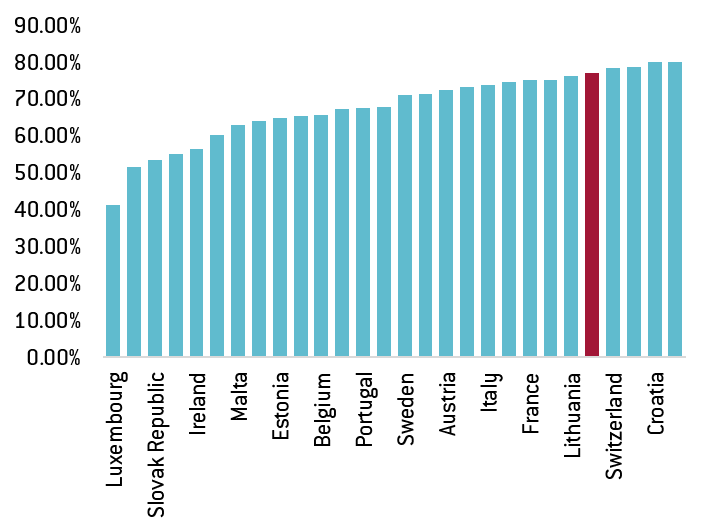

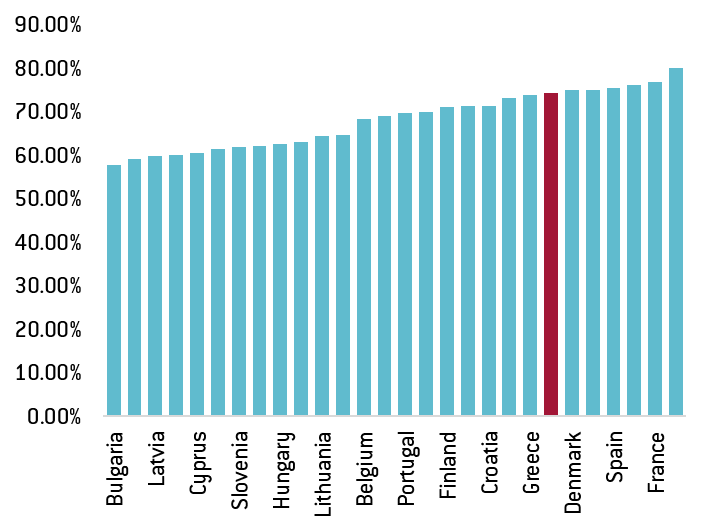

The UK obtains a very high proportion of value added content from the European supply chain. For the UK’s exports to the EU and the UK’s domestic final demand, the embedded domestic value added by the UK itself accounts for shares of 76.9 percent and 74.2 percent respectively, greater than the level for most EU countries (Figures 2a and 2b).

Figure 2a: Home Value added share embodied in exports

Source: OECD Trade in Value Added (TiVA) Database.

Figure 2b: Home value added share embodied in domestic final demand

Source: OECD Trade in Value Added (TiVA) Database.

Consistently, comparing the value added of the UK’s final demand by source country with the reverse – the UK’s value added embedded in these countries’ final demand – we also find that the UK enjoys a larger value added in nearly all the other EU countries than these countries’ value added in the UK (Figure 2). Therefore, a hard Brexit leading to a disruption of the European supply chain would be more costly for the UK than other EU countries, at least as far as the production chain is concerned.

Two UK sectors to suffer the most: automobiles and electronics

Though the UK is a service-based economy, its participation in the international production chain is still dominated by goods (60 percent). The impact of Brexit on UK trade in intermediate goods will be very different for different sectors.

It is difficult to provide an exact assessment without a final agreement between the UK and the EU. However, we investigate the case of a hard Brexit, in which EU-UK trade is based on the minimum common denominator of the tariffs applied by the World Trade Organisation’s most favoured nation (MFN) regime. We compare the increase in tariffs from the current zero offered by the EU single market to the MFN tariffs on a sector-by-sector basis.

We report the results for the UK’s major products, namely those with a share in manufacturing trade of 1 percent or more. These major traded manufacturing goods fall into three sectors: transport equipment, chemicals/minerals and electrical/optical equipment. These three sectors are crucial for the UK economy, accounting for half of the UK’s non-food manufacturing value added.

The most relevant sector is transport equipment. The MFN tariff for its major product, motor cars, is as high as 10 percent. Car parts would also be subject to 2 percent to 4 percent tariffs under MFN rules. Therefore, any disruption in the European supply chain would be detrimental for firms in the transport equipment sector. Beyond its size (about 4 percent of UK GDP), the automobile sector is particularly relevant in terms of employment, with more than 10 percent of the total employees in the manufacturing sector (about 325,000 workers). One obvious solution to this problem would be for the UK government to subsidise the sector for the equivalent of the new MFN tariff. But this is not a small amount. It would amount to $4.5 billion, which is half of the UK’s current annual net contribution to the EU.

