Making the best of Brexit for the EU27 financial system

The EU27 needs to upgrade its financial surveillance architecture to minimise the financial market fragmentation resulting from Brexit

The issue

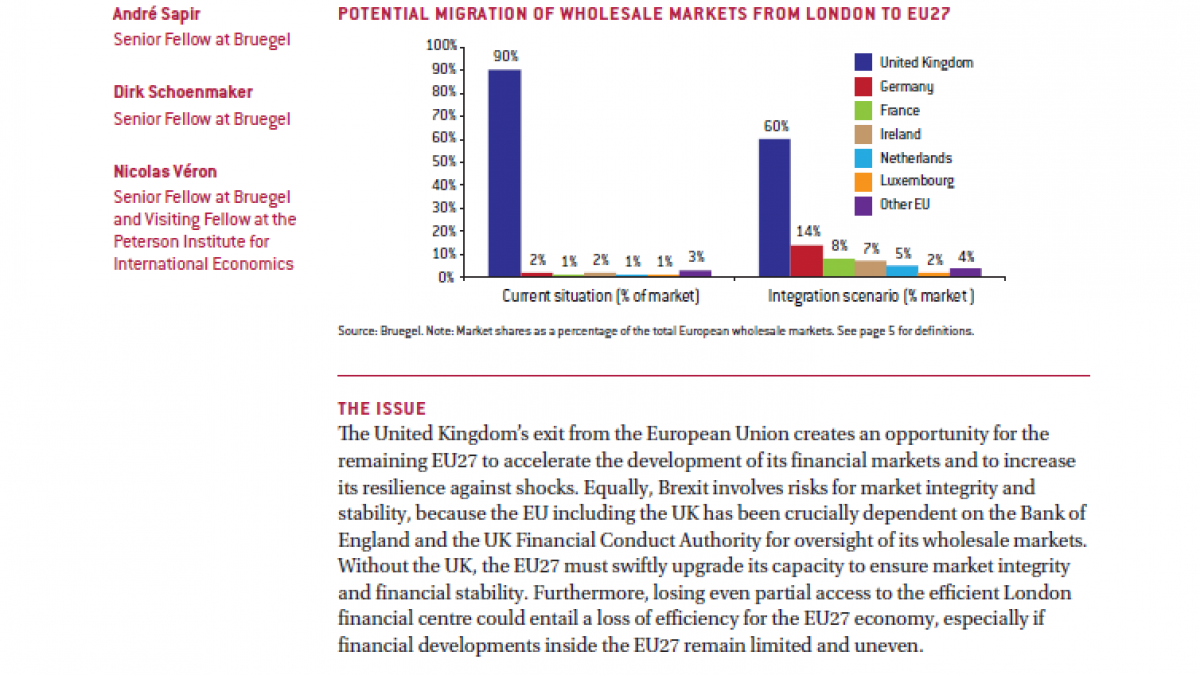

The United Kingdom’s exit from the European Union creates an opportunity for the remaining EU27 to accelerate the development of its financial markets and to increase its resilience against shocks. Equally, Brexit involves risks for market integrity and stability, because the EU including the UK has been crucially dependent on the Bank of England and the UK Financial Conduct Authority for oversight of its wholesale markets. Without the UK, the EU27 must swiftly upgrade its capacity to ensure market integrity and financial stability. Furthermore, losing even partial access to the efficient London financial centre could entail a loss of efficiency for the EU27 economy, especially if financial developments inside the EU27 remain limited and uneven.

Policy challenge

The EU27 should upgrade its financial surveillance architecture to minimise the financial market fragmentation resulting from Brexit and the corresponding increase in borrowing costs for firms. While some decline in cross-Channel integration is unavoidable, the EU27 should move quickly towards a fully integrated single market for financial services, with harmonised rules and consistent supervision and enforcement. Policy initiatives need to include governance reform and greater empowerment of the European Securities and Markets Authority, further steps towards banking union and third-country regimes for the supervision of market infrastructure firms (eg clearing houses), similar to those in the United States. With policy integration, there will be less need for financial firms to move to one location, reducing the pressure for all facilities (infrastructure, offices with trading floors, residential housing) to be in one city.