The second important sector, chemicals and minerals, accounts for 10.6 percent of UK total intra-EU exports and 11.5 percent of intra-EU imports. Here we see a different story. This sector will hardly be affected because the MFN tariffs for its largest component – medical products and blood – are already zero. The third most relevant sector in terms of exports (and also second in terms of imports) is electrical and optical equipment. Though more diverse than the previous two, a good chunk is composed of telephone sets, with an MFN tariff of only 1.28 percent. On the whole, this sector would also clearly be less affected that the automobile industry.

All in all, a hard Brexit without a favourable trade agreement between the EU and the UK will affect UK automobile production extensively. There would be less impact on other important sectors, especially chemicals and minerals.

The impact on UK service sectors would be concentrated on distribution

We also calculate the downstream and upstream flows for the UK’s service trade with other EU countries. The most relevant sector for the UK is research and development (R&D). If a hard Brexit leads multinational companies to divert some of their business or some of their high-skilled workers from the UK to other EU countries, a sharp reduction in UK exports of R&D-related services into EU should be expected.

The next two important service sectors for the UK are wholesale and retail services, and transport and storage. These respectively account for 9.7 percent and 7.3 percent of the UK’s total intra-EU exports of services (9.9 percent and 9.6 percent of total intermediate imports within the EU). The impact of Brexit on these two sectors depends on a number of factors. There could be more demand from industrial firms to sustain their existing supply chain as the environment gets tougher with Brexit. In the same vein, the distribution and transport sector might update, adapt and modify their services to circumvent Brexit-induced trade barriers[1].

This might create new opportunities for some firms in these sectors to increase their mark-up and make more profit. However, it may well be that the actual production of intermediate goods (especially in the automobile industries) moves outside the UK, in which case it will be very difficult to maintain the related distribution services. The fate of such services, though, is even more significant than that of trade in goods for employment. The retail and transport/storage sectors employ 5 million and 1.8 million people respectively, whereas there are 3 million workers in the manufacturing sector as whole.

Finally, financial services are usually viewed as the sector in which the UK retains its comparative advantage to sell services to the global supply chain. There are 1 million employees engaged in this sector. However there is a demand risk that, if some international production activities are diverted to other countries, the demand for financial services could fall. To make things even worse, if the mobility of high-skilled EU financial workers is restricted, it would be more costly for financial firms to hire employees, further hampering their business in the UK. This could negatively affect the financial sector, or even push some firms to move their business out of the UK.

In sum, four service-related sectors will likely be affected by Brexit: wholesale and retail, transport and storage, R&D and financial services. R&D and financial firms are expected to be affected in the case of hard Brexit if firms divert their investment abroad or relocate skilled workers to other branches. The other two distribution service sectors (wholesale and retail; transport and storage) are also likely to be affected, especially the firms that directly serve the automobile sector. However, the final impact on them need not necessarily be highly negative if they manage to adapt their services to the post-Brexit environment.

Policy implications

It seems clear that a hard Brexit will come at a cost in terms of the UK’s participation in European production chains – especially for the automobile sector and some services, but less so for pharmaceuticals. Our findings suggest the UK government should take measures as soon as possible to avoid further potential negative impacts in the long run.

First, in terms of trade, the best strategy for the UK following Brexit is clearly to stay within the EU single market. This would be the case even at the cost of paying the same contributions to the EU as a full member, because it would be more costly to compensate firms for all related tariffs in order to sustain the existing global supply chain located in the UK. If there are difficulties in negotiating with the EU on single market status, the UK should at least maintain a zero tariff schedule on some key industries, in particular automobiles.

Second, the UK needs to be more transparent about its attitude towards the post-Brexit UK-EU trade agreement. The uncertain environment will make it difficult for firms to predict how to operate their businesses in the UK. This is especially important for transportation/storage sector and wholesale/retail providers, which will need to adapt and update their services in the new environment. The quicker the UK government offers guidance on the likely trade agreement, the better these firms can prepare to offer services that minimise the cost of distributing goods into and out of the UK.

Last, but definitely not least, is vital to avoid the exclusion of UK researchers from the European research network. R&D is the largest component of the UK’s service trade. Brexit and associated restrictions on labour and investment mobility could bring long-lasting challenges for research centres, higher education and scientific cooperation for the UK. To avoid a shift of skilled workers out of the UK, the government needs to reassure research personnel working in the UK that they will be able to stay in the same way as before. The UK government must also continue to support research cooperation to attract more international researchers.

[1] Samantha White , ‘How to prepare for Brexit’s effects on supply chains’, CGMA Magazine, available at http://www.cgma.org/magazine/news/pages/brexit-effects-on-supply-chains.aspx.